Casual Tips About P&l Financial Statement

A p&l statement is an indicator of the financial health of your company based on its ability to generate income through sales, manage expenses and sustain a healthy profit margin.

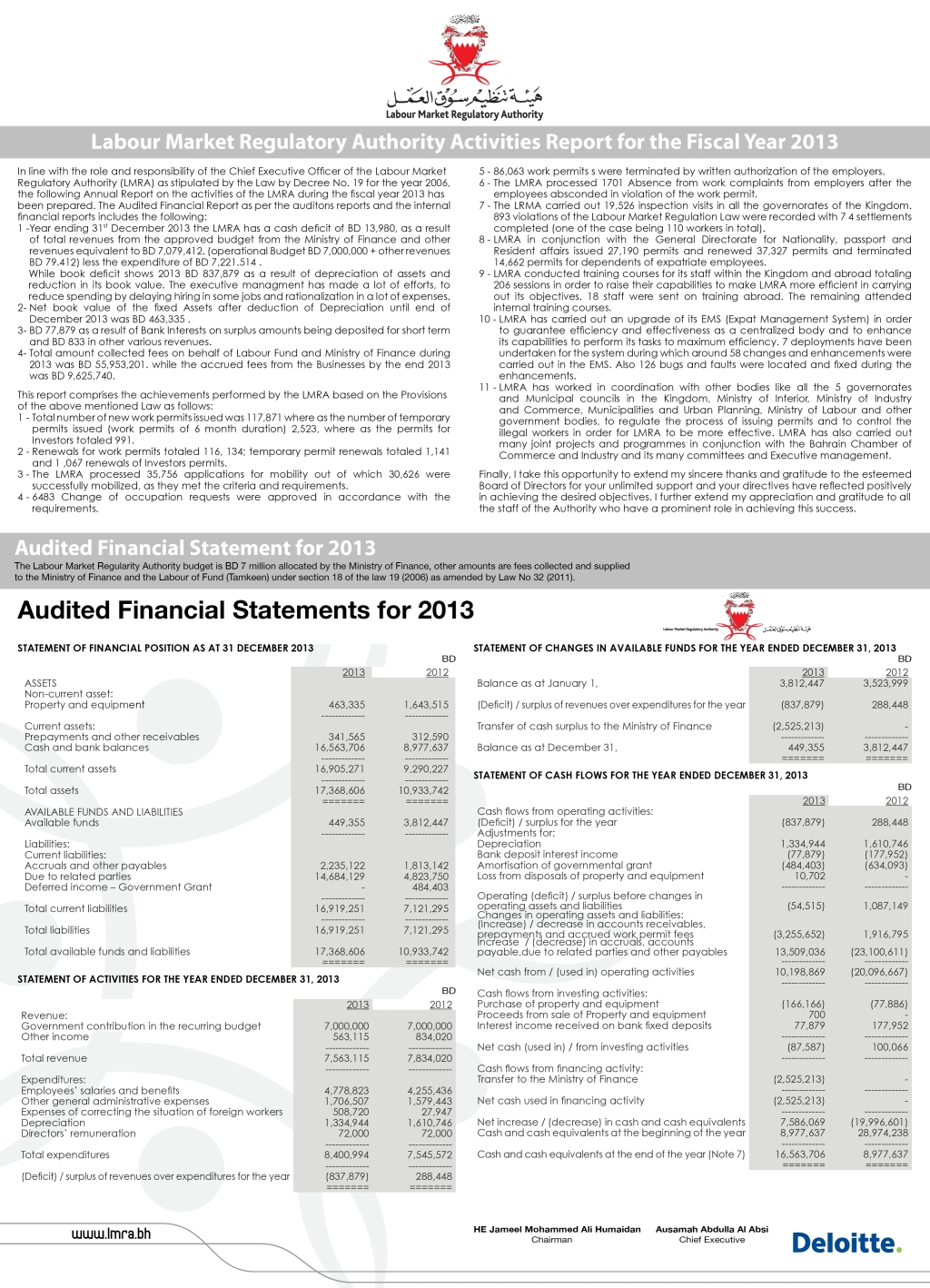

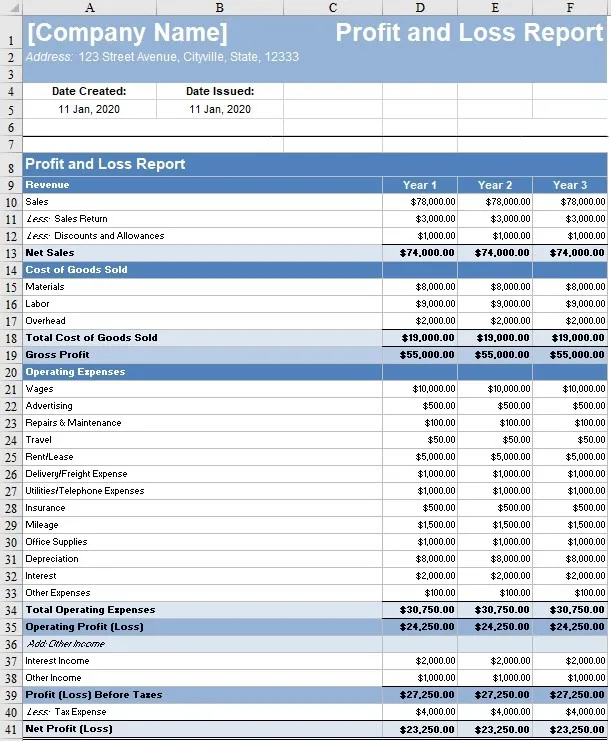

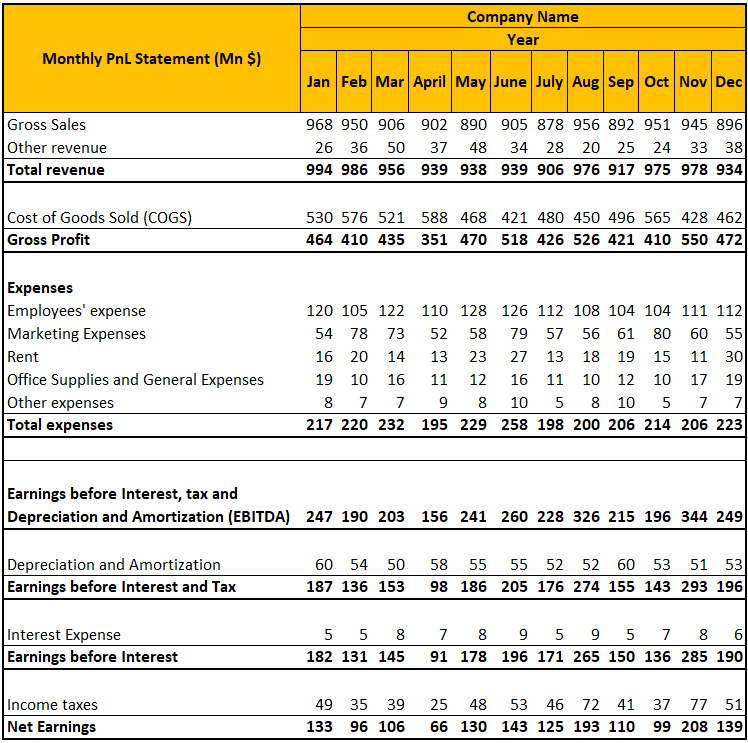

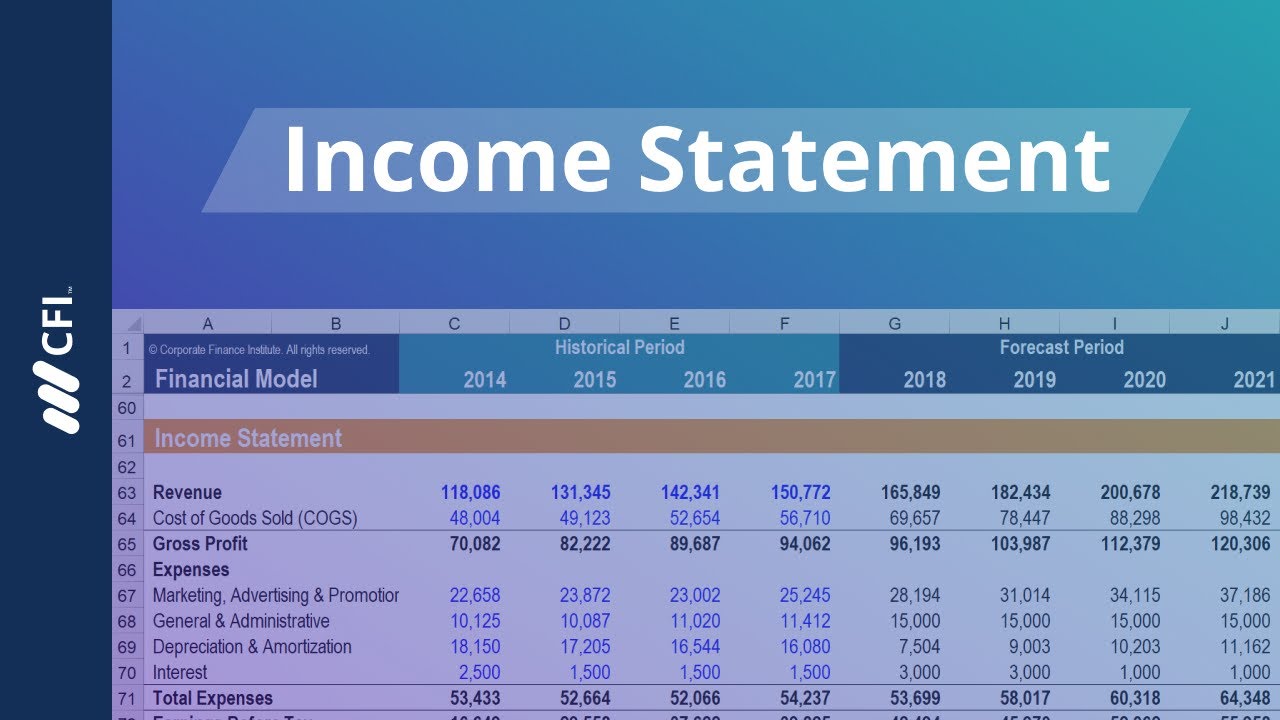

P&l financial statement. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Below is a screenshot of the p&l statement template: Such statements provide an ongoing record of a company's.

