Inspirating Info About Liquidity Position Of Company

According to the 2022 deloitte global treasury survey, cfos consider improving liquidity risk management to be a top priority for their treasury.

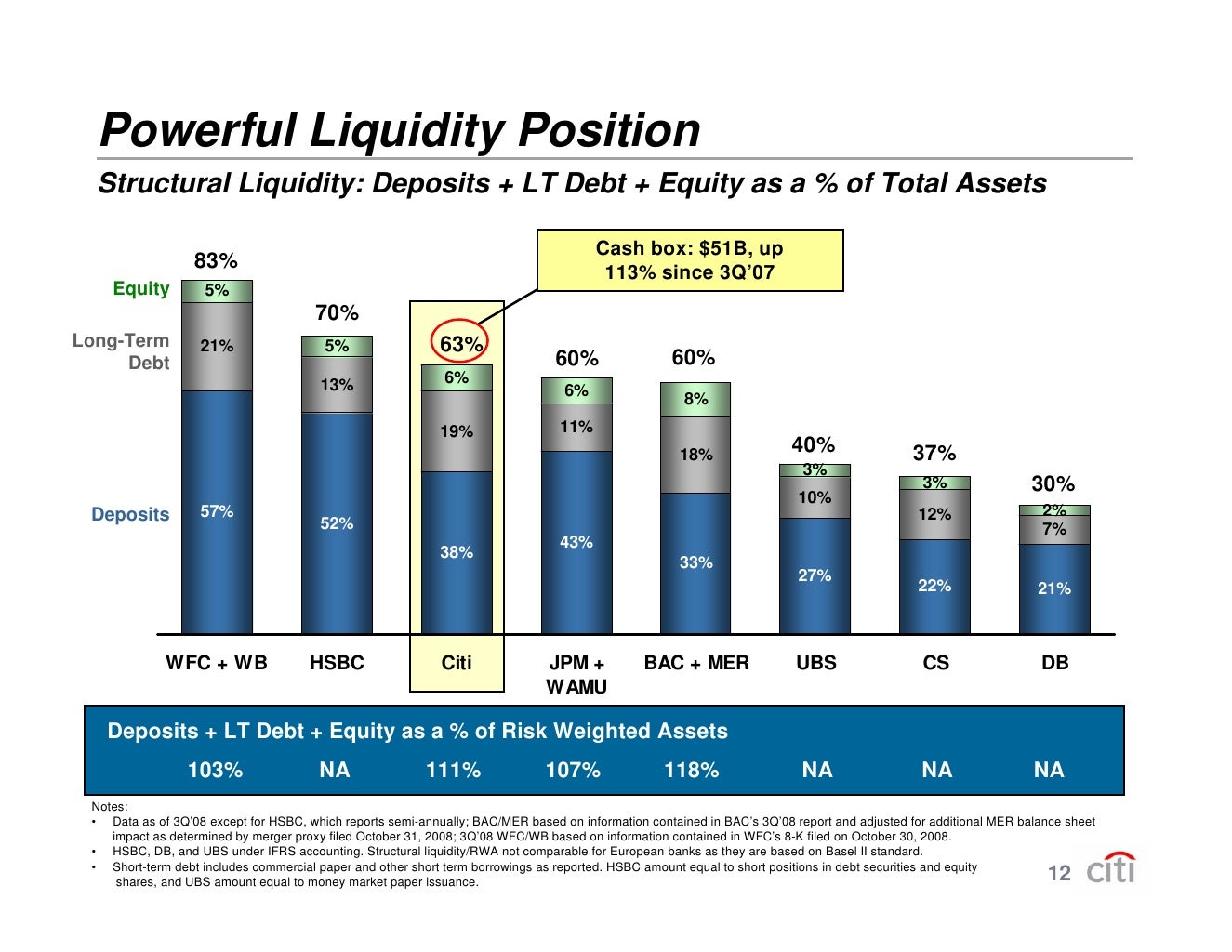

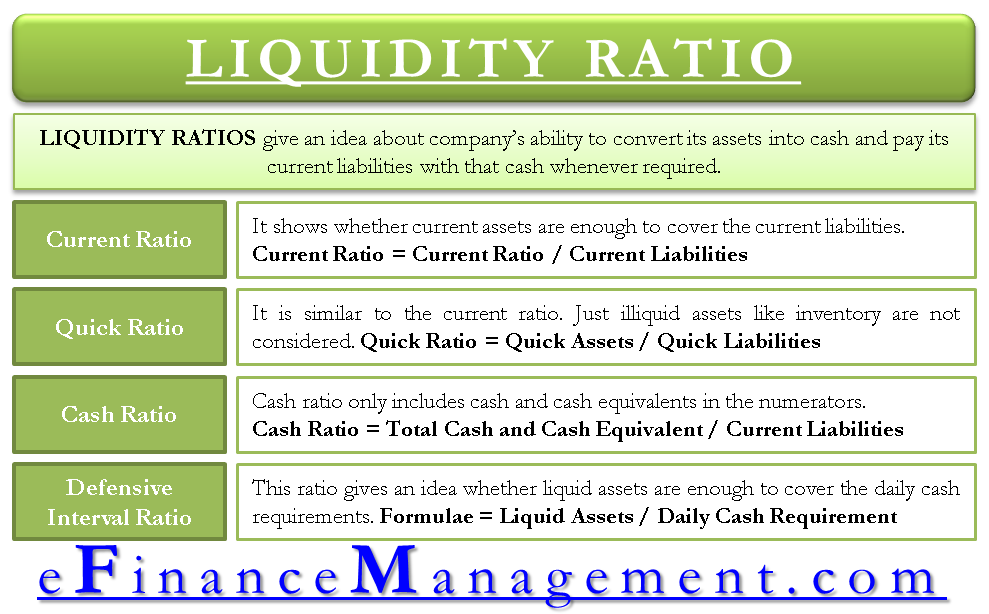

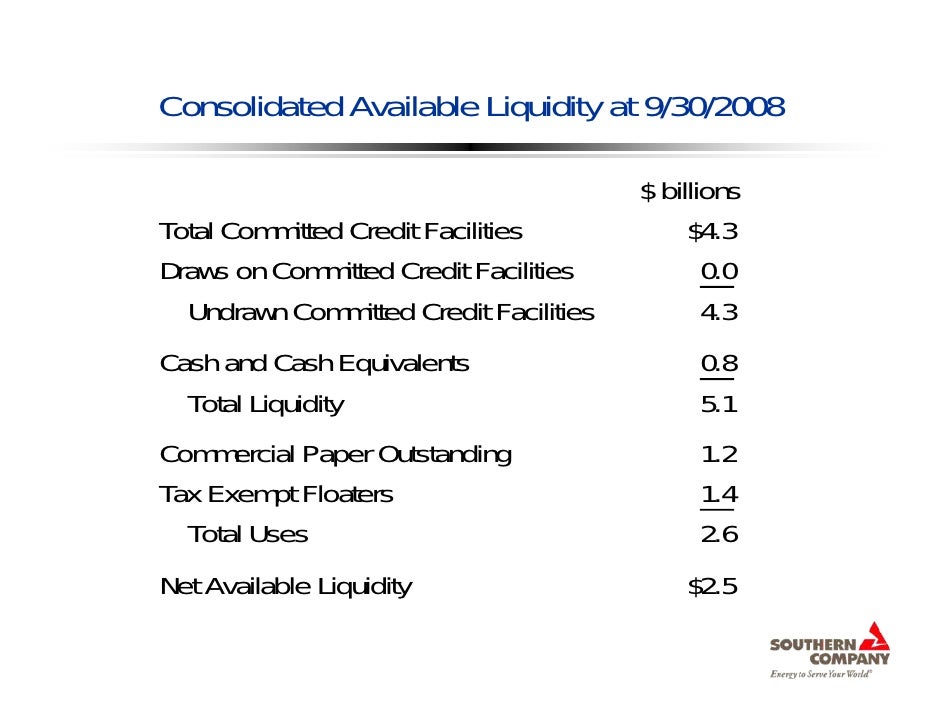

Liquidity position of company. A company’s liquidity ratio is a measurement of its ability to pay off its current debts with its current assets. More complex liquidity and cash analysis can be done for companies, but this simple liquidity analysis will get you started. Basic liquidity ratio = monetary assets / monthly expenses.

