Top Notch Info About Cash Provided By Operating Activities

Net cash provided by operating activities of $2.4 billion;

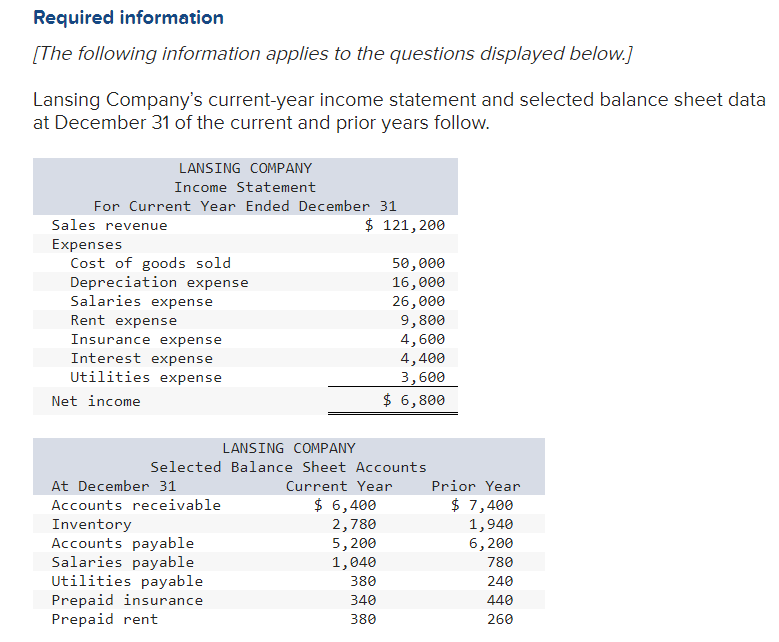

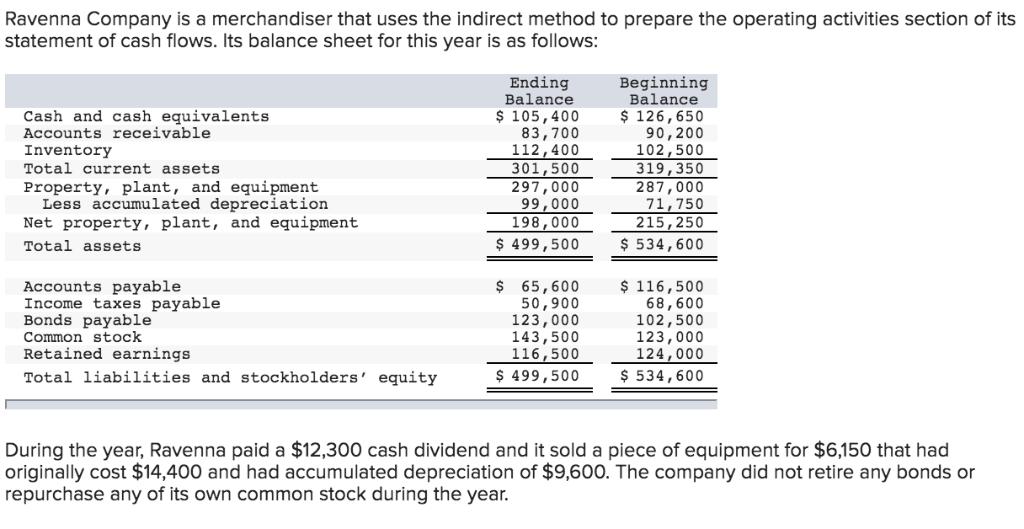

