Awesome Tips About Sample Dentist Profit And Loss Statement

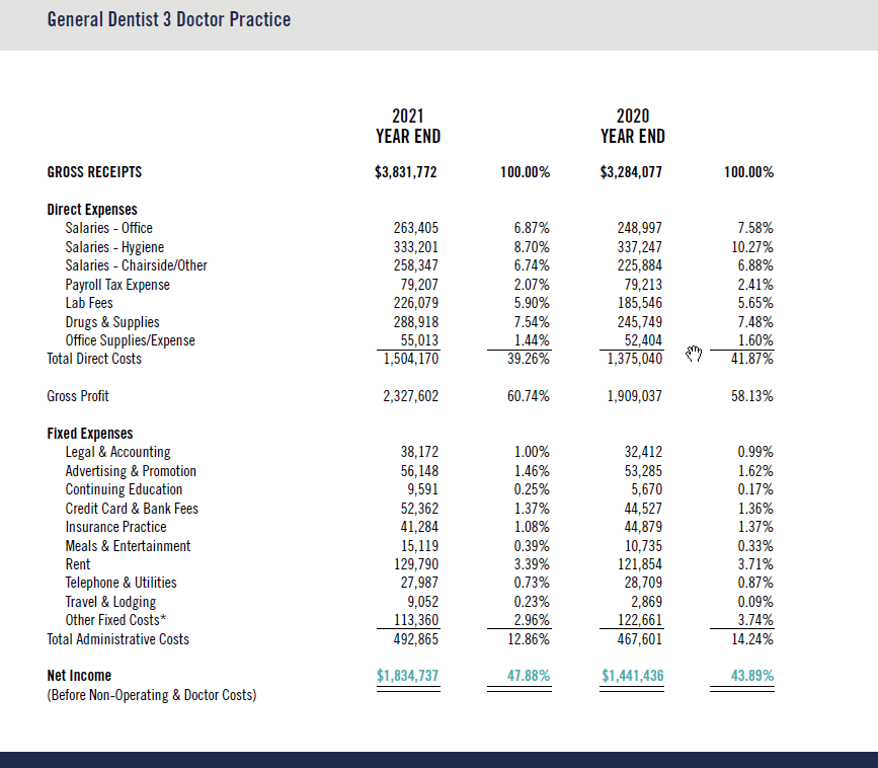

Best practice dental expense benchmarks facility and equipment expenses:

Sample dentist profit and loss statement. This is the amount you actually collected from your patients. This is not your production. One of the most important documents your executive coach will be using in analyzing your profitability is your profit and loss statement.

