Who Else Wants Info About Simple Personal Financial Statement

Total value of assets create a list of liabilities

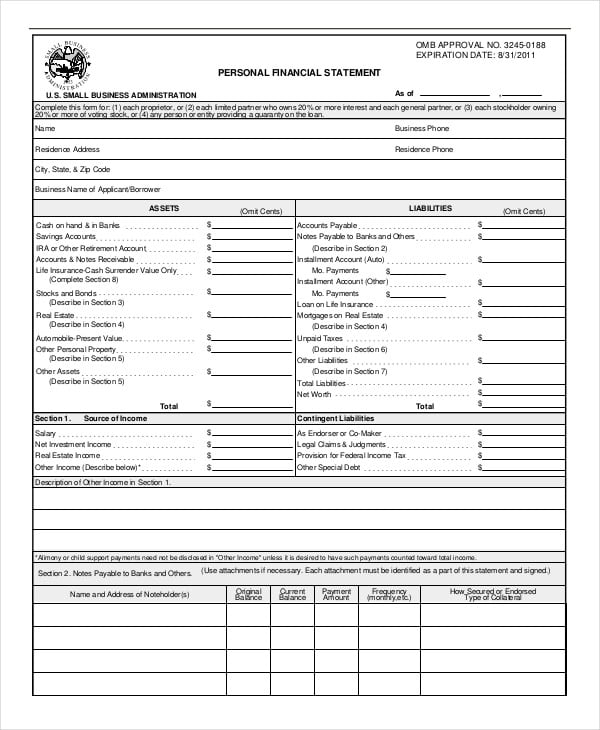

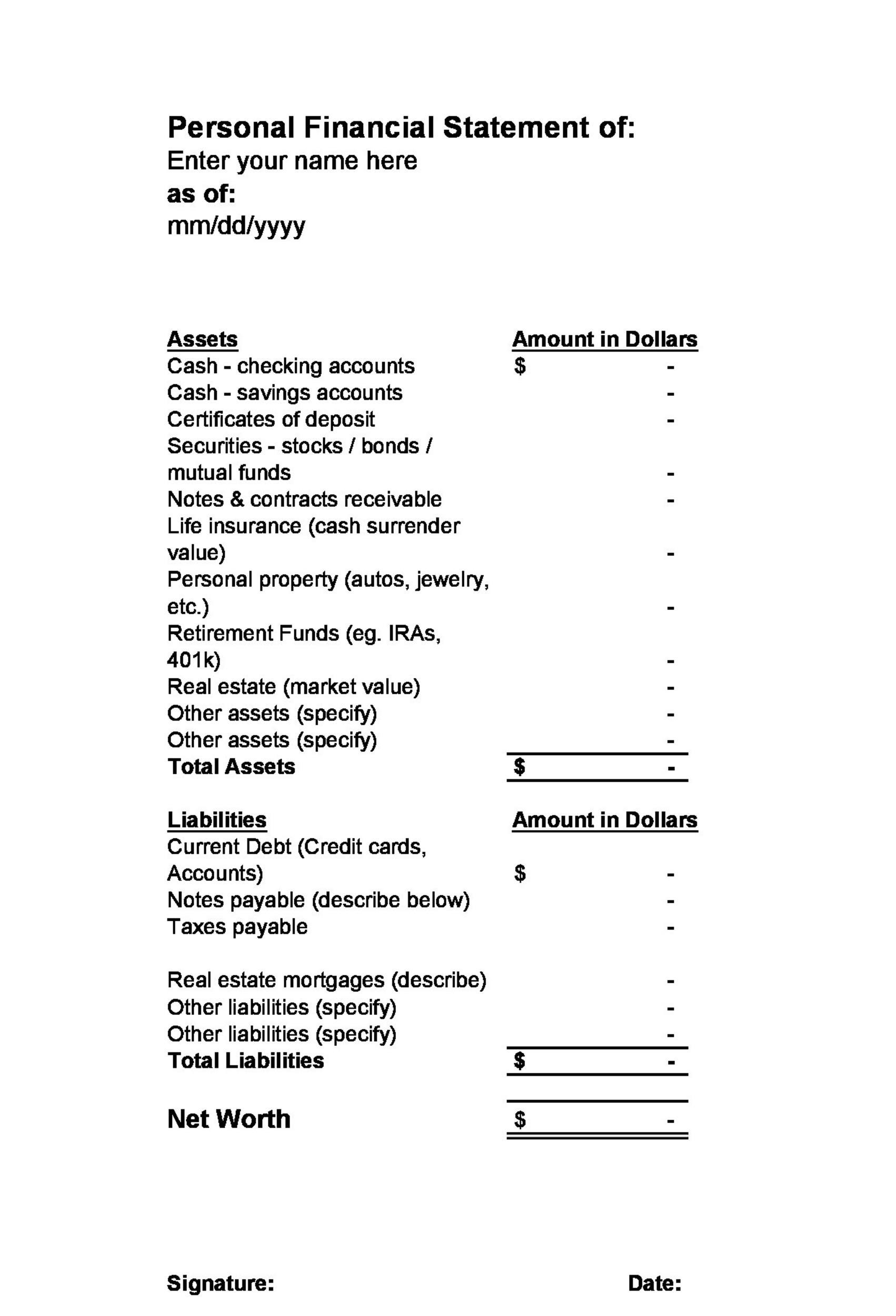

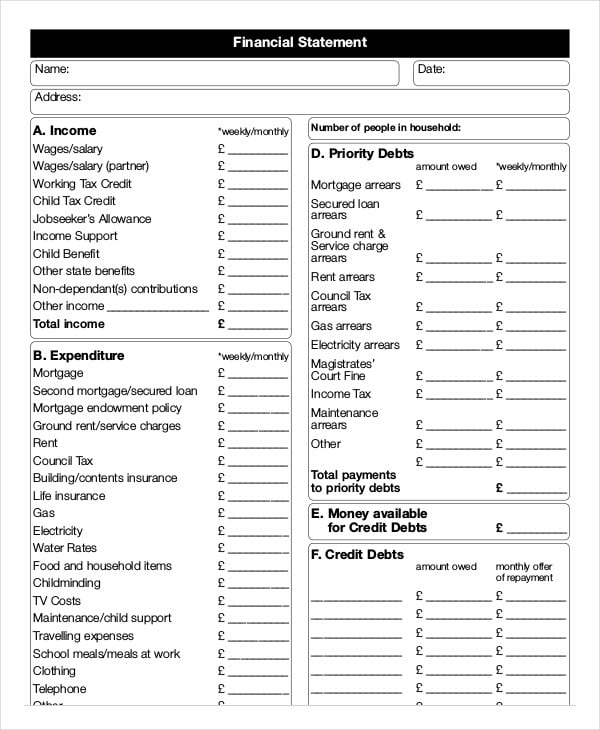

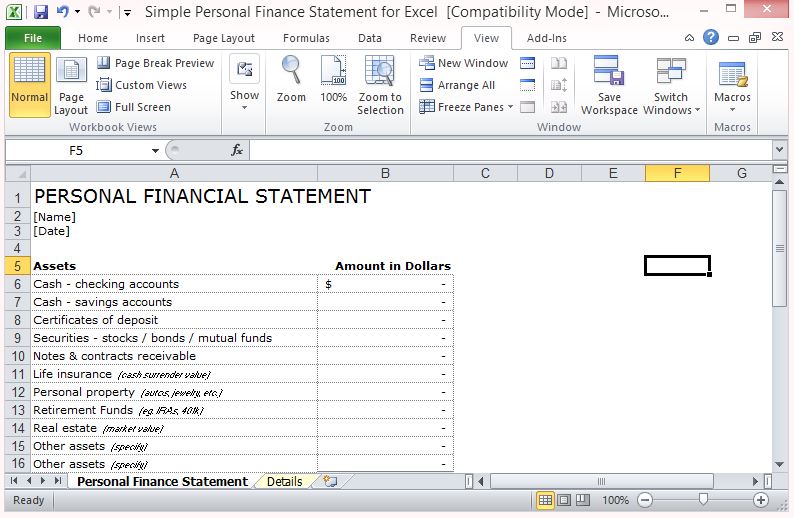