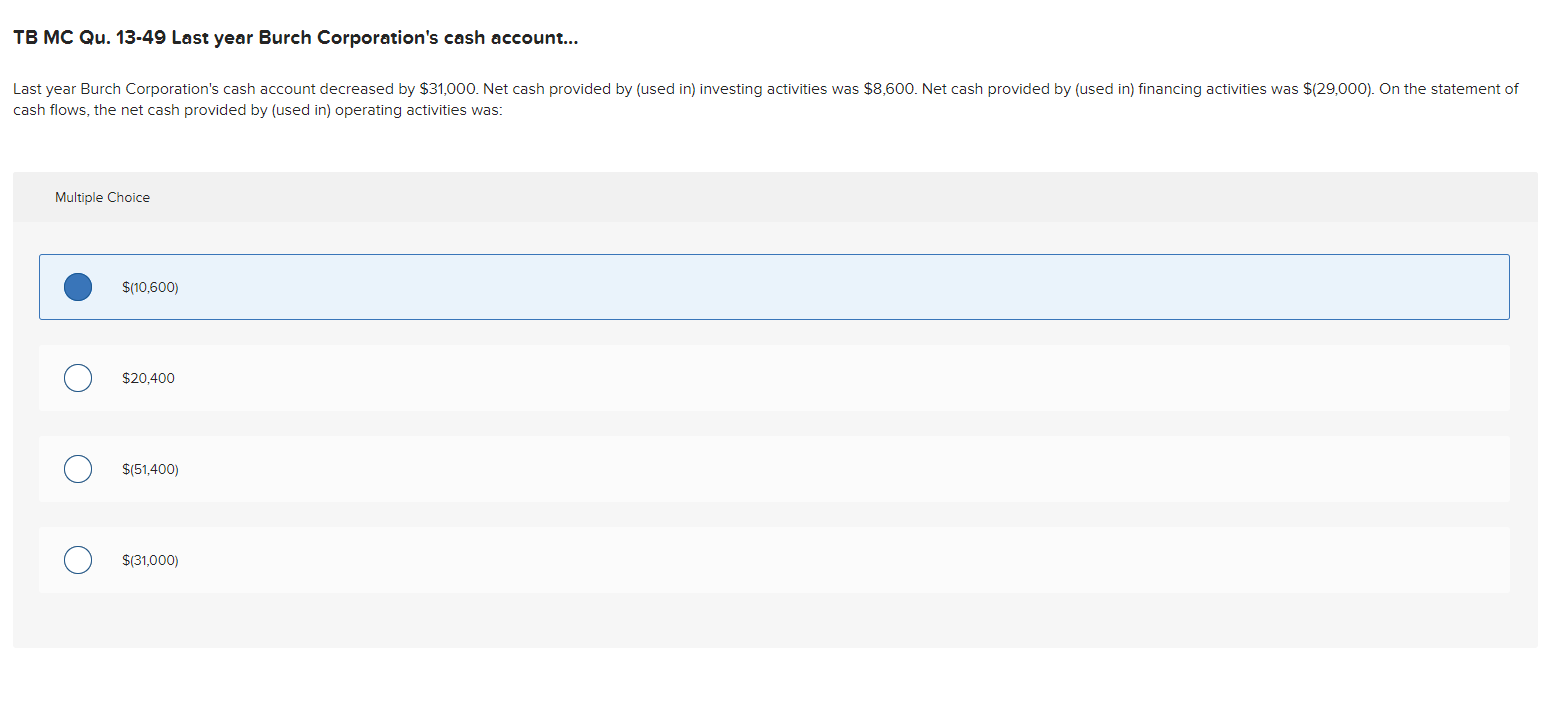

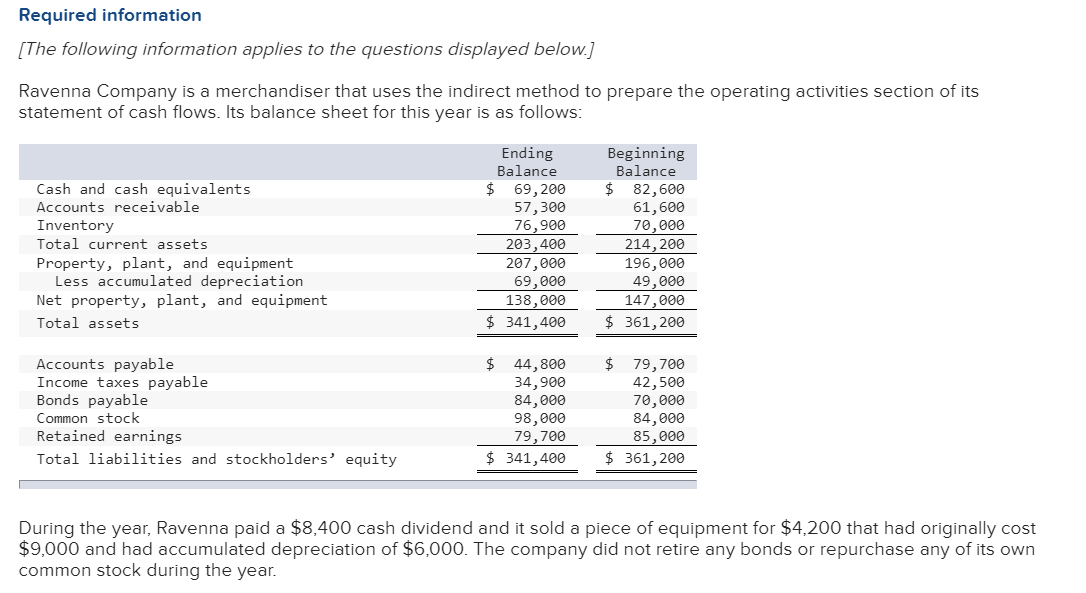

Cash provided by operating activities. Increase in income taxes payable: Net cash provided by operating activities is a financial metric that measures the amount of cash generated or used by a company's normal business operations, such as sales and expenses. There are three types of cash flows:

