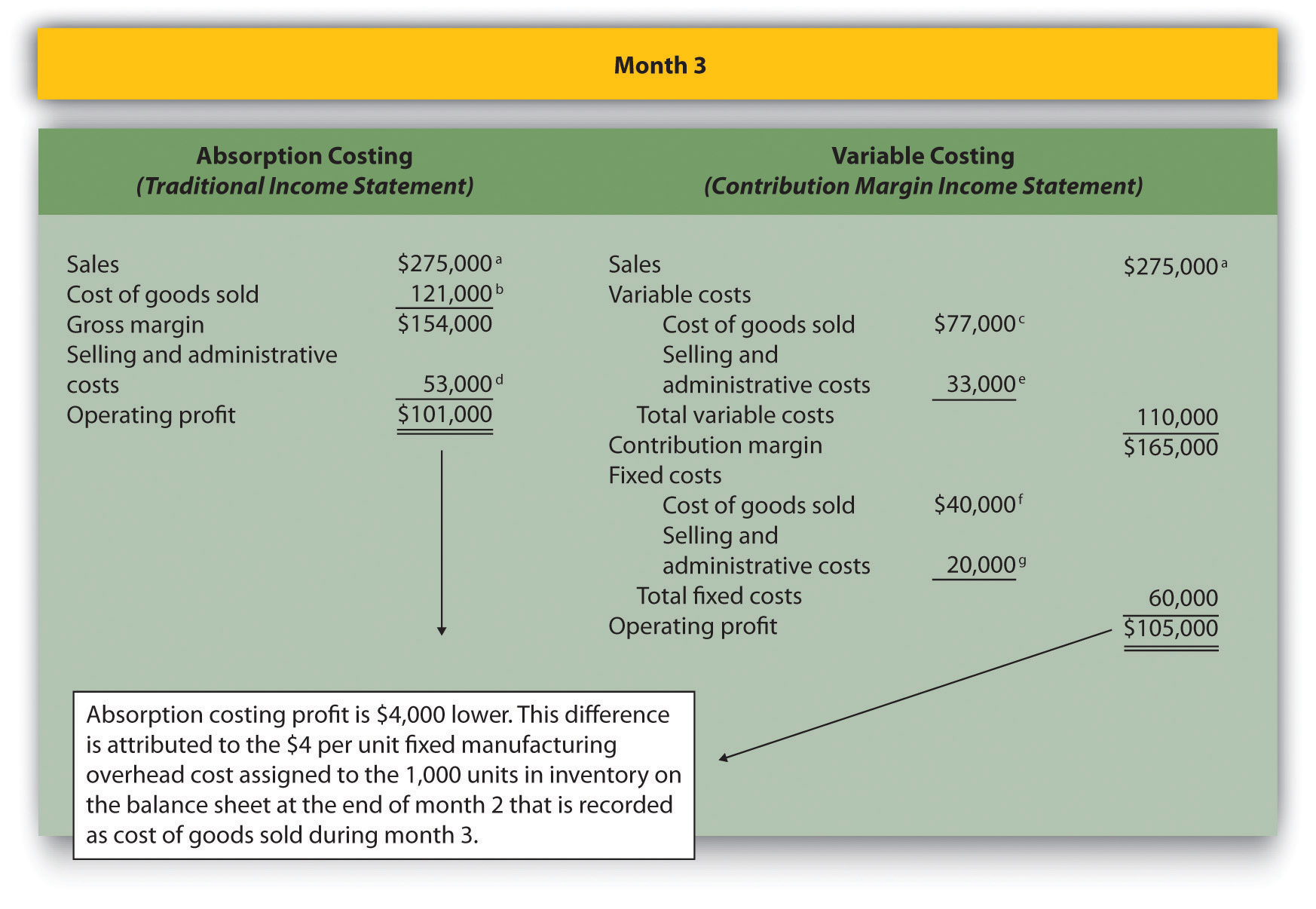

Impressive Info About Format Of Income Statement Under Absorption Costing

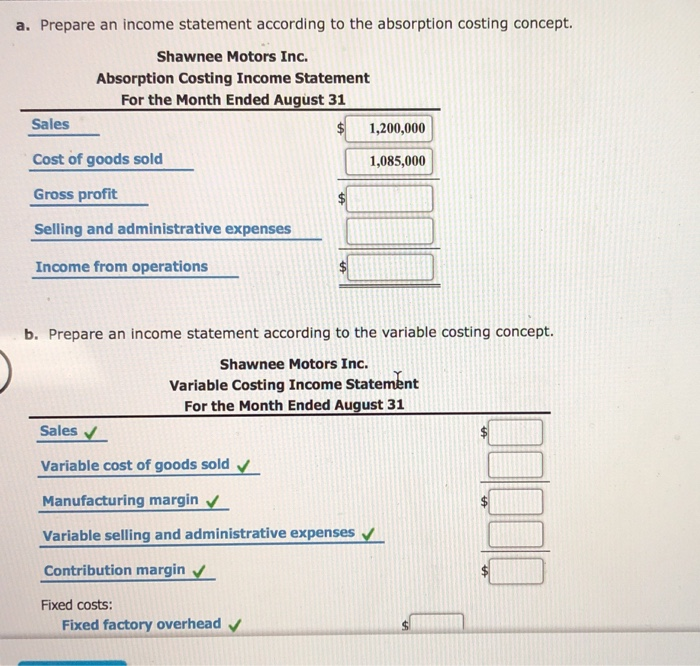

The format for the traditional income statement.

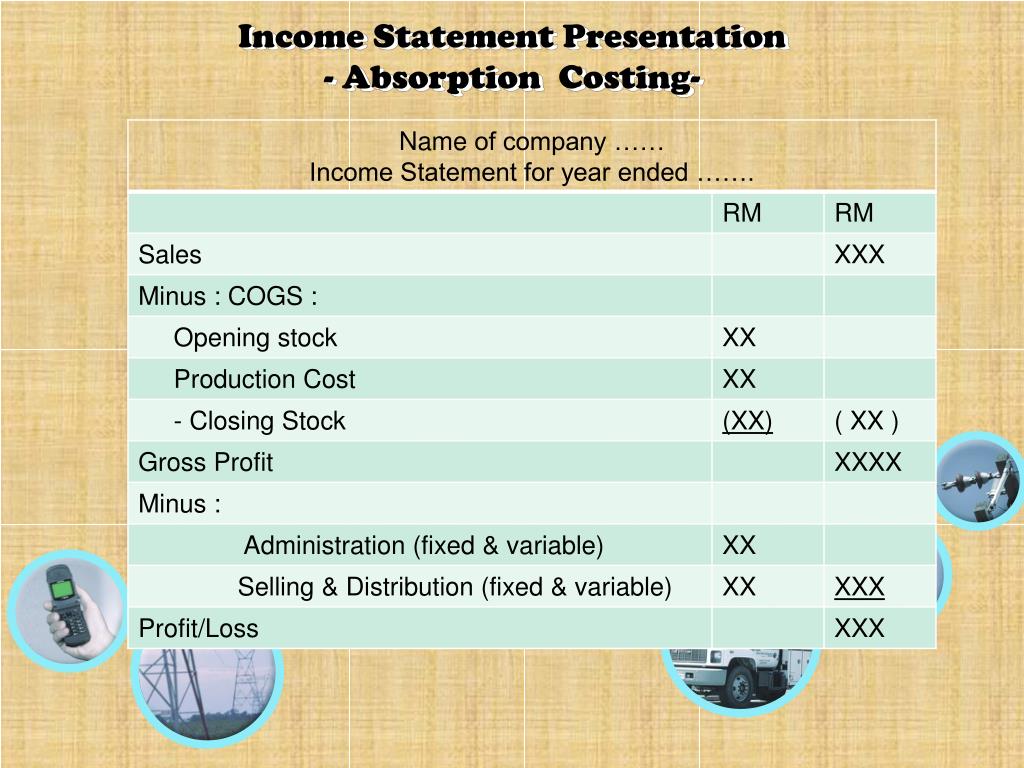

Format of income statement under absorption costing. 59 3.5k views 2 years ago absorption costing statement prepared using only 5 steps. Marginal cost = (change in the total cost of production)/ (change in total quantity) the discussion below will help you to understand it better. In this video i explain what absorption costing is, so that you understand the logic when show more