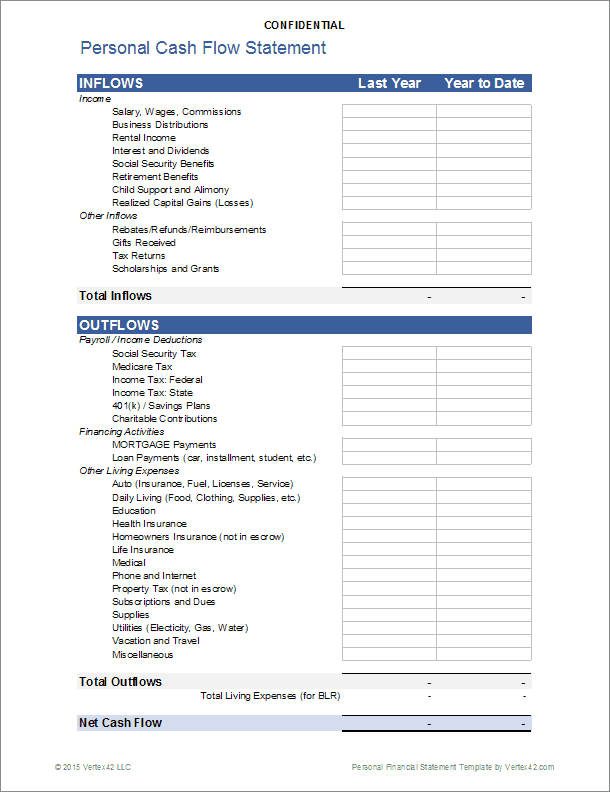

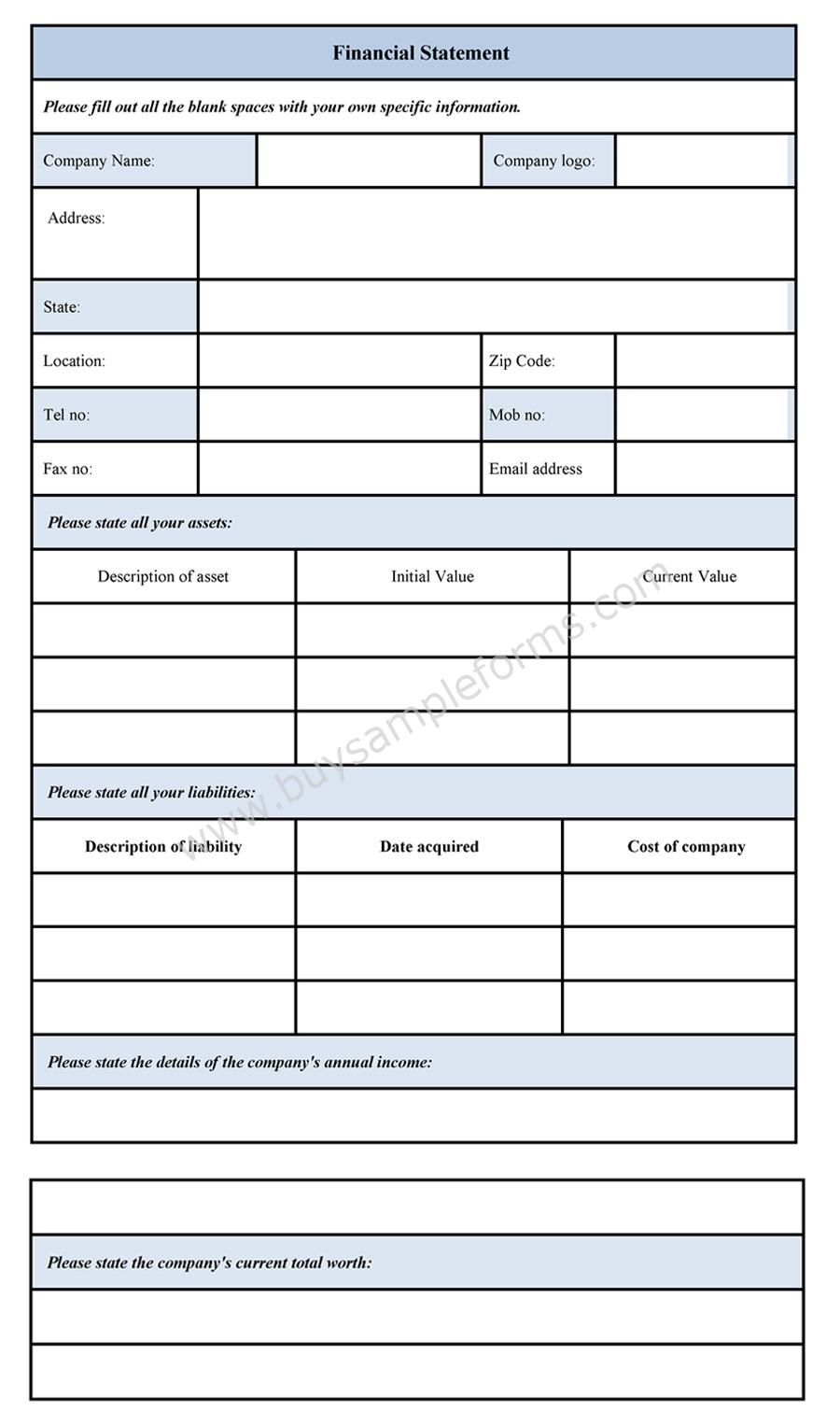

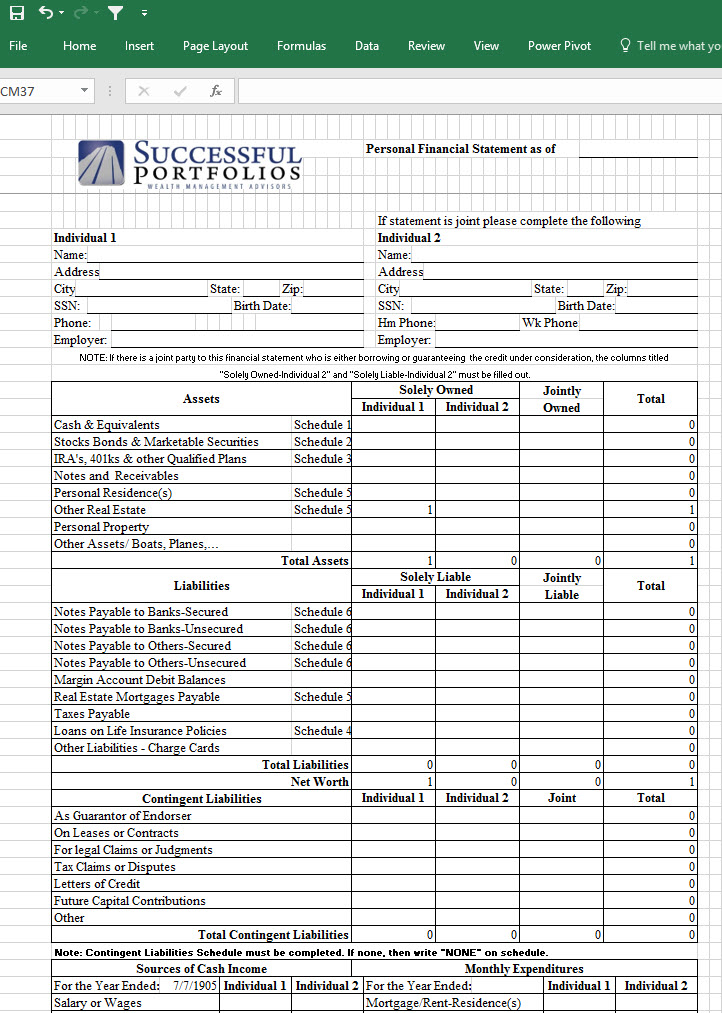

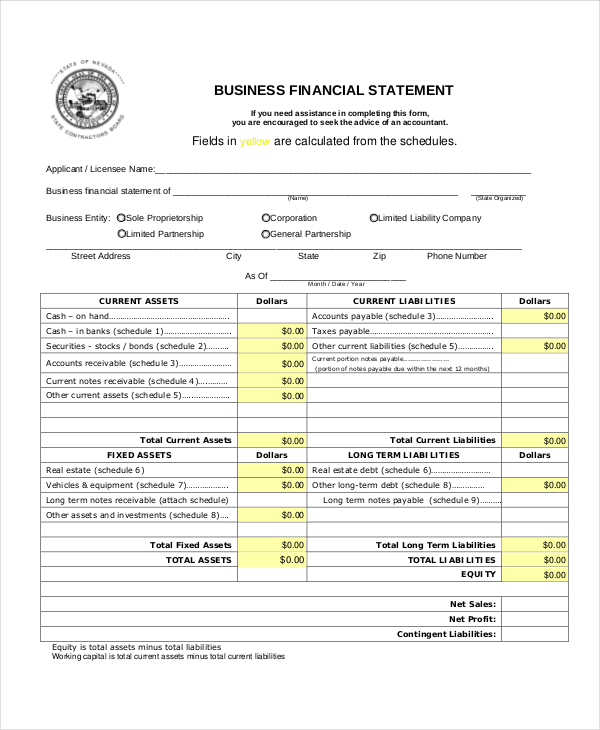

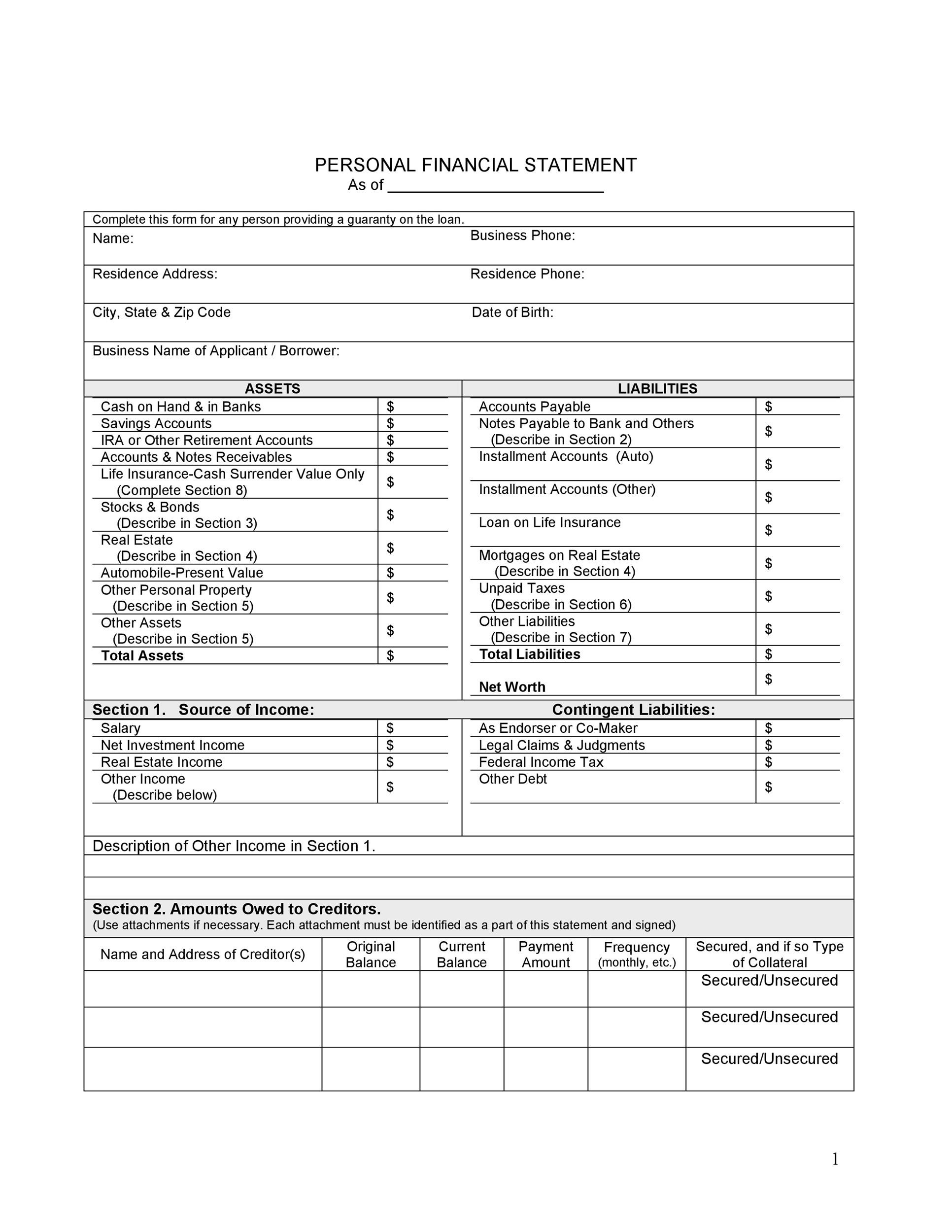

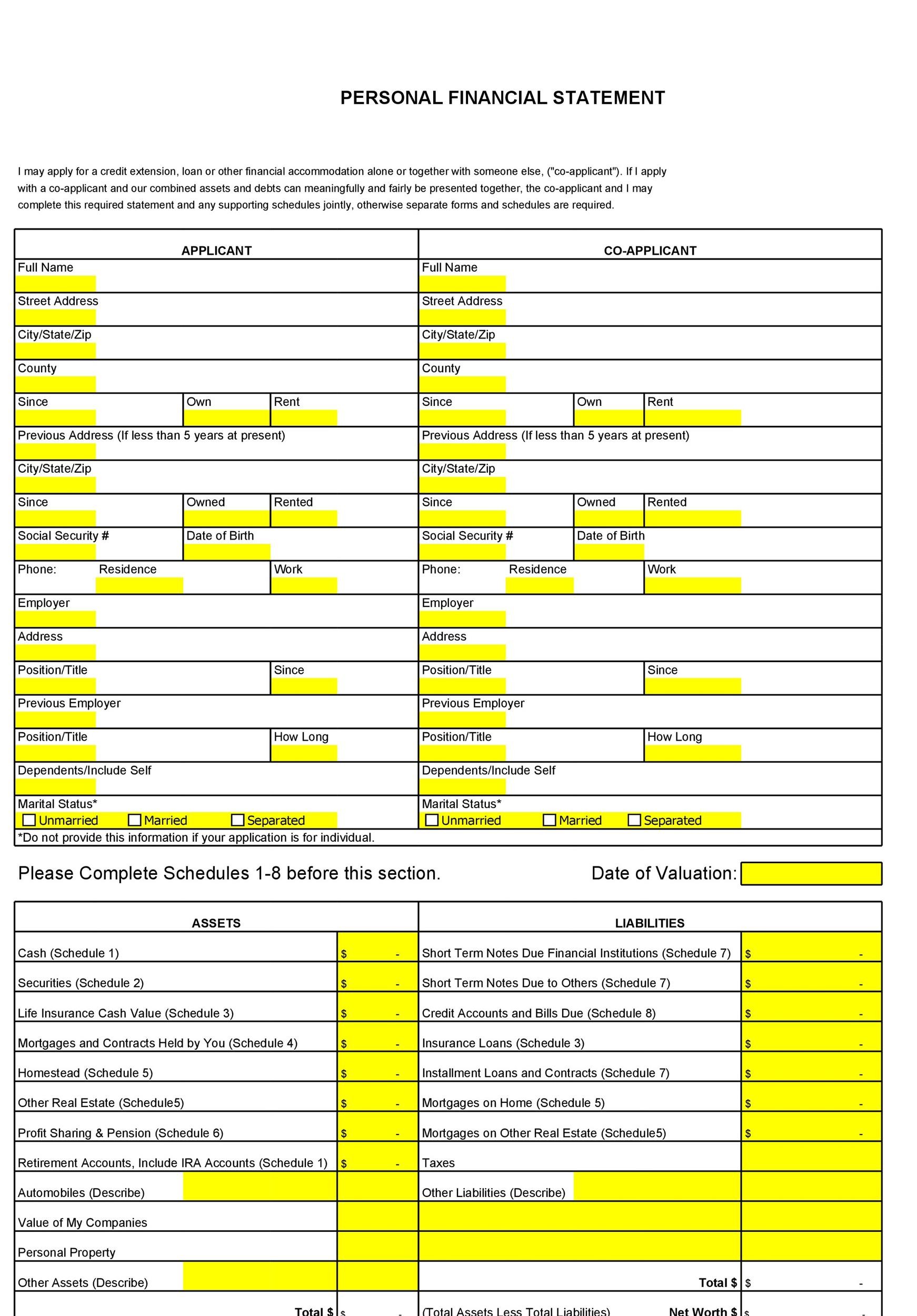

Simple personal financial statement. Getting all your financial documents ensures you have accurate information. It provides a full list of their personal assets and liabilities as well as their income and expenses. It may be requested by financial institutions or investors if you're.

A personal financial statement is an overview of a person or household's finances. Imposter scams remained the top fraud category, with reported losses of $2.7 billion. And they are the basis for building all great wealth.

It includes information about your income, expenses, debts, and assets. 1 identify necessary financial information gather all documents needed create a list of assets calculate total value of assets approval: This information can be used to make informed decisions about your finances.