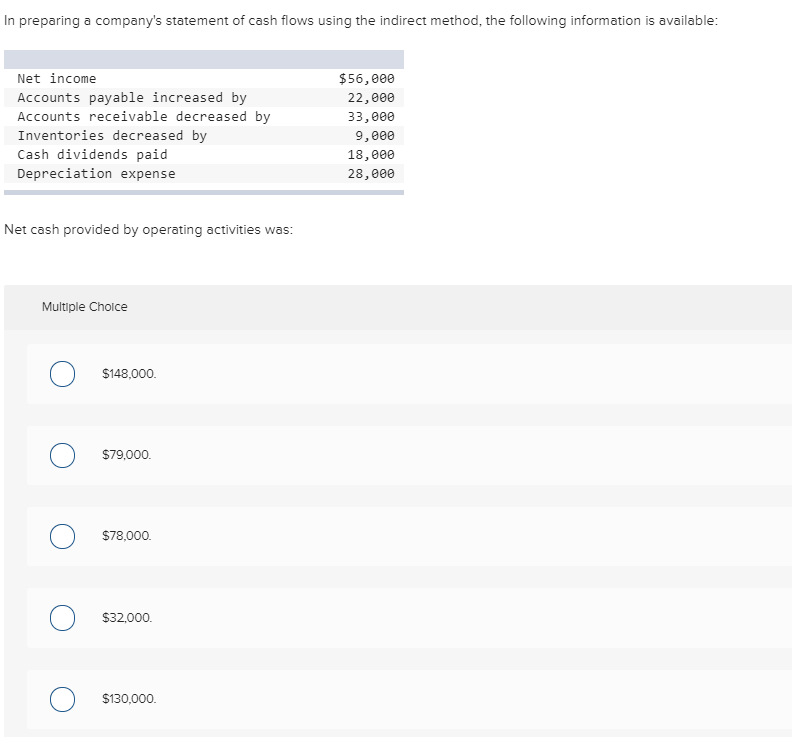

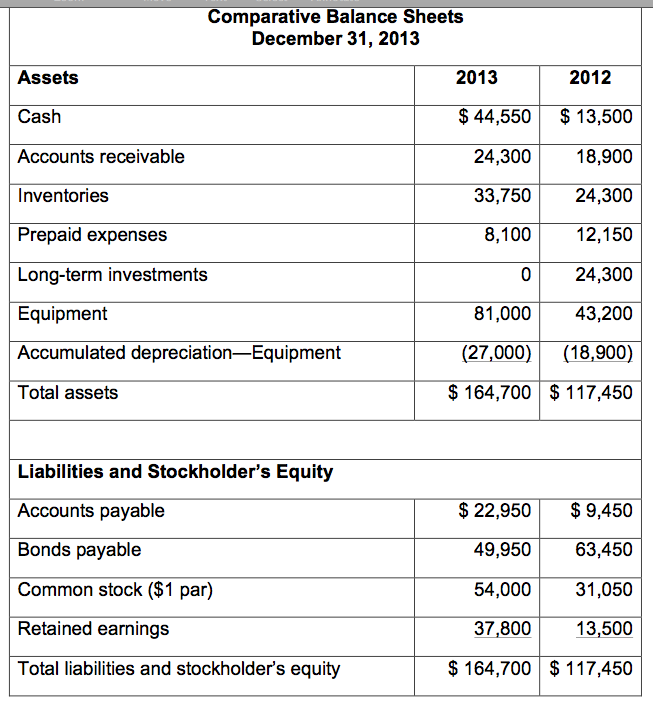

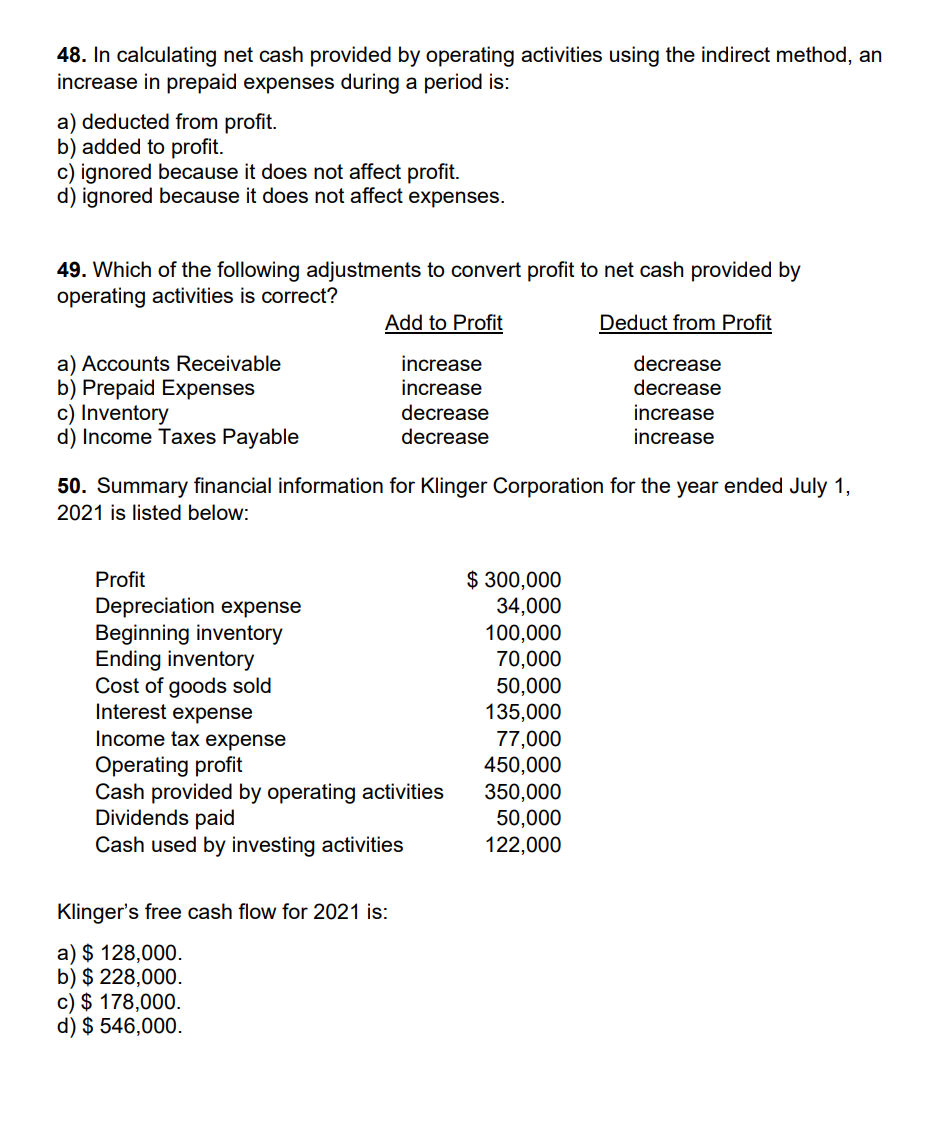

The cash flow statement begins with net income, which is equal to revenues minus all costs. Operating activities operating activities are the transactions that enter into the calculation of net income. Assume that a corporation had net cash provided by operating activities of $200,000 and had capital expenditures of $140,000.

A company's ability to generate positive cash flows consistently from its daily business. The following example shows the format and calculation of cash flows from operating activities using direct method. Cash flow from operating activities may also be referred to as operating cash flow (ocf) or net cash provided from operating activities.

The ocf calculation will always include the following three components: Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital.