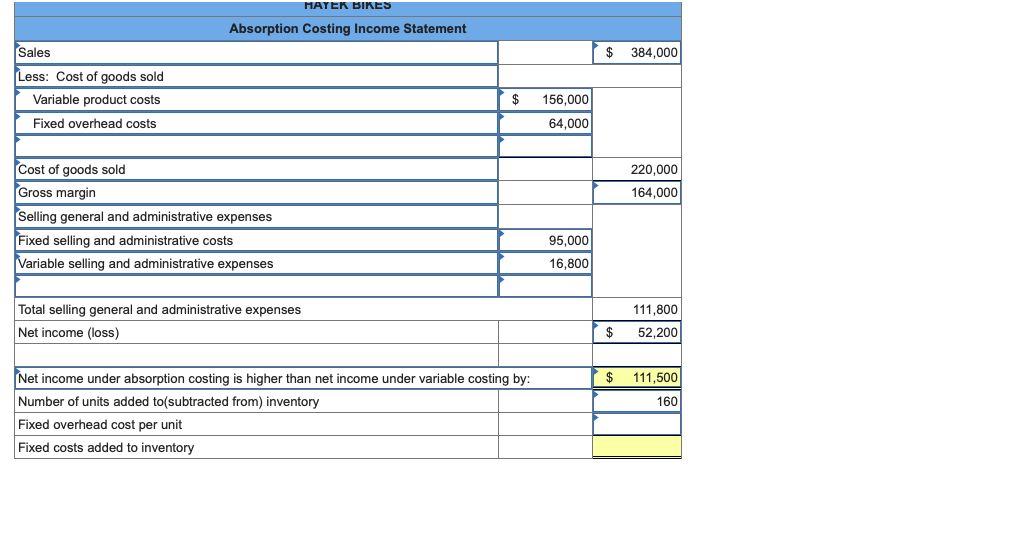

It helps in making decisions regarding accepting or rejecting special orders. Absorption costing income statement net income under absorption costing is calculated as follows: There are a variety of habits to think about business costs.

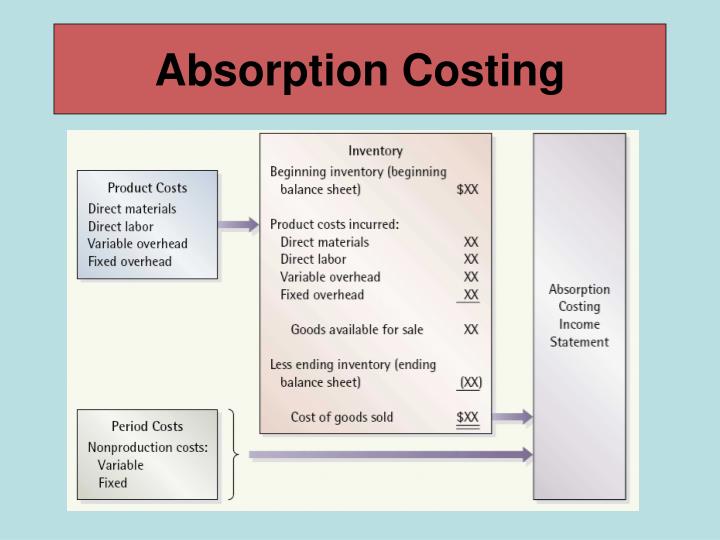

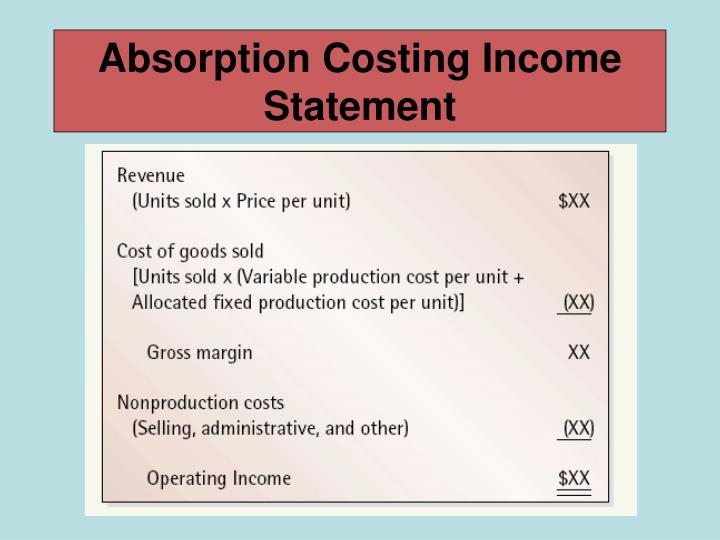

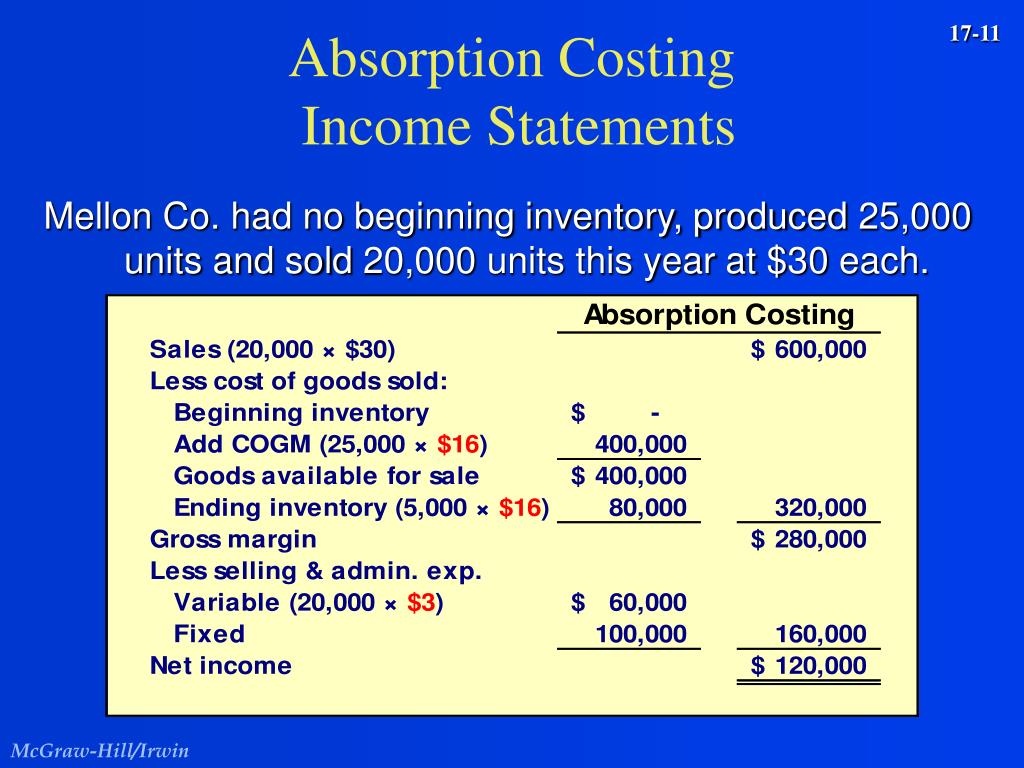

Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs. The following data summarize the results for july: The variable costs are directly charged in this costing method.

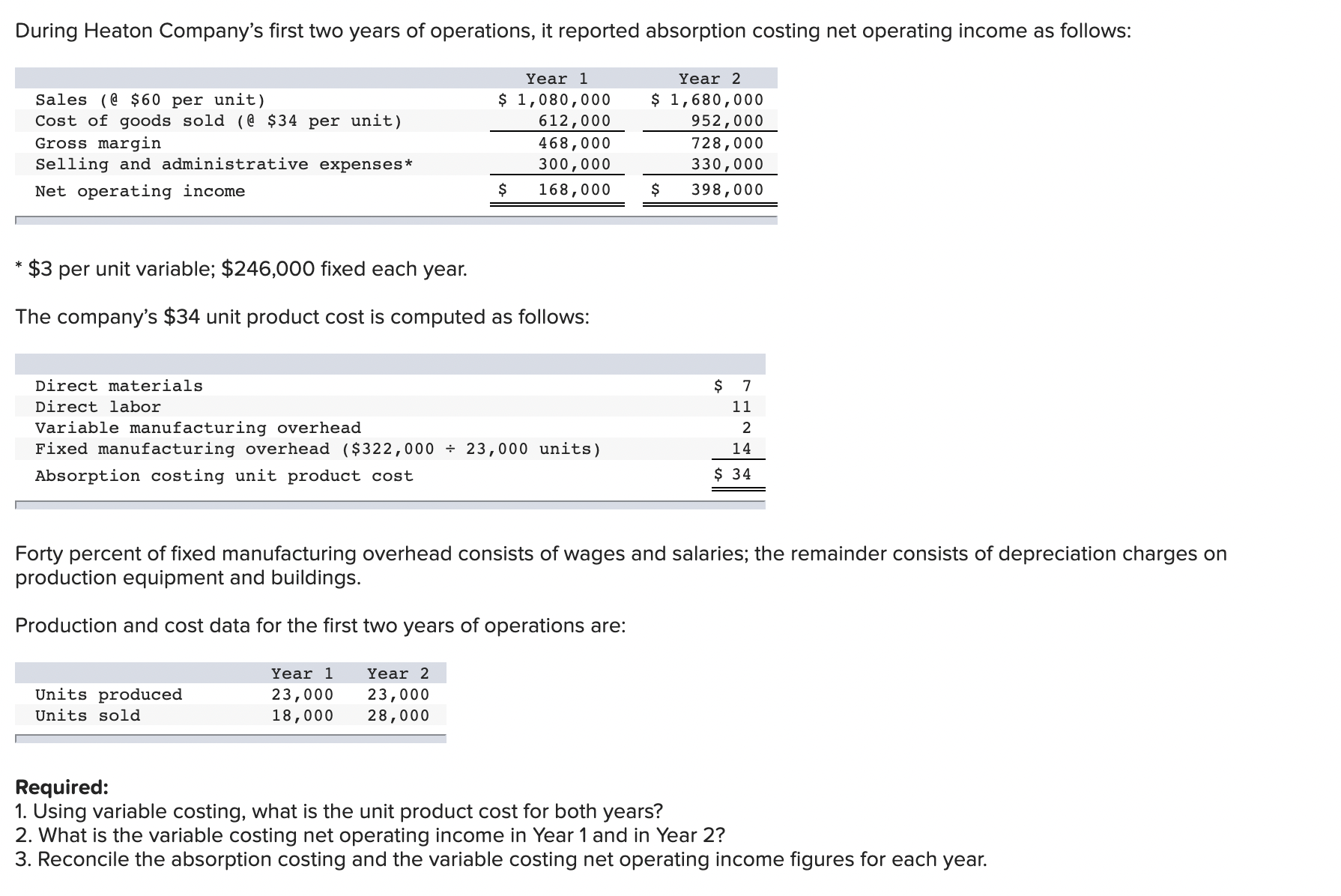

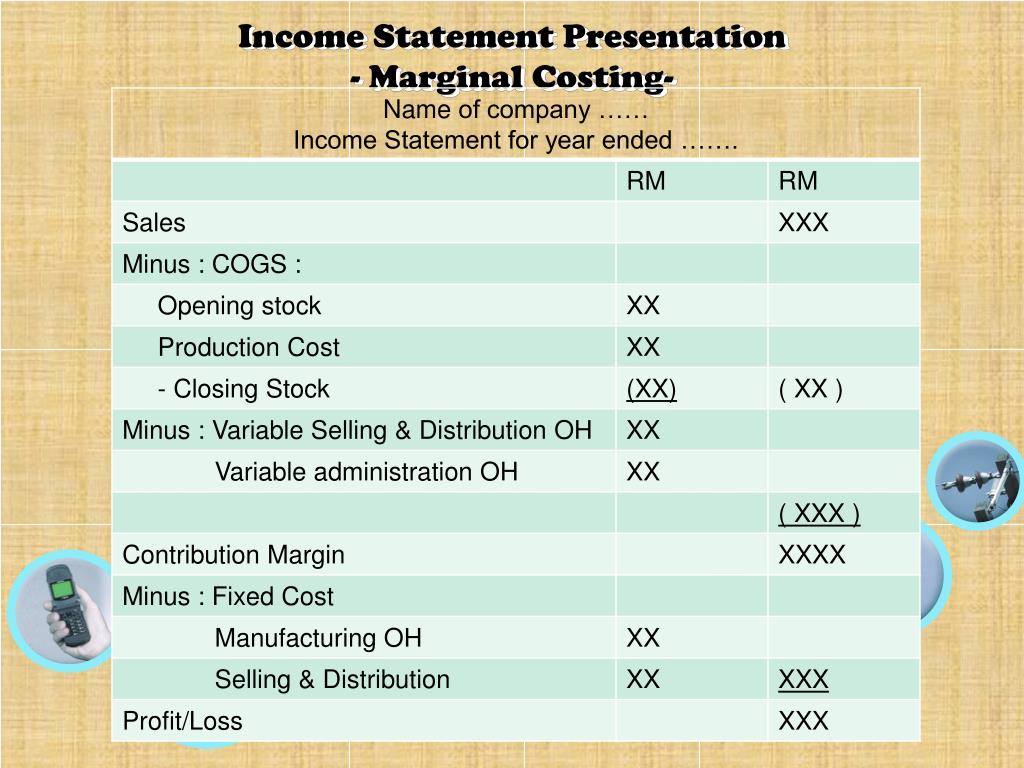

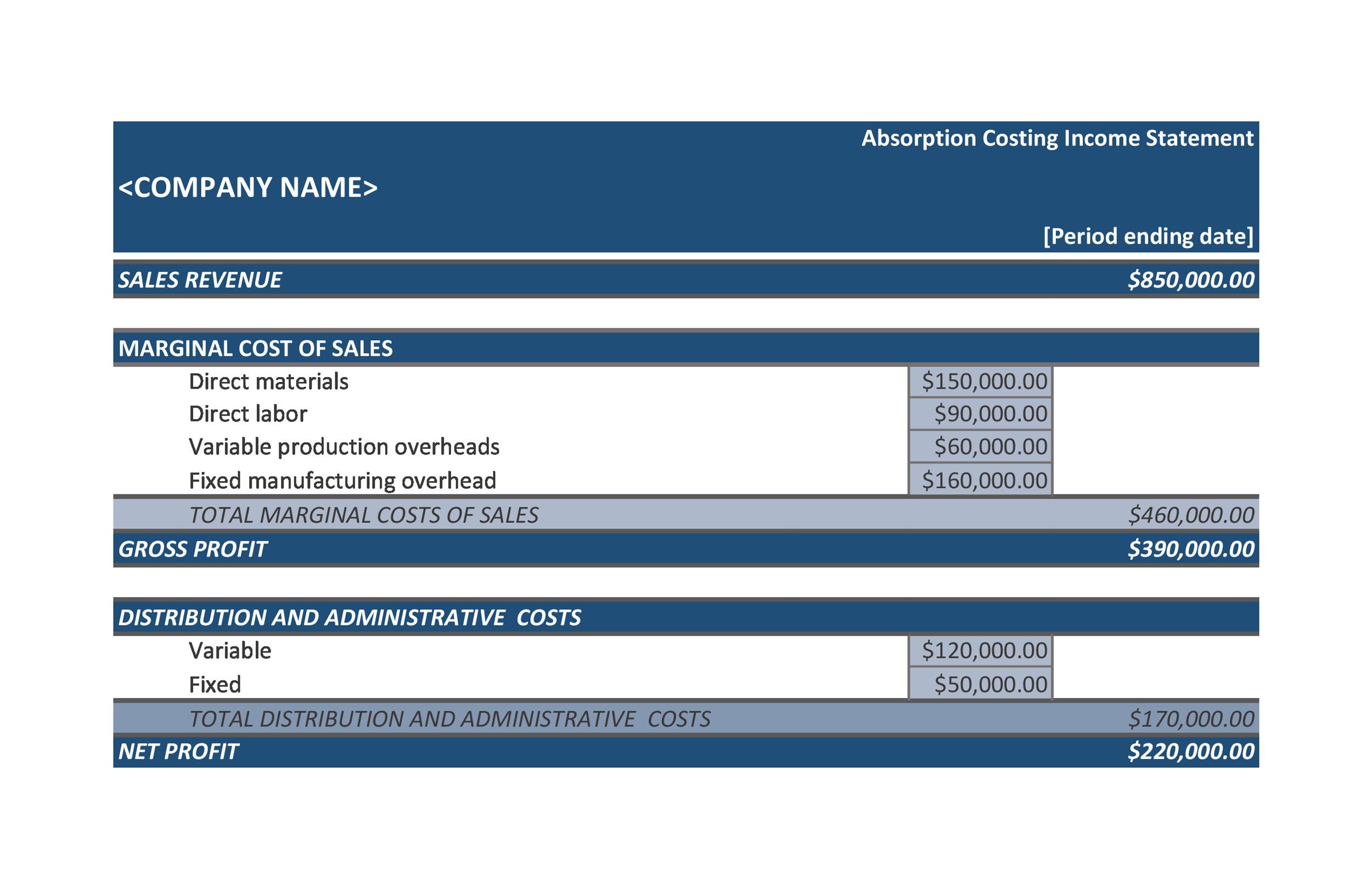

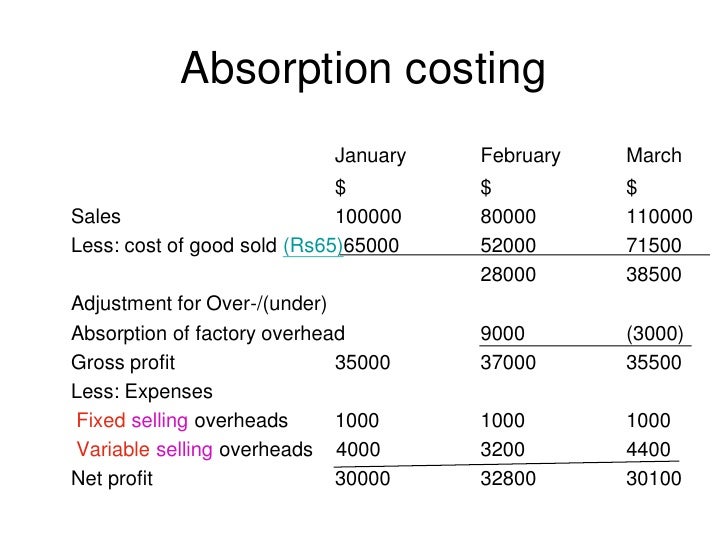

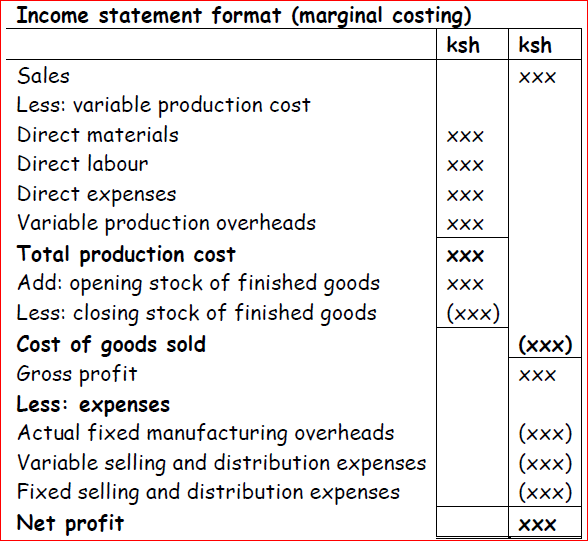

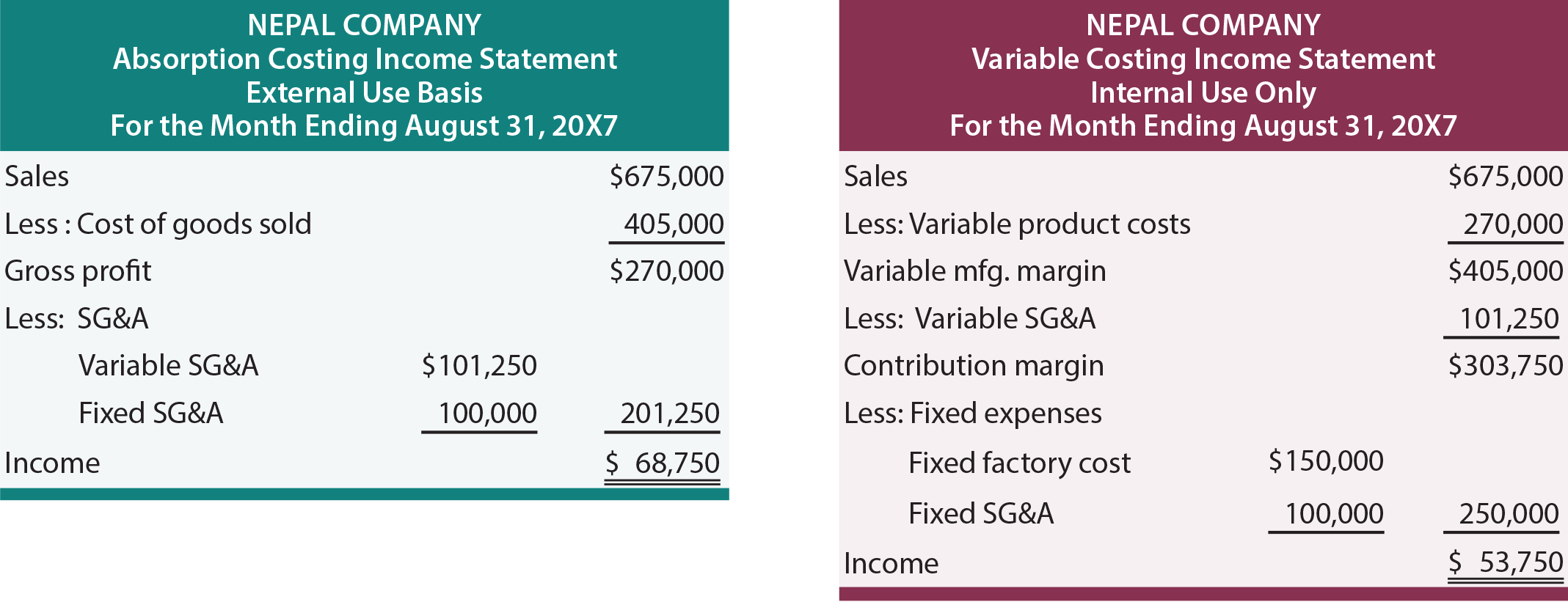

Less cost of sales opening inventory (valued at absorption rate) xxx cost of manufactured goods (valued at absorption rate) xxx closing inventory (valued at absorption rate) (xxx) (over)/under absorption of direct fixed costs (xxx)/xxx cost of sales (xxx) gross profit. You are required to present income statements using (a) absorption costing and (b) marginal costing account briefly for the difference in net profit between the two income statements. This is why income statements ready on marginal selling and absorption value basis out up having dissimilar figures for benefit.

Income statement under absorption costing usd: It does not affect net income due to fluctuations in inventory levels. However gross profit does not find any place in the marginal costing statement.

It shows that the gross profit is less than the selling and that the administrative expenses are equal to the operating income. 1,30,000) is due to difference in valuation of closing stock. Marginal costing income statements live more useful for analyzing inventory and production fees, while resorption costing is required under some accounting ethics.

It also shows that the cost of goods sold is equal to the gross profit. The difference in profits rs. Rate of profit on cost/sales;

Preparing an absorption costing income statement as accounting tools notes, the first line item of an absorption income statement is gross sales for the period. Under absorption costing, normal manufacturing costs are considered product costs and included in inventory. This has been a guide to variable costing income statement.

This income statement looks at costs by dividing costs into product and period costs. Marginal cost statement treats fixed and variable cost separately and shows contribution. The company began operations on july 1 and operated at 100% of capacity during the first month.

In order to complete this statement correctly, make sure you understand product and period costs. How do you calculate income statement under absorption costing? Absorption costing means that every product has a fixed.