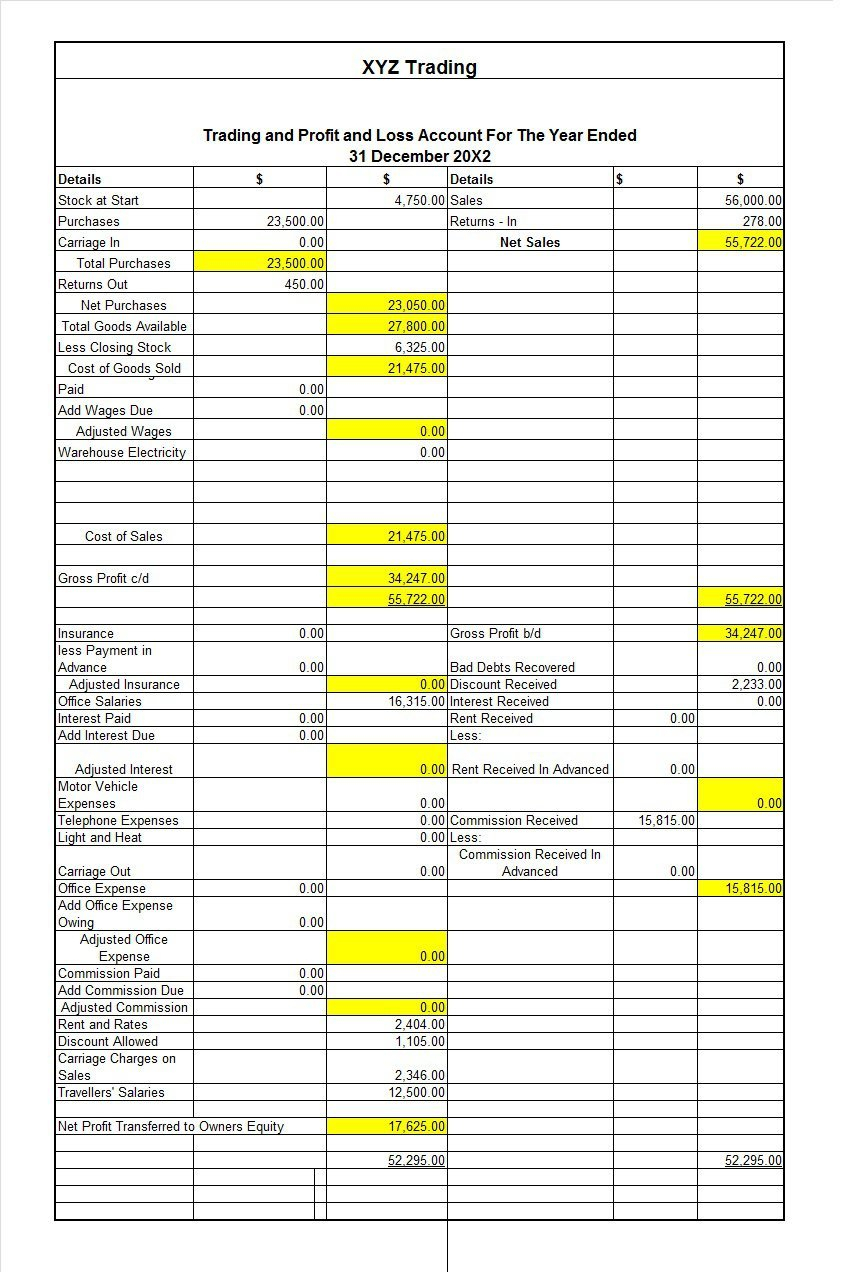

A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. All companies require an accounting profit and loss statement (p&l) or income statement for their accounts. There are several reasons why you need the financial report, including:

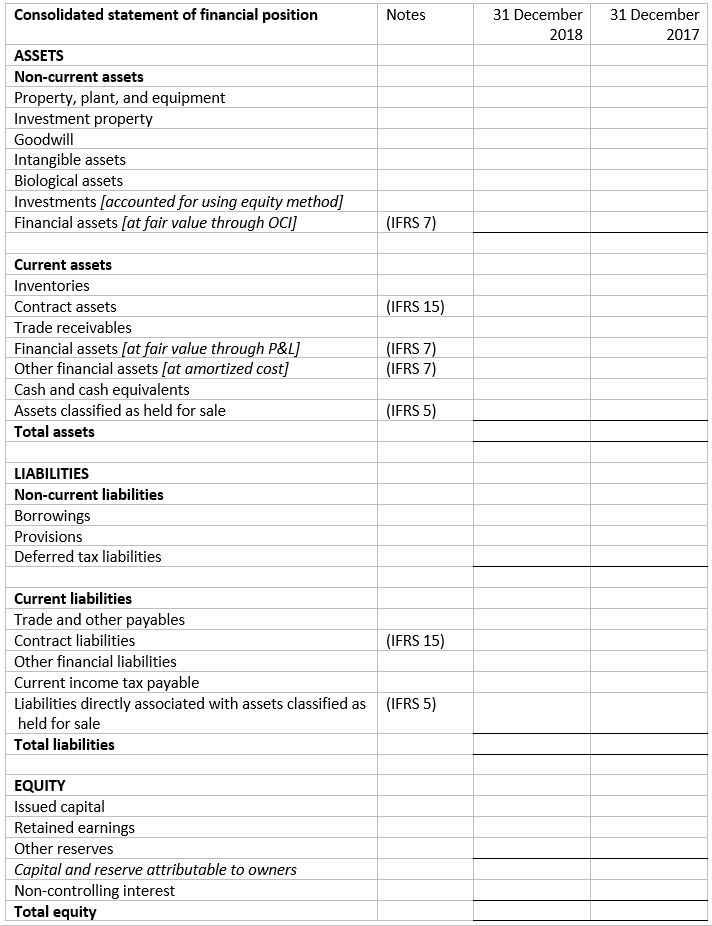

#1 monthly profit and loss template The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly. The result is either your final profit (if things went well) or loss.

A p&l statement, also known as an “income statement,” is a financial statement that details income and expenses over a specific period. It captures how money flows in and out of your business. A profit and loss (p&l) statement, also known as an income statement or statement of earnings, is a vital financial document that provides insights into a company’s financial performance during a specific period.

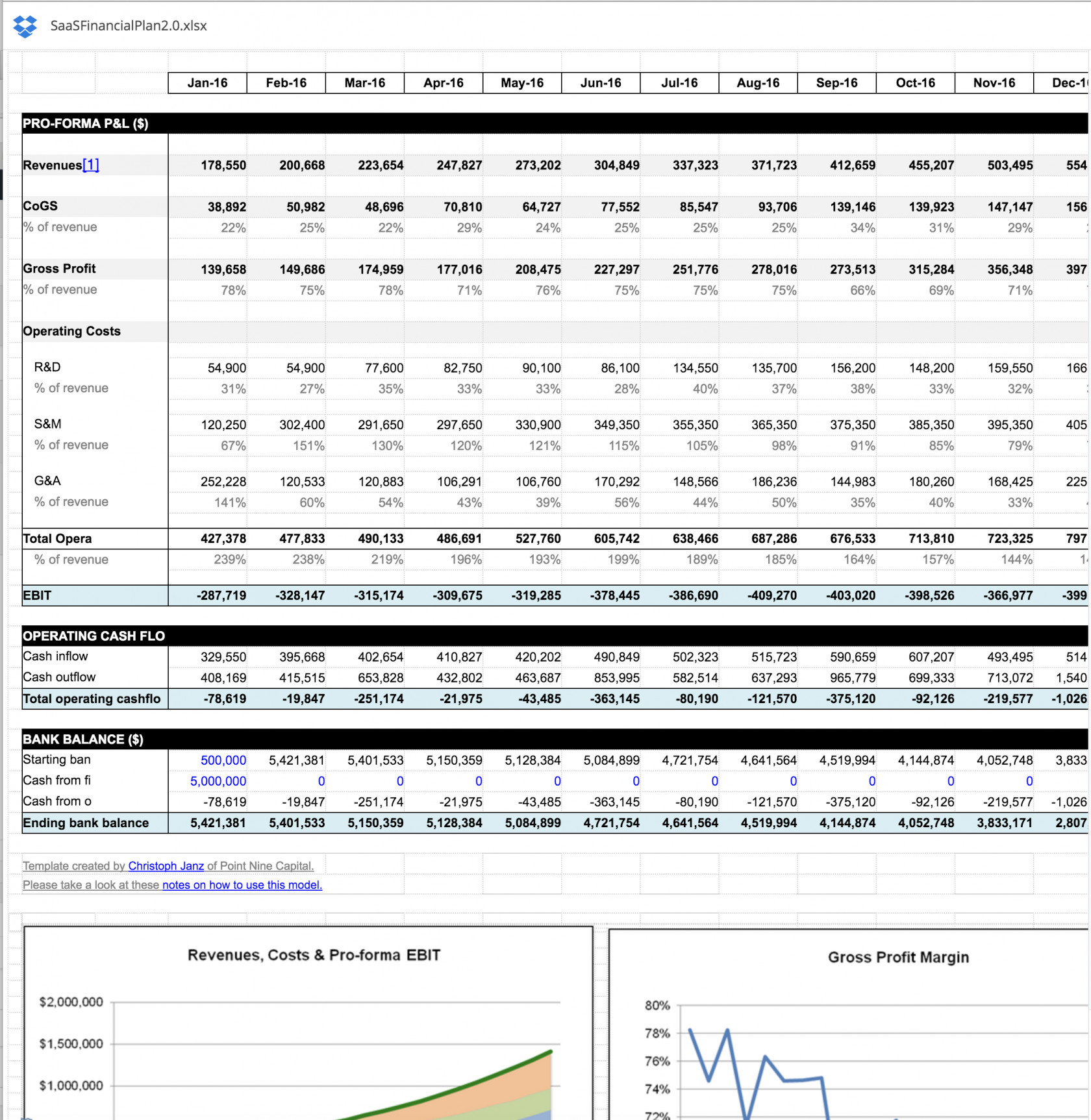

A profit and loss (p&l) statement is the same as an income statement. Profit and loss (p&l) statement template. It offers a comprehensive overview of a company’s revenues, costs, and expenses, enabling stakeholders to evaluate its.