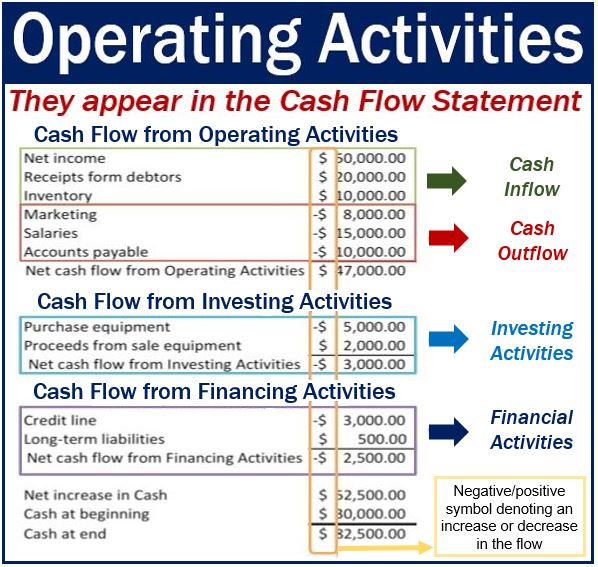

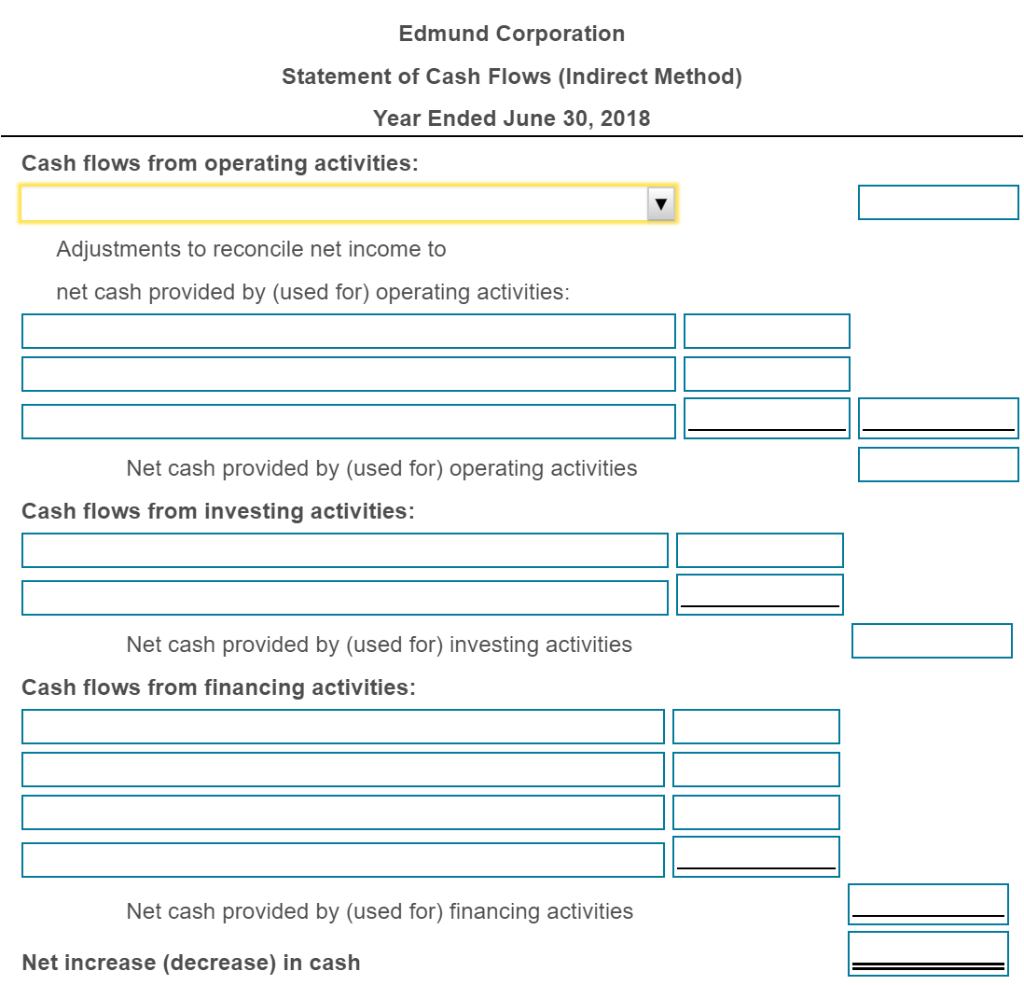

Cash flow from investing, cash flow from financing, and cash flow from operating activities. Changes in cash due to changes in operating assets and liabilities: Net cash provided by operating activities for the fourth quarter of 2023 was a record $114 million, or 19.9% of total revenue, compared to $39 million, or 7.5% of total revenue, for the fourth quarter of 2022.