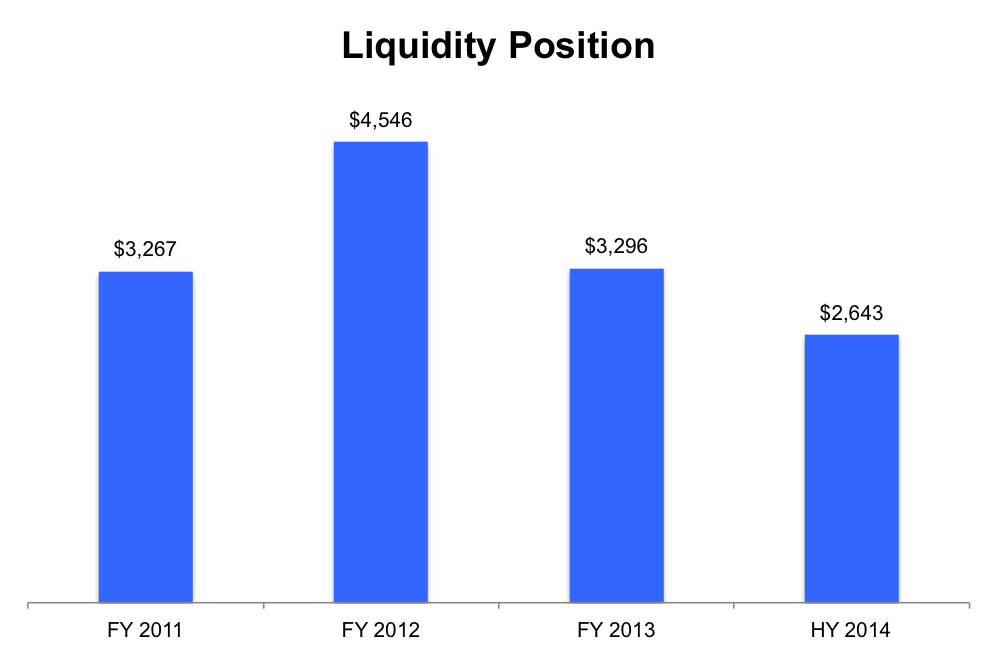

Current ratio = current assets / current liabilities. We show you here why. Disparate indices reveals that the overall liquidity position of the selected company, t itan company ltd.

Solvency is a measure of its. A company can gauge its liquidity by calculating its current ratio, quick ratio, or operating cash flow ratio. The current ratio and the net working capital positions both.

If you are looking for ways to improve the liquidity of your business, you are in the right place: Looking at this summary, the company improved its liquidity position from 2020 to 2021, as indicated by all three metrics. How to measure a company's liquidity.

Liquidity ratios determine how quickly a company can convert the assets and use them. The three main liquidity ratios are the current ratio, quick ratio, and cash. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data.

02/12/2022 having a good grasp of business liquidity will help you make sure cash flow remains strong so you can cover any expenses and unexpected events. Liquidity ratios measure the liquidity of a company. As a useful financial metric, the liquidity ratio helps to understand the financial.

A company needs to have a strong liquidity. Companies can increase their liquidity ratios in a. The higher the ratio, the better the company's liquidity position.

Liquidity is important as it indicates whether there will be. The paper also offers few suggestions. Three liquidity ratios are primarily used to measure a company's accounting liquidity:

/Balance-Sheet-56a0a31d5f9b58eba4b25300.gif)