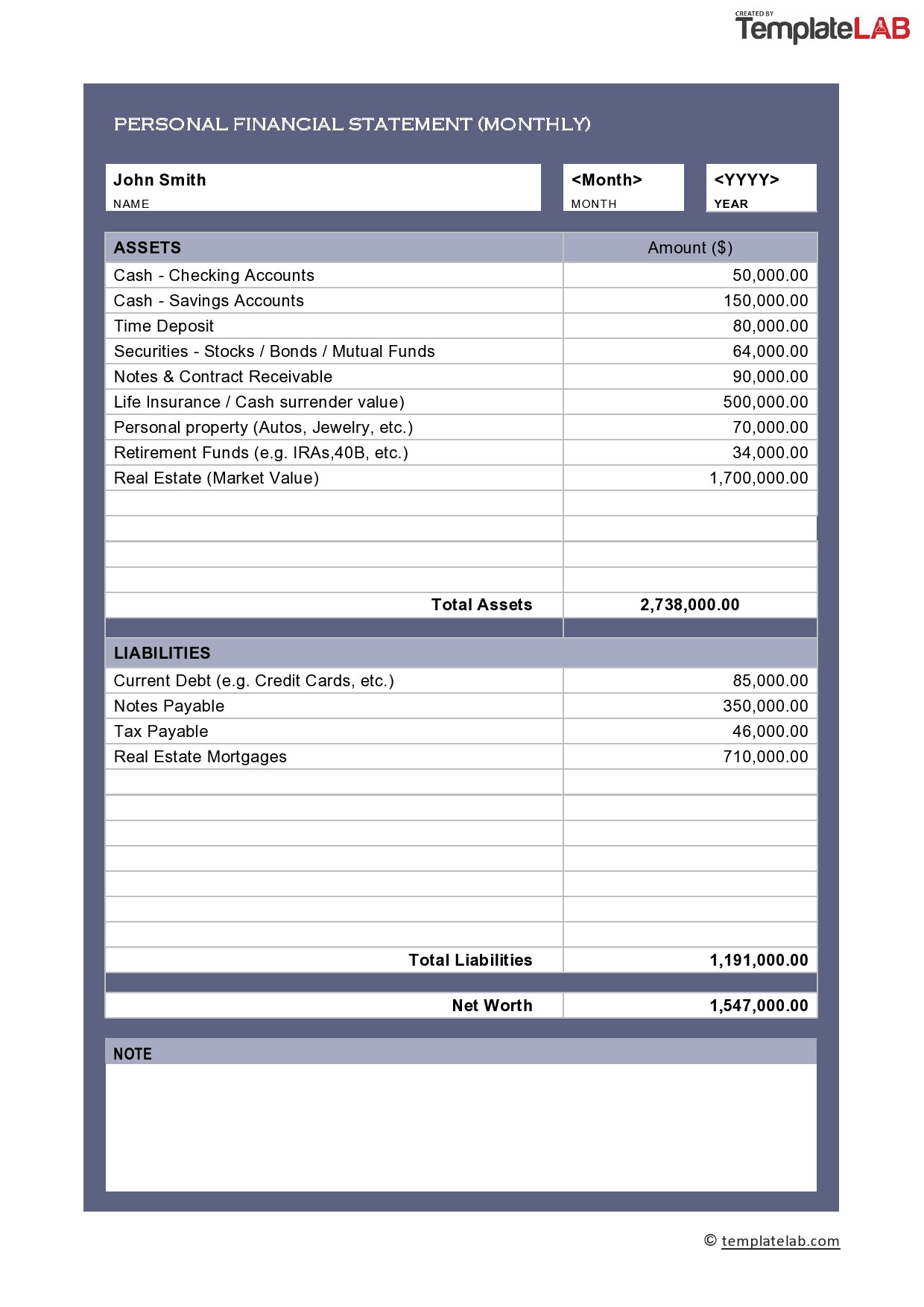

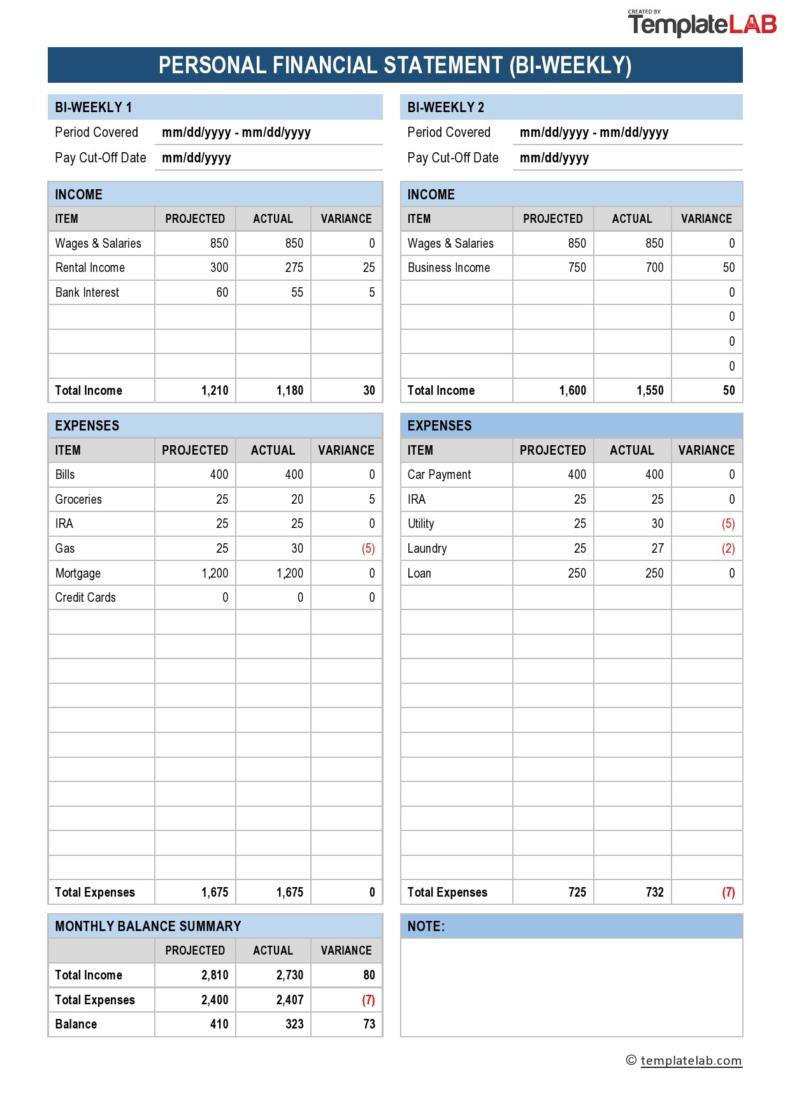

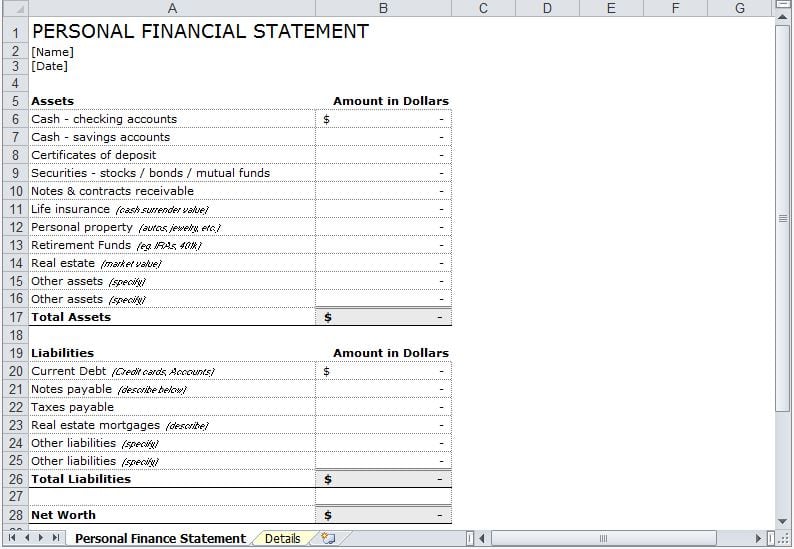

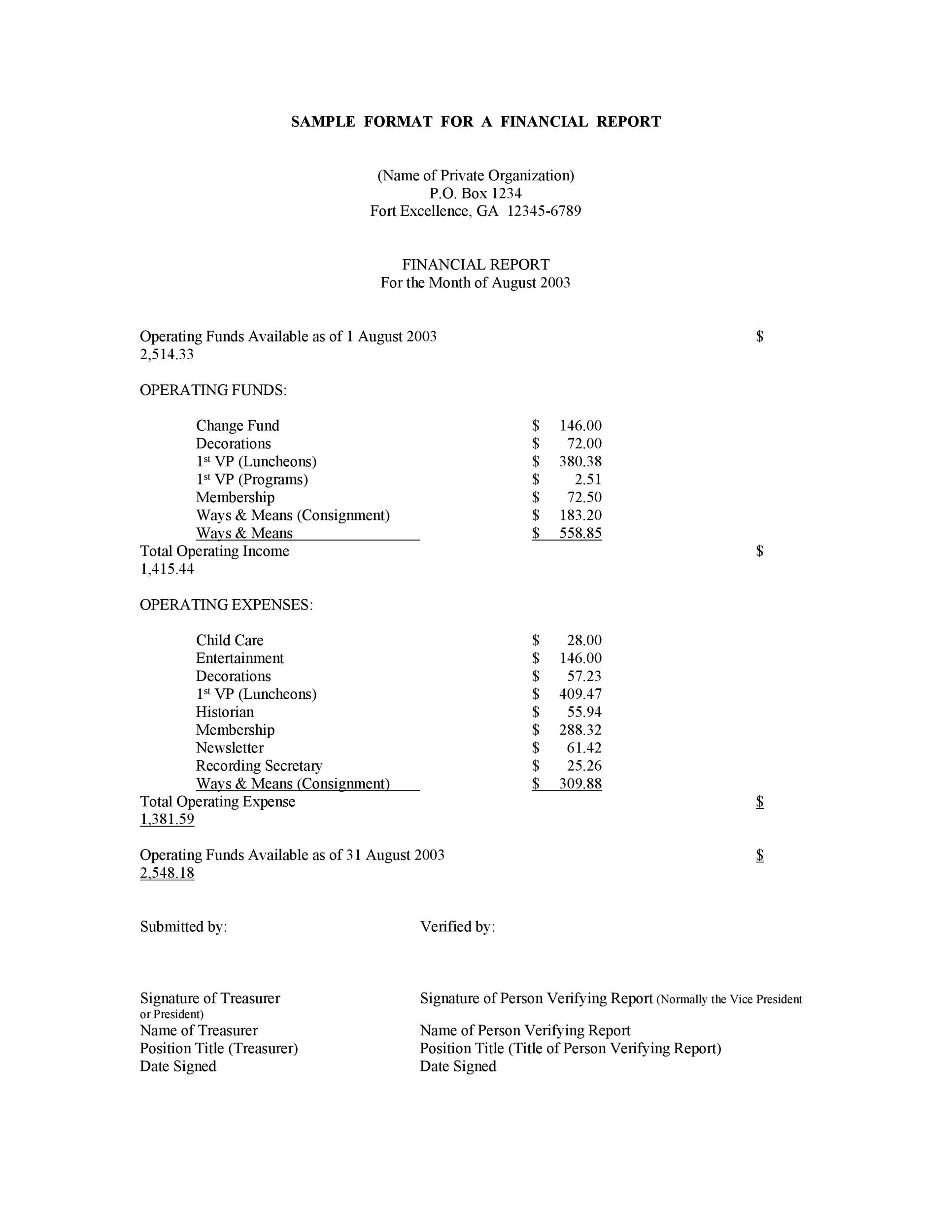

Here are other takeaways for 2023: Some people create more detailed personal financial statements, including an income statement or other documents. You can create a personal balance sheet by completing the following steps, including getting all relevant documents, listing your assets and liabilities, and calculating your net worth.

