Peerless Tips About Cash Receipts From Operating Activities

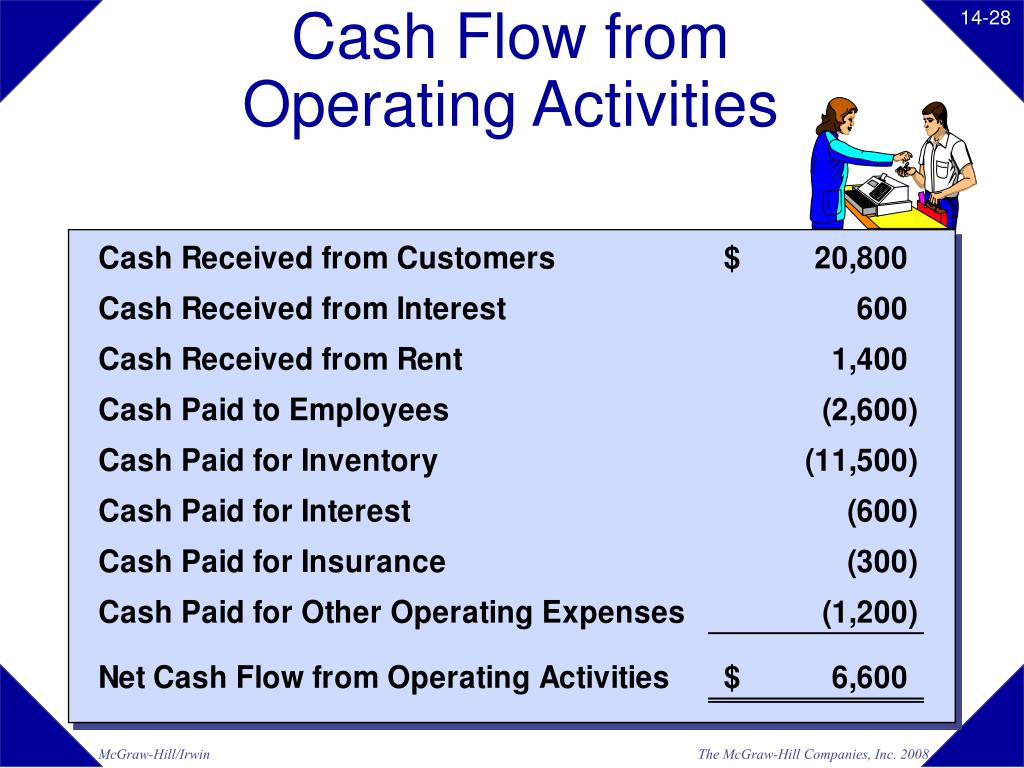

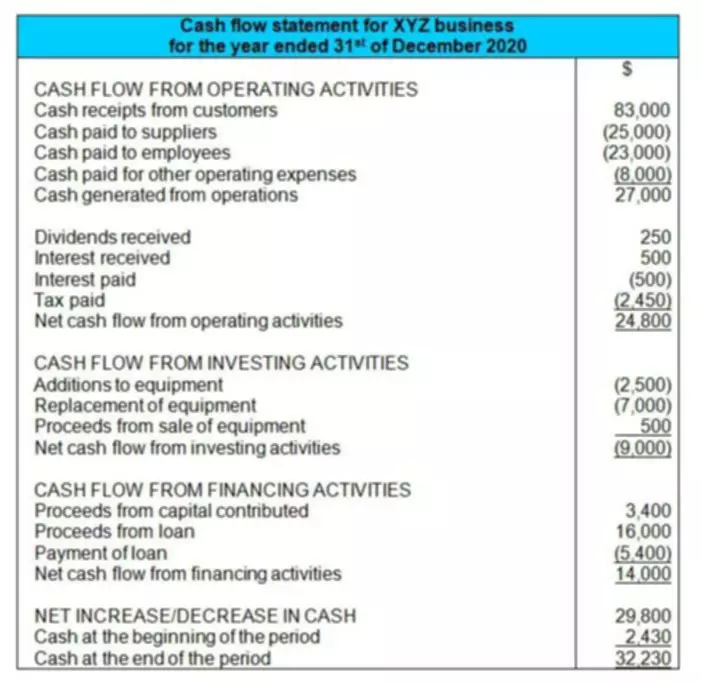

The total of operating cash disbursements is deducted from the total of operating cash receipts to arrive at net cash flows from operating activities.