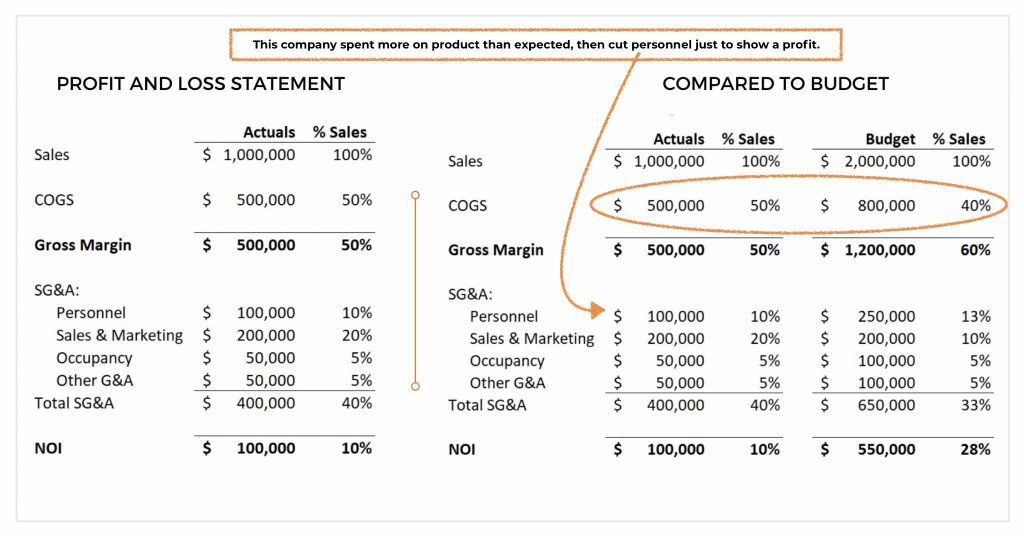

But, learning how to read one isn’t always intuitive. Knowing how to read a profit and loss statement is key to making informed. The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons.

According to investopedia, “a profit and loss statement is a financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time, usually a fiscal quarter or year.” This report helps you understand what’s behind a company’s profitability by categorizing revenues and expenses. The p&l statement shows a company’s ability to generate sales, manage expenses, and.

A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given accounting period. A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of its costs from its revenue during a specific accounting period,. Then, it subtracts the costs of making those goods or providing those services, like.

A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period. An accountant typically prepares the reports. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

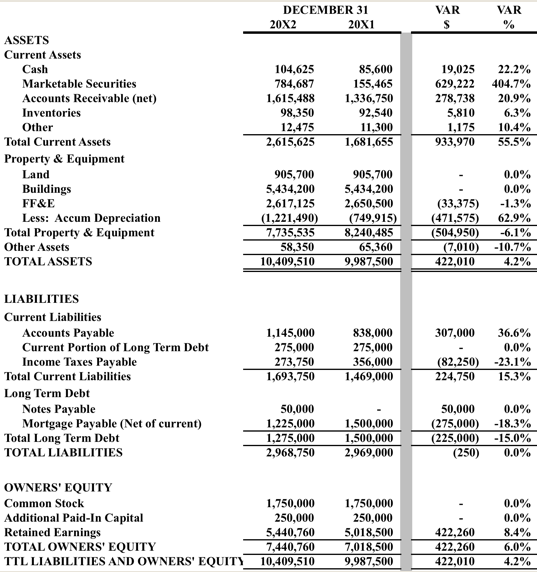

Together, alongside the cash flow statement (cfs) and balance sheet , the p&l statement provides a detailed depiction of the financial state of a company. The financial statement provides information and conveys the financial position of the company. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)