16, 2024 updated 9:59 a.m. A personal financial statement gives you a clear idea of how you’re doing financially at any point in time. A personal financial statement template is a document containing your financial status at a specific duration.

The statement typically includes general. Creating and maintaining your own personal financial statement is useful for 4 main purposes: A personal financial statement is a form or spreadsheet detailing a person's financial state at a certain point in time.

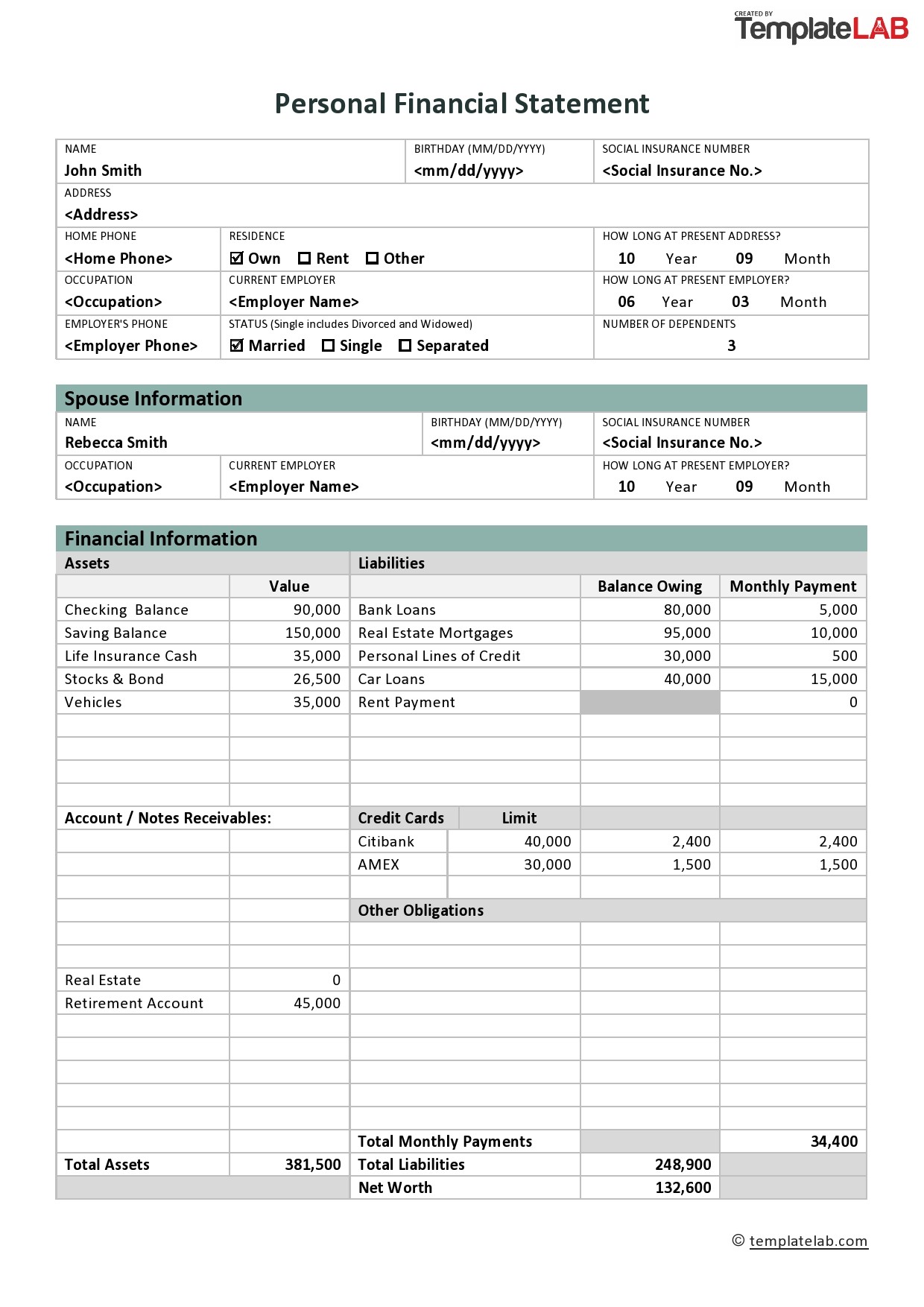

Commonly required by financial institutions when applying for credit or a loan, it demonstrates a person’s creditworthiness and repayment ability. A personal financial statement is a document or set of documents that outline an individual’s financial position at a given point in time. This spreadsheet typically contains personal and financial information about an individual, such as his name, address, a breakdown of his total assets and liabilities, and his total income and expenses.

In personal finance, we discuss our net worth or the total value of our assets fewer debts. This template allows you to itemize and quantify your assets, such as cash in checking and savings accounts, certificates of deposit, securities, retirement funds, and real estate. Personal financial statement form.

The personal financial statement is mainly used when someone wants to apply for a loan. Going back to an earlier comment, a person with a high financial iq and $100,000 would be able to know how to invest it in assets that are true assets—ones that put more money back in the pocket. A personal financial statement is a document that lists all your assets, liabilities, and resulting net worth.

Personal financial statements can be used by individuals and businesses. The term “personal financial statement” refers to the summary of an individual’s financial position at a particular time. A personal financial statement is a snapshot of your personal financial position at a specific point in time.