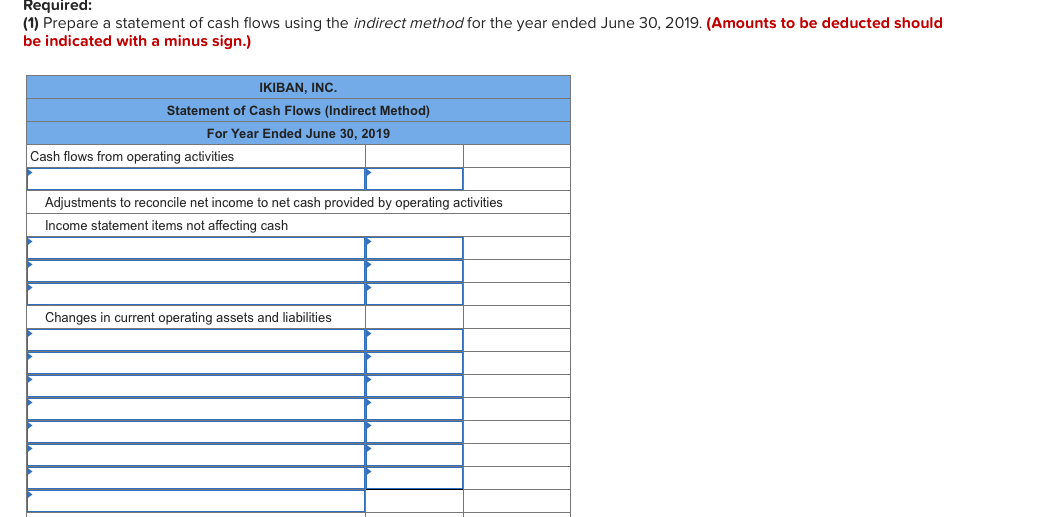

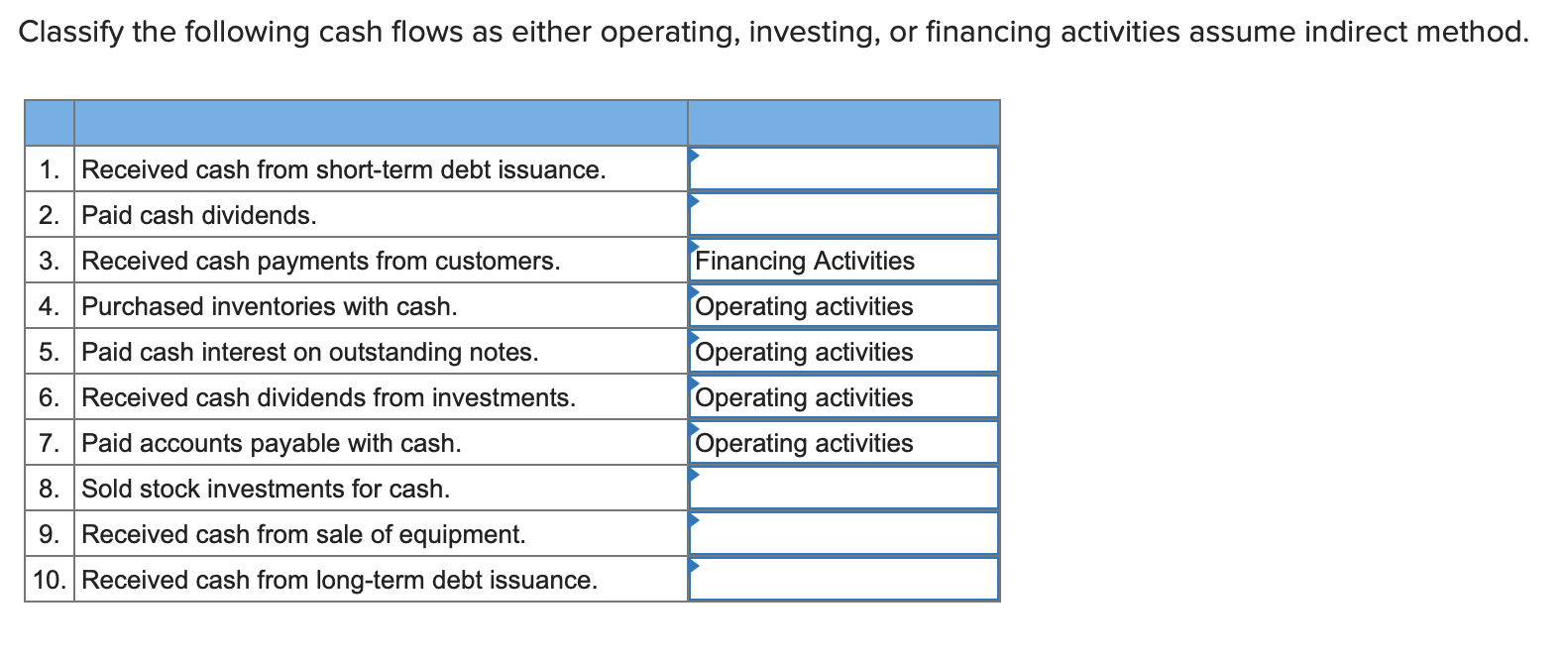

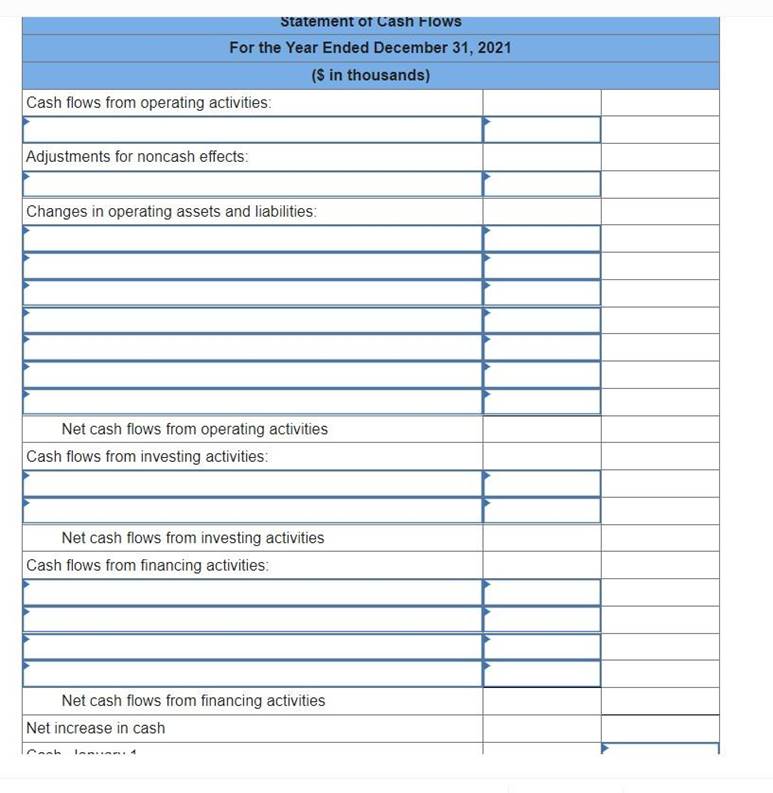

Cash receipts from operating activities. Cash flow is calculated using the direct (drawing on income statement data using cash receipts and disbursements from operating activities) or the indirect method (starts with net income,. Cash receipts from the sale of goods and rendering of services; Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a.