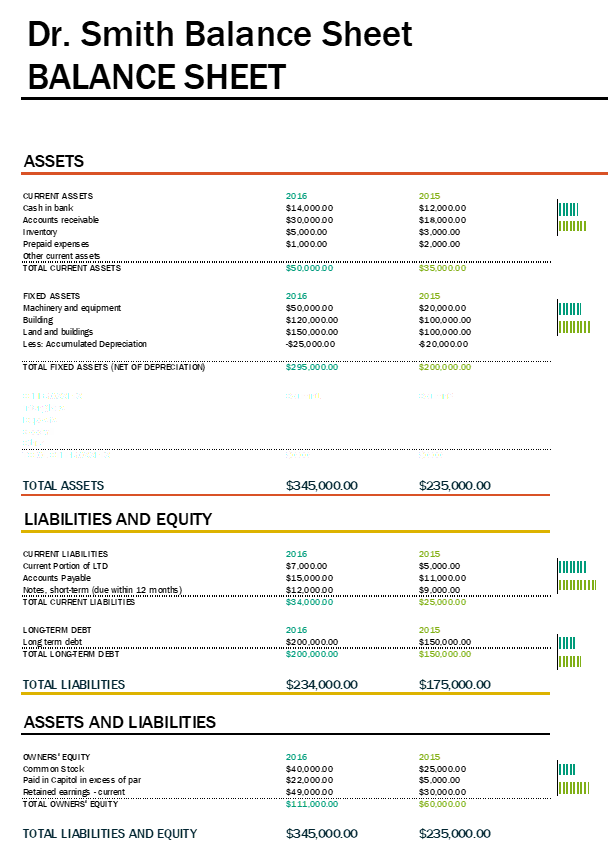

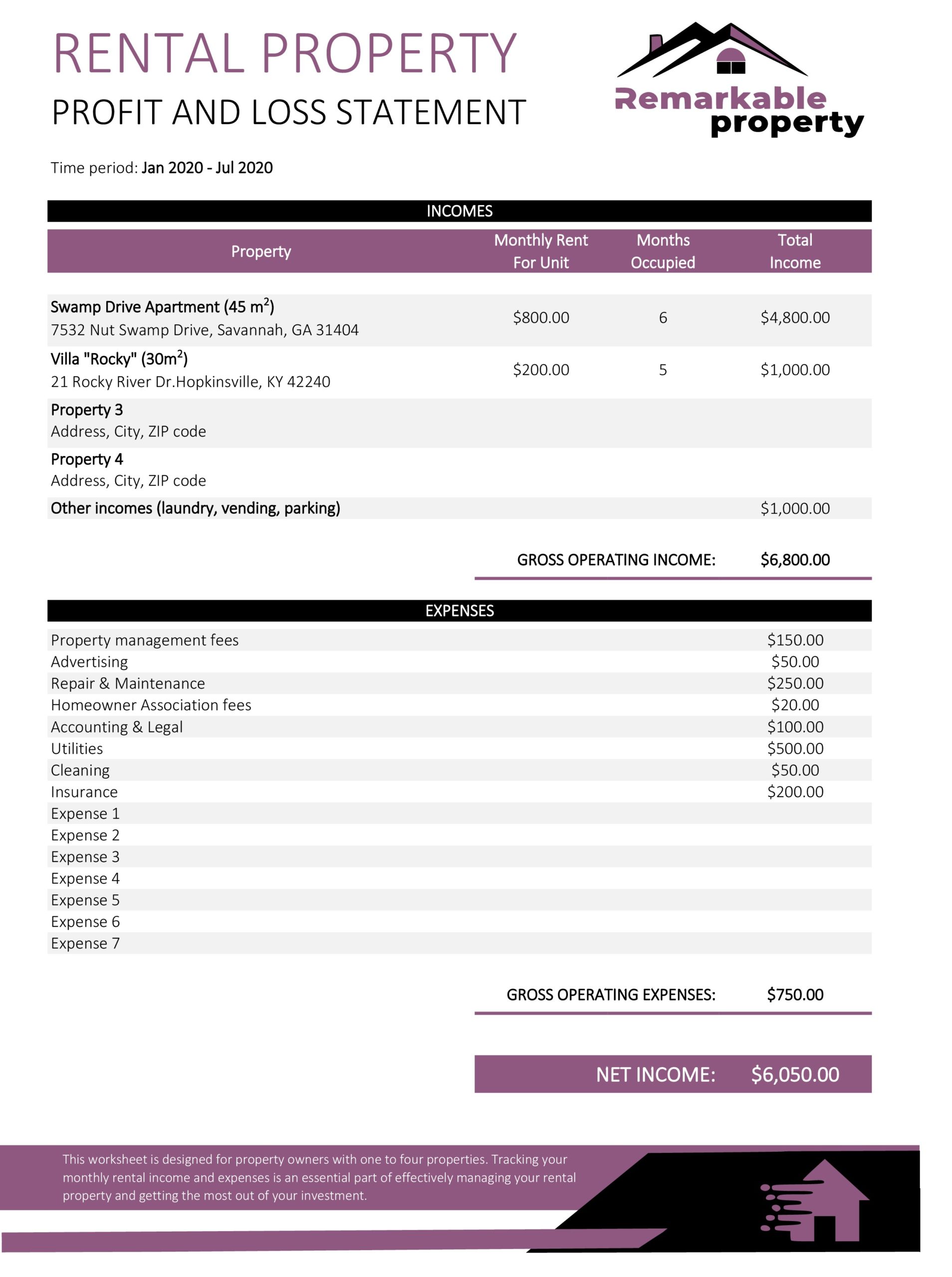

Willis banks and other financial institutions use several standard types of statements to assess the financial health of a business. Whatever you choose to call it, this statement keeps track of revenue. How often should you check your p&l statement?

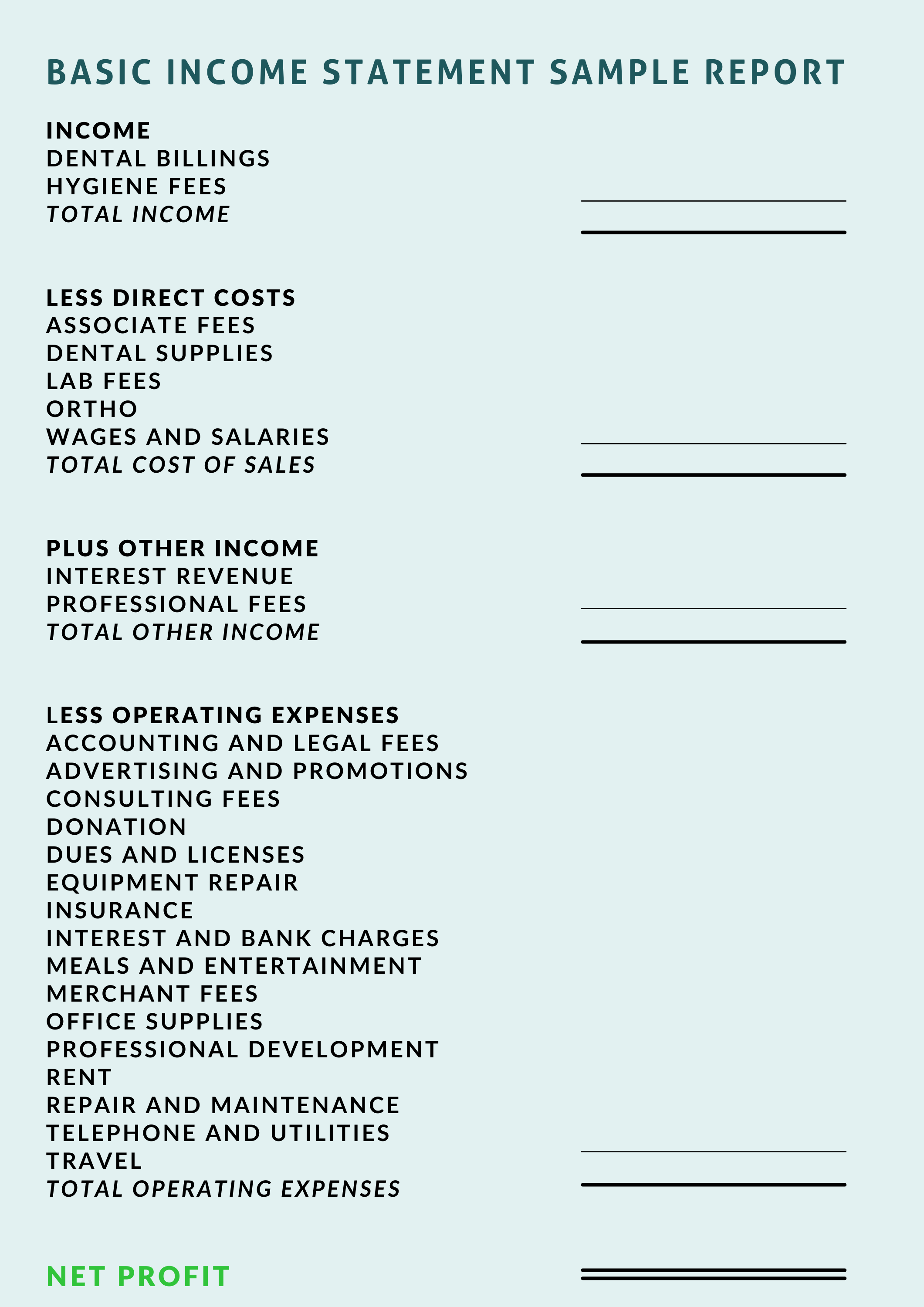

Your dental practice income statement, sometimes called your profit and loss statement, or your p&l statement, can be a foundational management tool for your practice if it is purposely designed. This is income before expenses. This viva podcast will discuss the profit and loss statement.

Your financial reports, if presented properly,. Infodocs profit and loss statement for the year ended december 31, 2023; Dental podcast hosted by dr.

Understanding your dental practice’s financial statements can mean. Understanding how to develop these statements, what each component is,. Unfortunately, many dentists have no idea their.

Schiff says this differs from dentist to dentist. Dental practice accounting 101: Today’s topic is profit and loss statements for dentists.dental practices often have a disconnect between their accounting a.

The information on your statement helps you determine how your money is coming in, and what expenses are causing it to go right back out. This includes dental supplies, lab work, medical. Profit loss statement and analysis by paul lipcius september 21, 2020 as the ceo of your practice, you should monitor the financial health of your practice regularly.

Chapter 3 dentistry by the numbers david o. The p&l must be prepared and reviewed monthly. Understanding your dental practice’s financial statements can mean the difference amid successful promotions once you go to sell—or no offers.

By looking at gross profit as a percentage i can more easily compare my other services and gauge their profitability. A profit and loss statement is where the elements comprising overhead are noted and quantified. Here am a few financial reports.

Comparing the current statement with the year to date p&l and the previous year p&l is important to. Here’s a guide to understanding your p&l: Many doctors are concerned with overhead costs.

![Dental Resume Examples for 2024 [+Skills, Format]](https://cdn-images.resumelab.com/pages/dentist_template_diamond.png)