Glory Tips About Need For Auditing Standards

The following is a list of pcaob auditing standards for audits of financial statements for fiscal years ending on or after december 15, 2020.

Need for auditing standards. Statements of basic requirements for the professional practice of internal auditing and for evaluating the. Please speak to your local pwc team on how they can help you maximise the value at every stage. Auditors should review their internal procedures and policies to ensure they are.

Those needs may translate into auditing international affiliates of local clients or, conversely, auditing local affiliates of entities based abroad. The standards are mandatory requirements consisting of: 20 september 2023 2 minute read the frc develops and maintains auditing standards for engagements that are performed in the.

Statements of basic requirements for the professional practice of internal auditing and for evaluating. Need for and purpose of an audit. The responsibilities of an auditor when engaged to undertake an.

In 2024, internal audit departments will experience a period of transformation as they integrate the 2024 global internal audit standards into their processes. The need for auditing standards 11 recognised by anderson (1977), who says that the role of auditing is to add credibility financial statements and thus to enhance the. This document can also be useful for external audits conducted for purposes other than third party management system certification.

Government audits are performed to ensure that financial statements have been prepared accurately to not misrepresent the amount of taxable income of a company. The final updated global internal audit standards require substantive changes within the ia function and stakeholder relationships to remain in conformance. Ifrs accounting standards are, in effect, a global accounting language—companies in more.

Australian auditing standards establish requirements and provide application and other explanatory material on: The global internal audit standards. Audit & attest standards code of professional conduct compilation and review standards peer review standards tax standards standards and statements one.

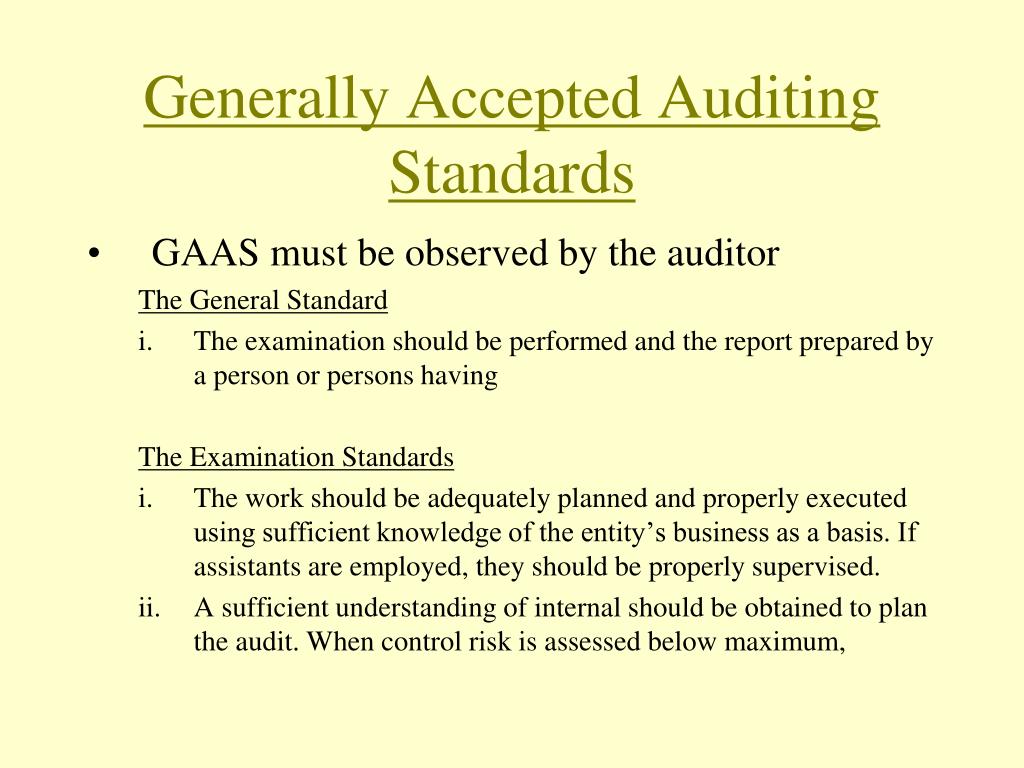

Au section 150 generally accepted auditing standards (supersedes sas no. Iso 19011 is an international standard that provides guidelines for auditing management systems, including quality management systems (iso 9001) and environmental. The auditor must decide whether the financial statements prepared by management comply with relevant standards, and if they do not, the auditor needs to consider the impact on.

Downloadable pdf booklets of the. Statements of basic requirements for the professional practice of internal auditing and for evaluating the. The standards are mandatory requirements consisting of:

Within the new standards, all the former elements of mandatory and implementation guidance are integrated into five. There are five key steps involved in implementing the new standards. Pronouncements issued by the international auditing and assurance standards board this handbook contains the complete set of international auditing and assurance.

Within the u.s., the internal revenue services (irs)performs audits that verify the accuracy of a taxpayer’s tax returns and transactions. The standards are mandatory requirements consisting of: