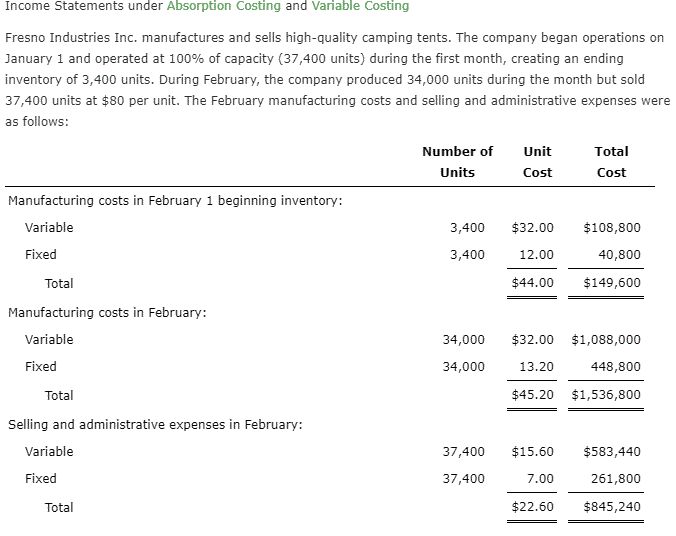

Looking Good Info About Income Statement Under Variable Costing

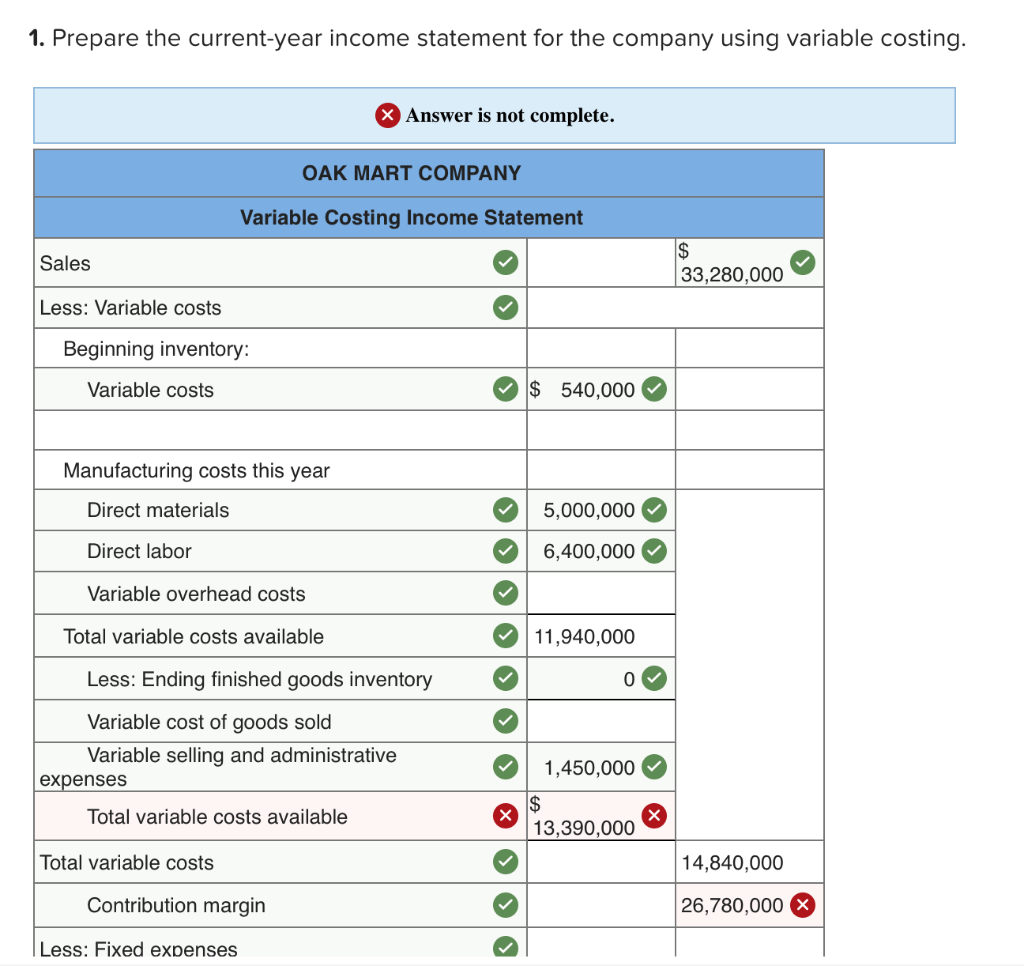

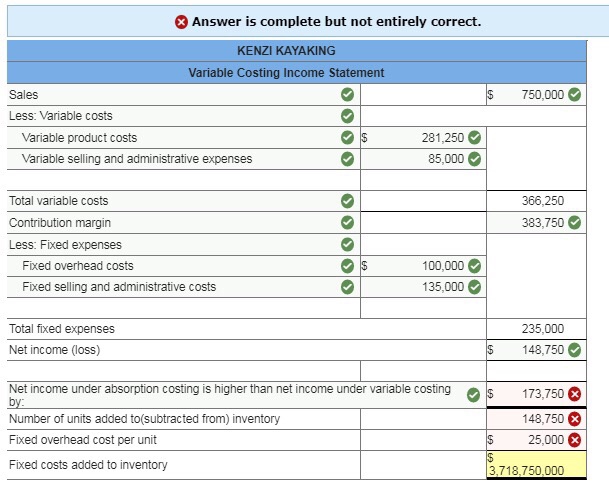

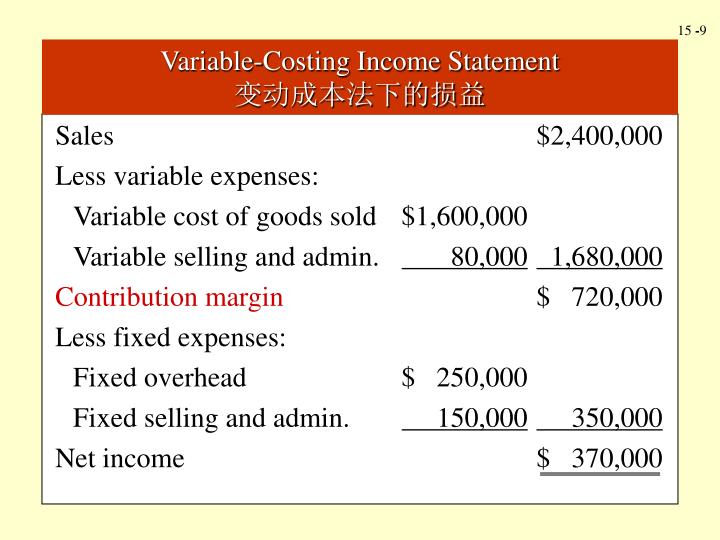

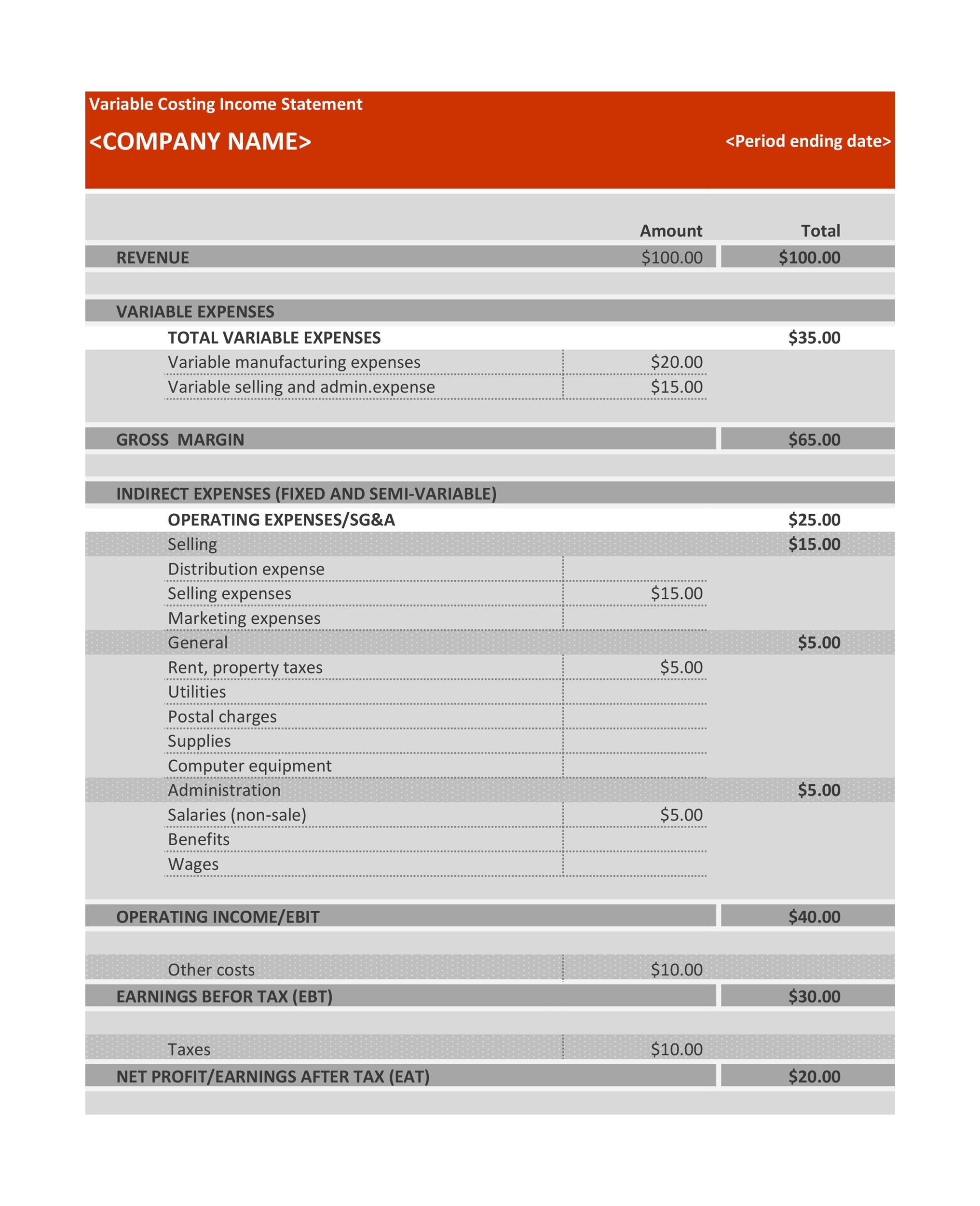

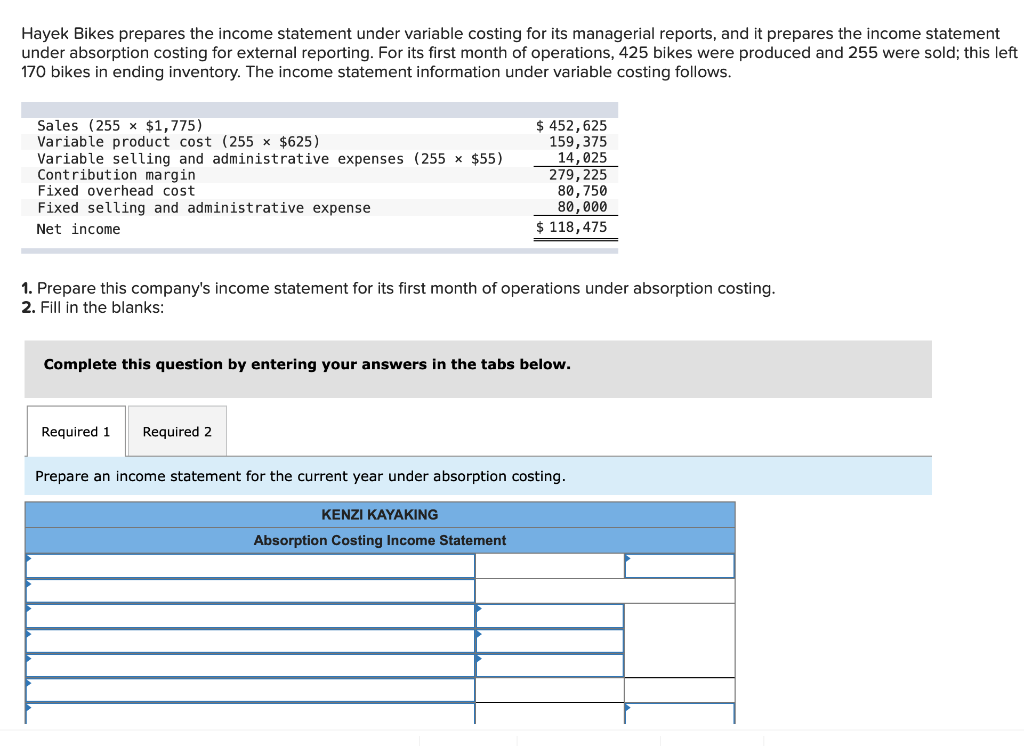

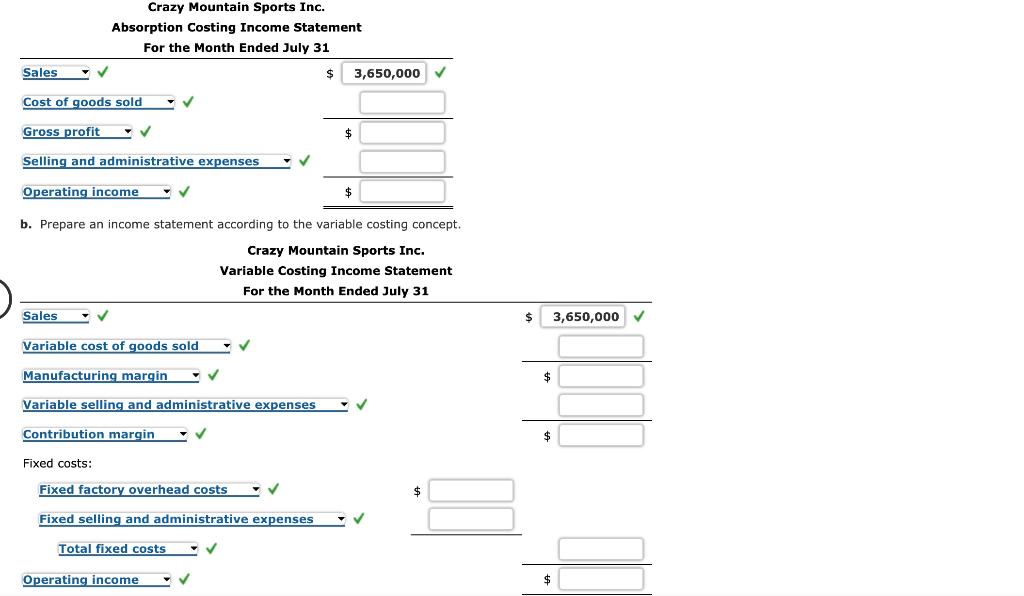

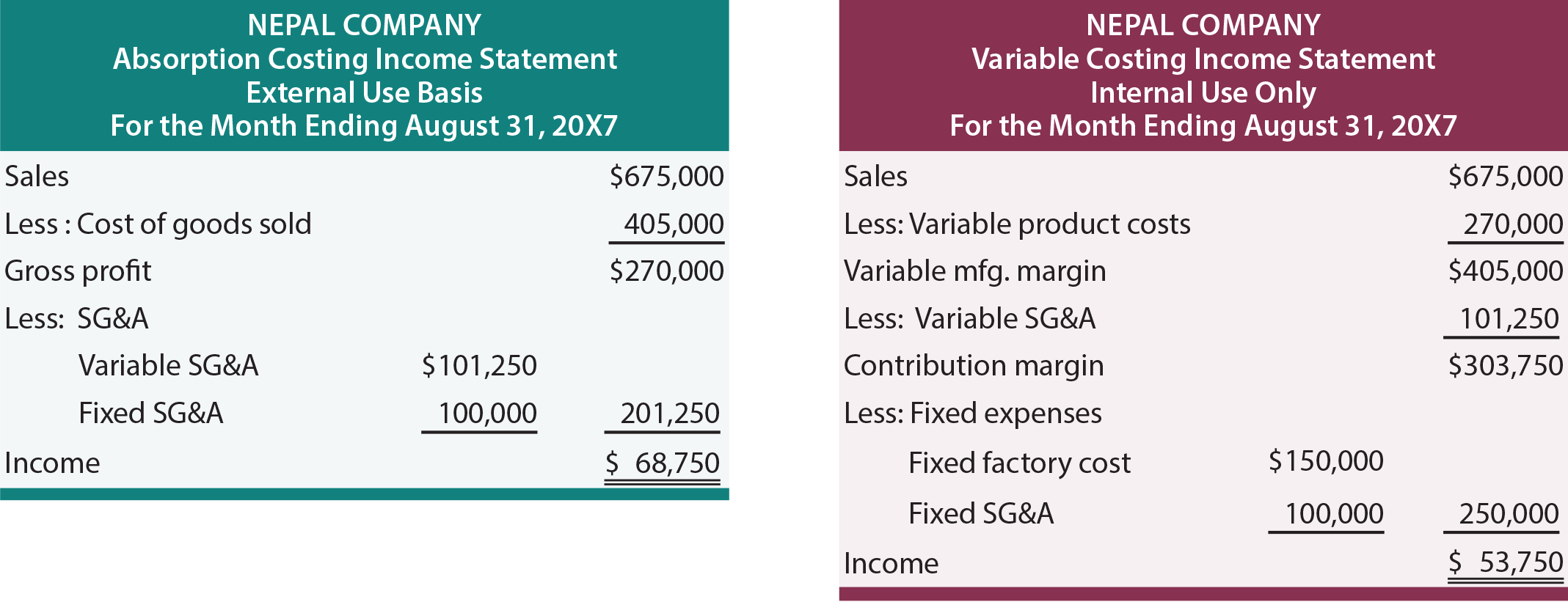

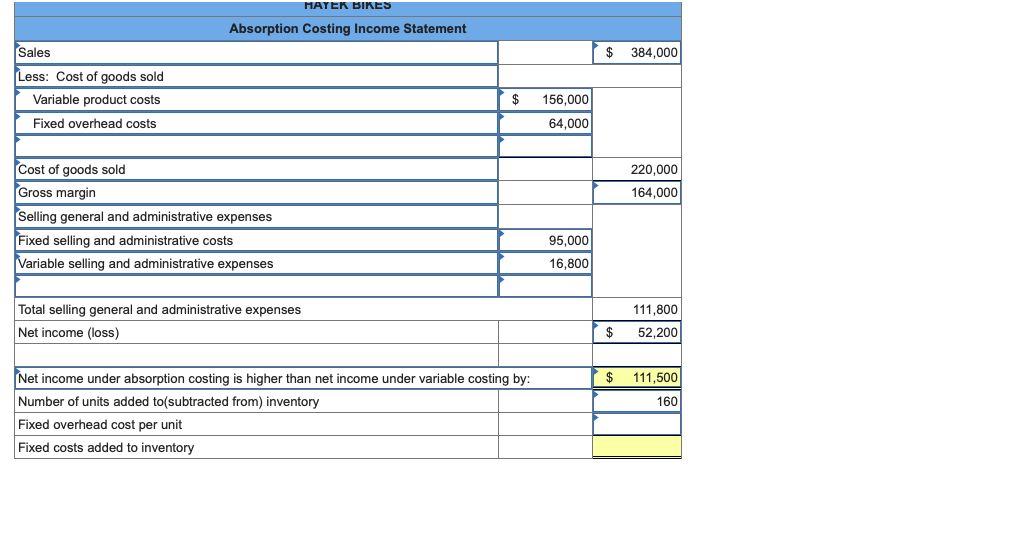

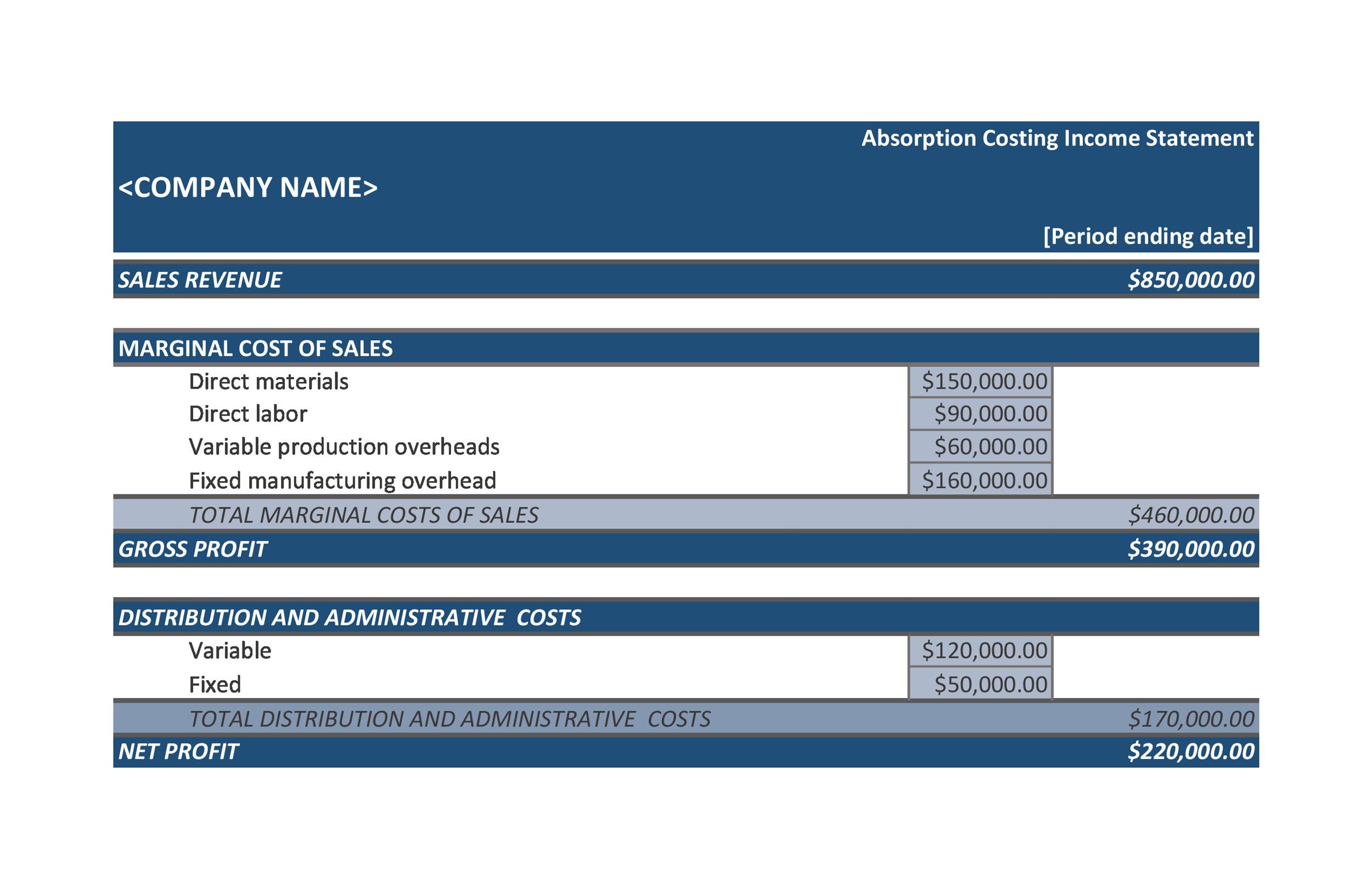

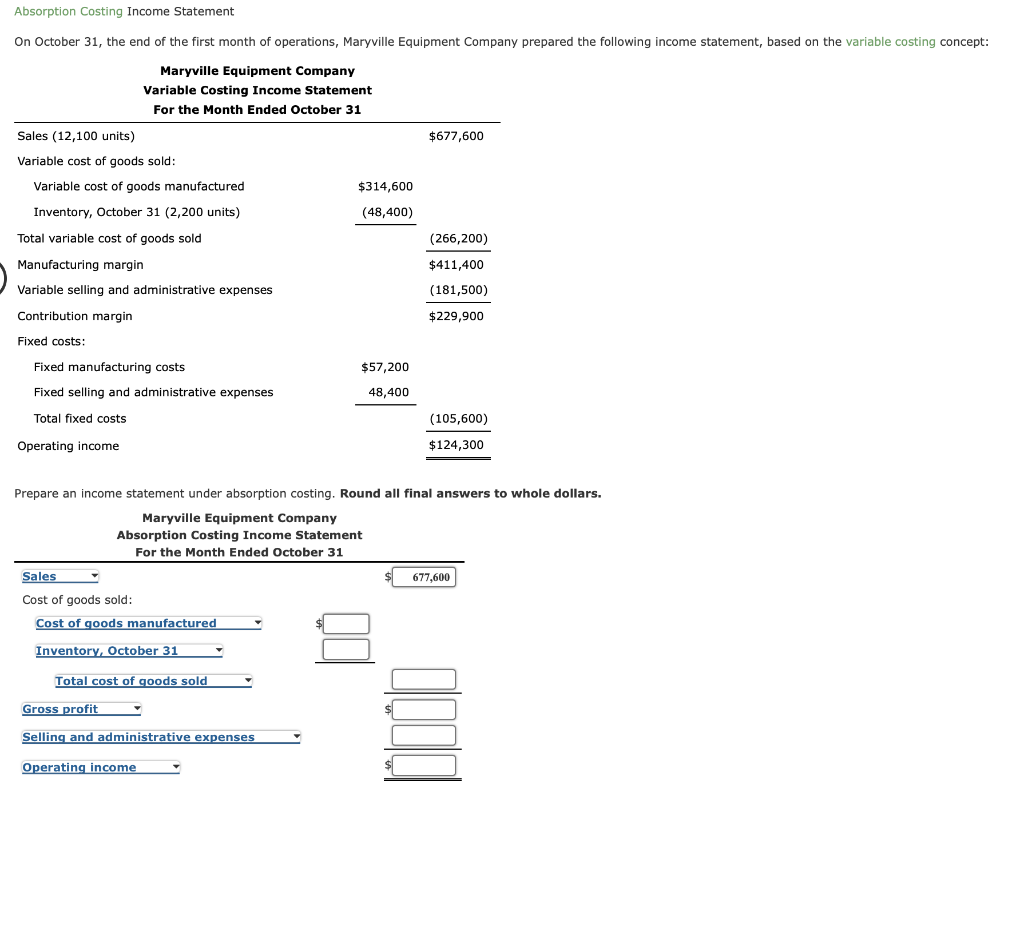

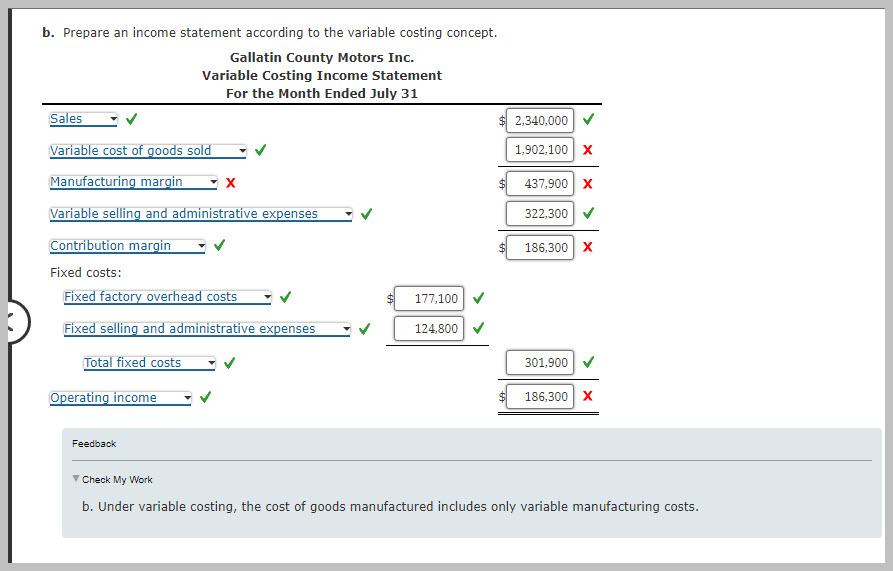

On a variable costing income statement, all variable expenses are deducted from revenue to determine the contribution margin, from which all fixed expenses are subtracted to arrive at operating income for the period.

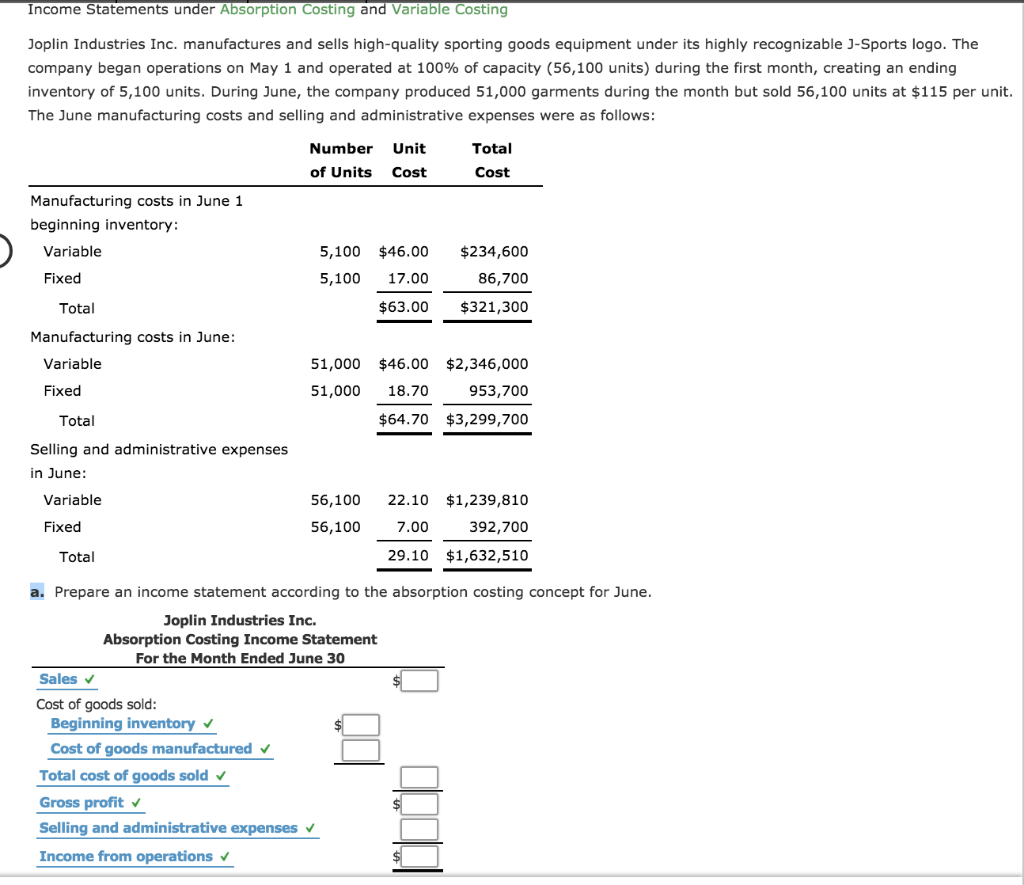

Income statement under variable costing. Fixed overhead (fixed portion only) 6,000: This contribution margin income statement would be used for internal purposes only. Cost of goods sold (9,000 x $3.30 per unit) 29,700:

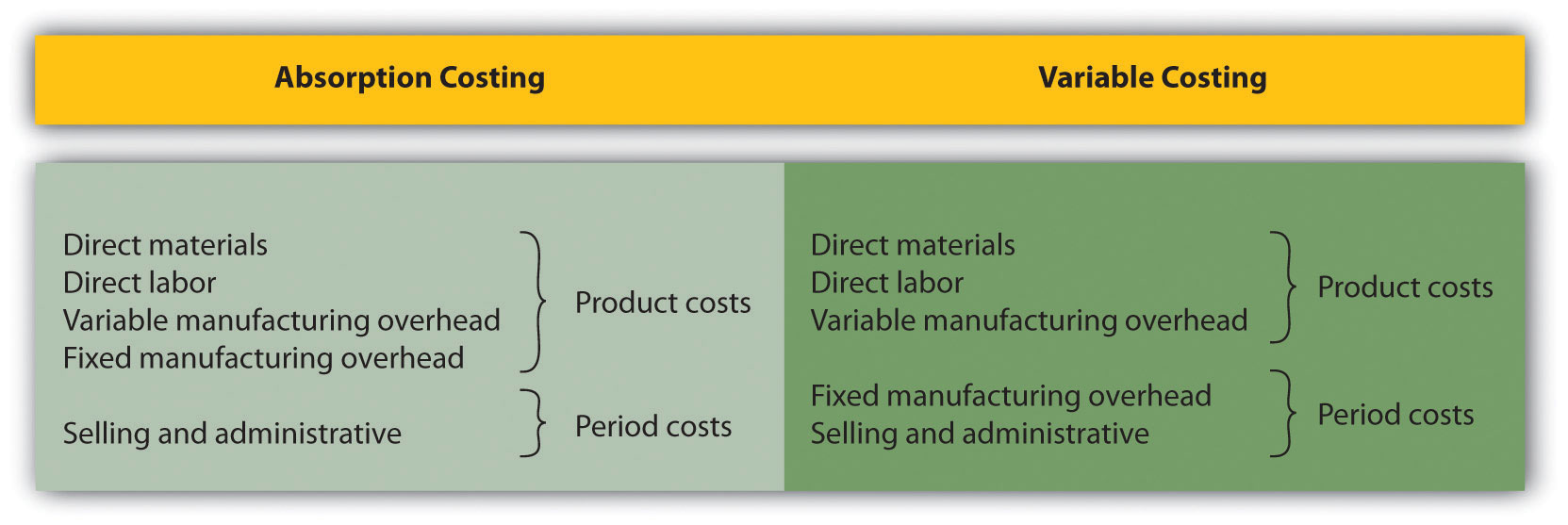

It only considers the variable costs when determining product costs. From this, all fixed expenses are subtracted to arrive at the net profit or loss for the period. The method contrasts with absorption costing, in which the fixed manufacturing overhead is allocated to products produced.

Consequently, it allows companies to calculate. Income statement (variable) for month ended may: Overall, the variable costing income statement is a report that companies prepare under managerial accounting.

Variable costing income statement has the following line items: The following is a sample variable costing income statement. A variable costing income statement is a type of income statement in which you subtract variable expenses from total sales revenue to arrive at a separate line item called contributions margin (the money left over from sales after paying all variable production expenses).

The contribution margin is the incremental profit earned when a product's sales exceed its variable costs. A variable costing income statement is a financial report in which you subtract the variable expenses from revenue, resulting in a contribution margin. Variable production costs include direct materials, direct labor and variable manufacturing overheads.

Sales (9,000 x $8 per unit) $ 72,000: The income statement we will use in not generally accepted accounting principles so is not typically included in published financial statements outside the company. The variable costing income statement is one where all variable expenses are subtracted from revenue, which results in contribution margin.

What is a variable costing income statement?