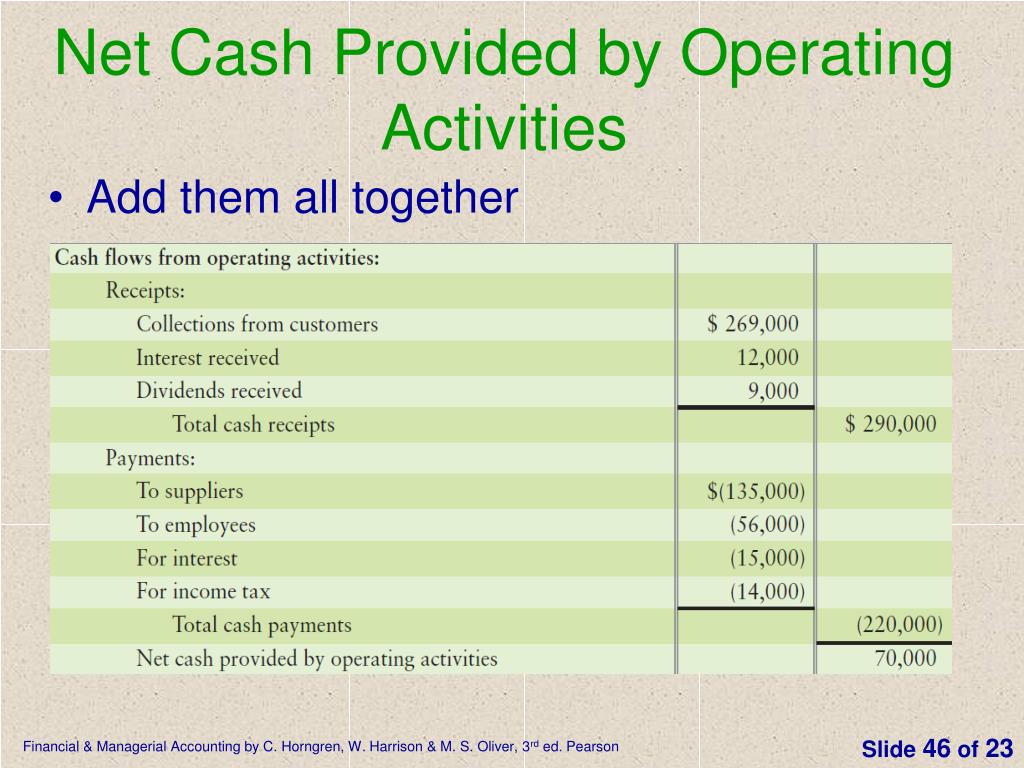

The following factors will all decrease cash flow from operating activities: Once all the cash inflows and outflows from operating activities are calculated, they are added together in the operating section of the cash flow statement to obtain the net cash flow from operating activities. Cash paid to suppliers of merchandise (or raw materials), cash paid to employees, cash paid for operating expenses, cash paid for interest expenses, and.

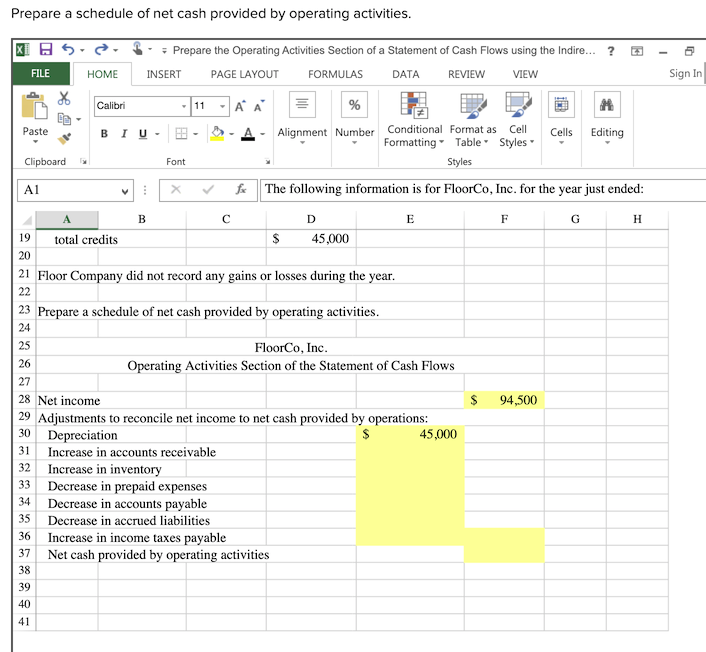

Adjustments to reconcile net income to net cash provided by operating activities: Adjusted, unlevered free cash flow for the fourth quarter of 2023 was a record $97 million, or 17.0% of total revenue. Gain on sale of equipment (90) increase in accounts payable:

Free cash flow is the cash that a company generates from its business operations after subtracting capital. Operations such as managing inventories, accounts receivable and payable, payroll, and taxes impact this category. What is cash flow from operations?

The operating cash disbursements or outflows usually include the following: Learning objectives at the end of this section, students should be able to meet the following objectives: Net cash flow from operating activities is the net income of the company, adjusted to reflect the cash impact of operating activities.

Operating cash flow measures cash generated by a company's business operations. It includes cash flows from receivables, payables, inventory, and depreciation. Cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time.

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)