Cash payments to suppliers for goods and services and to, and on behalf of, employees. Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Study with quizlet and memorize flashcards containing terms like a major source of cash from operating activities is:

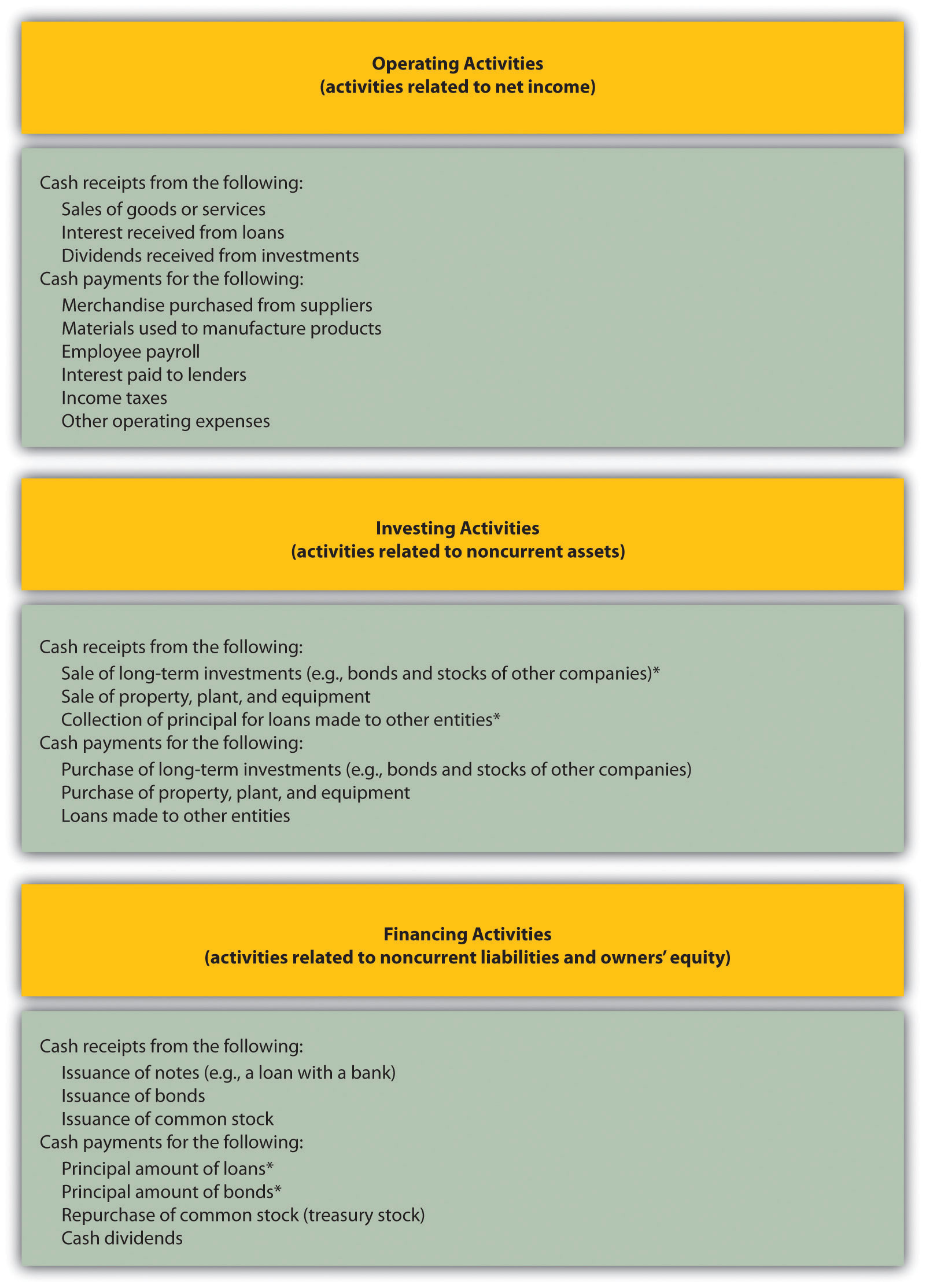

Cash flows from operating activities. Cash payments to suppliers for goods and services. Cash receipts from an equity method investee that represent returns on investment typically are classified as cash inflows from operating activities, consistent with the classification of cash receipts of interest and dividends.

