Who Else Wants Tips About Profit And Loss Accountability

Having p & l responsibility involves monitoring the net income after expenses for a department or entire organization, with direct influence on how company resources are allocated.

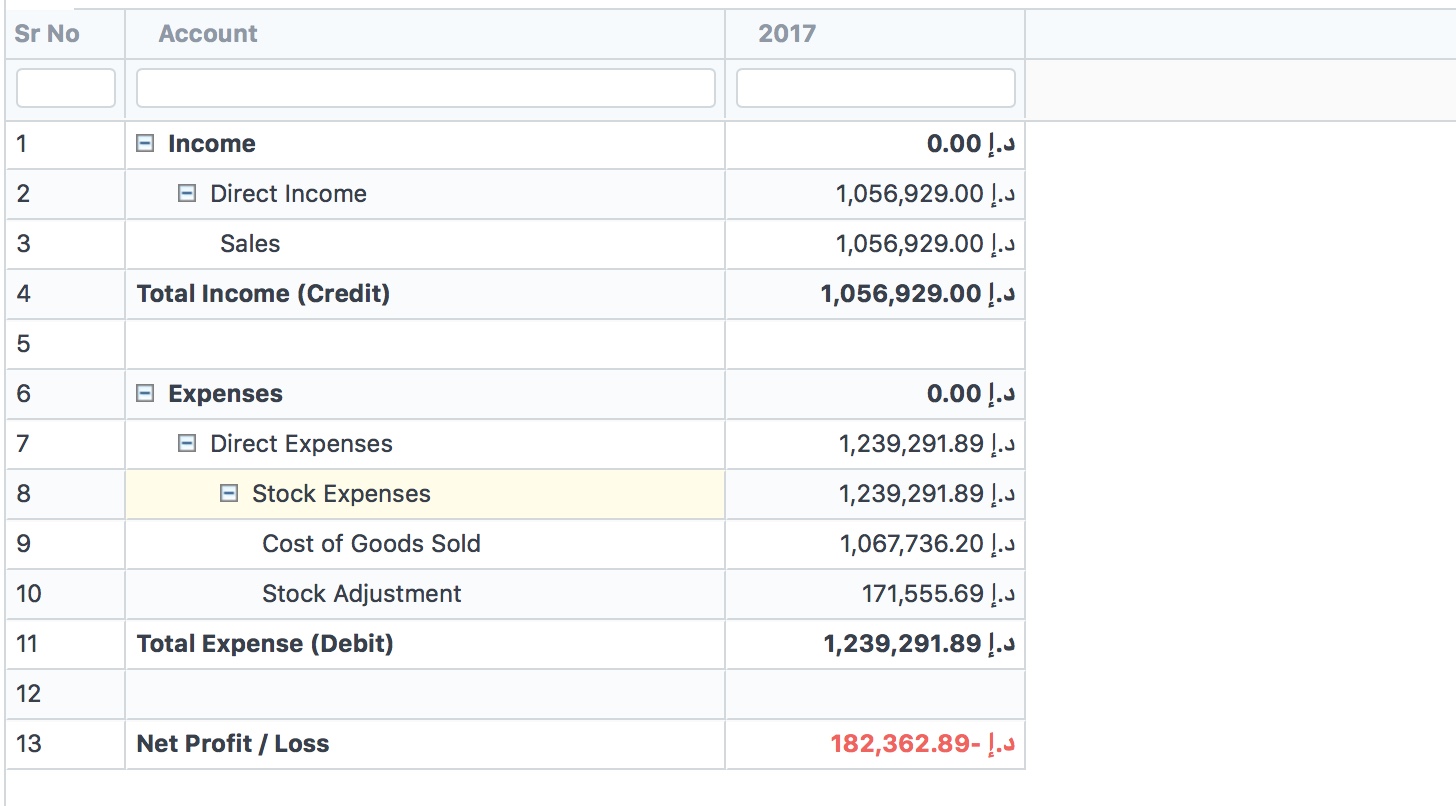

Profit and loss accountability. The basic formula for a profit and loss statement is: This is the most significant information to be reported for decision making. What is the profit and loss statement?

The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually. These statements provide a clear picture of the company’s profits and losses incurred during a. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

It involves monitoring net income after expenses for a department or an entire organization and demands a delicate balance between revenue optimization and expense control. Analysis of financial statement assignment. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Profit and loss (p & l) responsibility is one of the most important responsibilities of any executive position. P&l ( profit and loss) responsibility is undoubtedly one of the essential duties of any executive role.

Net income or net profit is calculated by charging all operating expenses and by considering other incomes earned in the form of. Herman vantrappen and frederic wirtz april 14, 2022 illustration by samuel finch summary. Alternatively, if expenses are larger than revenues, you will have a loss.

It includes the explicit costs of doing business, such as operating. Managing p&l means you work toward having greater revenues and fewer expenses. P&l accounting involves the creation of reliable profit and loss statements to assess the financial performance of an individual or business.

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. Demonstrating p&l responsibility on your resume proves your ability to handle these complex and dynamic challenges and means that you: In order to bring about specific results for specifics lines on the profit & loss statement, you need to allocate these lines to a specific person to be held accountable.

Profit and loss management is the way you handle your business’s profits and losses. Profit and loss management, or p&l management, is the process of creating profit and loss statements to analyze your company’s overall revenue and expenses. They often find ways to cut budget, expenditure and ensure any program the business invests in generates a positive return on investment.

Includes profit and loss statements, summary, recommendations and. Accounting profit is a company's total earnings, calculated according to generally accepted accounting principles (gaap). You may have figured out by now that revenues minus expenses will give you profit.

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. It's a straightforward presentation of a. Changing which parts of your company have full profit and loss (p&l) responsibility is not a decision.