Cash flow from investing, cash flow from financing, and cash flow from operating activities. The cash flow from operating activities section. Cash flow from operating activities:

The operating activities on the cfs include any sources and uses of cash from business activities. Cash receipts from selling goods, rendering services, and other revenue streams. There are three types of cash flows:

Some of the cash flows arising from operating activities are as follows: Examples of cash inflows from operating activities are cash receipts from the sale of goods and services, and receipts from the collection of accounts receivable. Cash paid to suppliers and employees ( 27,600) cash generated from operations.

Cash from operating activities. Interest paid ( 270) income taxes paid ( 900) net cash from operating activities. Cash receipts and cash payments resulting from acquisitions and sales of loans originally classified as loans held for sale.

Other cash inflows may come from lawsuit settlements. Receipts from sale of goods receipts from investment by owner receipts from sale of building receipts from borrowing, which of the following is a primary use of cash? Cash payments to suppliers for goods and services;

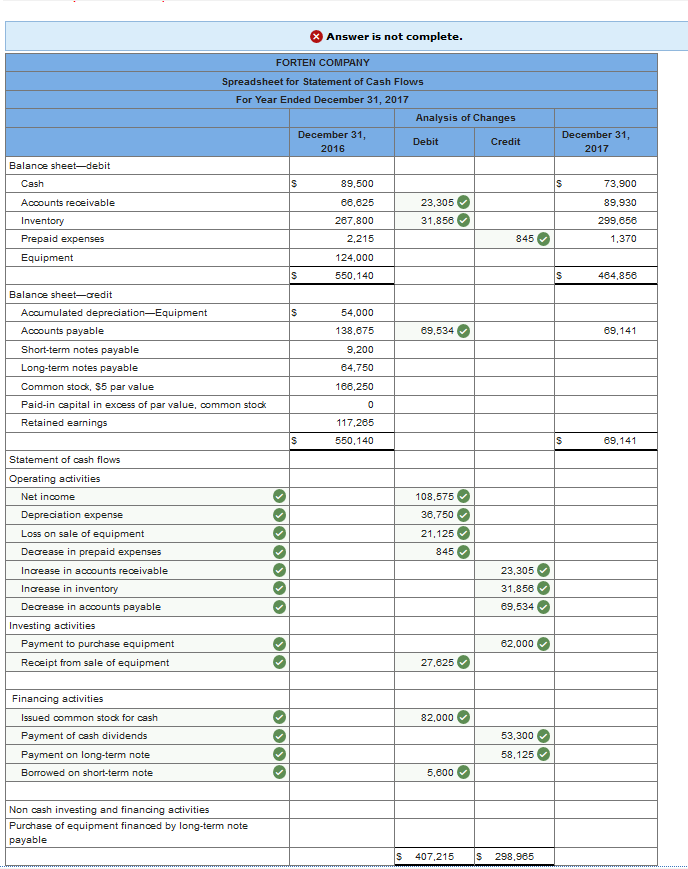

Reporting cash flows from operating activities from paragraph 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows interest and dividends taxes on income 17 18 21 22 25 Cash flows from operating activities are typically reported as part of the income statement. The formula for each company will be a little different, but the basic structure always consists of the three same elements:

Sale of equipment operating expenses borrowing investment by. Cash flows are either receipts (ie cash inflows) and so are represented as a positive number in a statement of cash flows, or payments (ie cash outflows) and so are represented as a negative number in a statement of cash flows. Under the direct method, the major classes of operating cash receipts and disbursements are reported separately in the operating activities section.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)