Beautiful Info About Provision For Bad Debts In Accounting

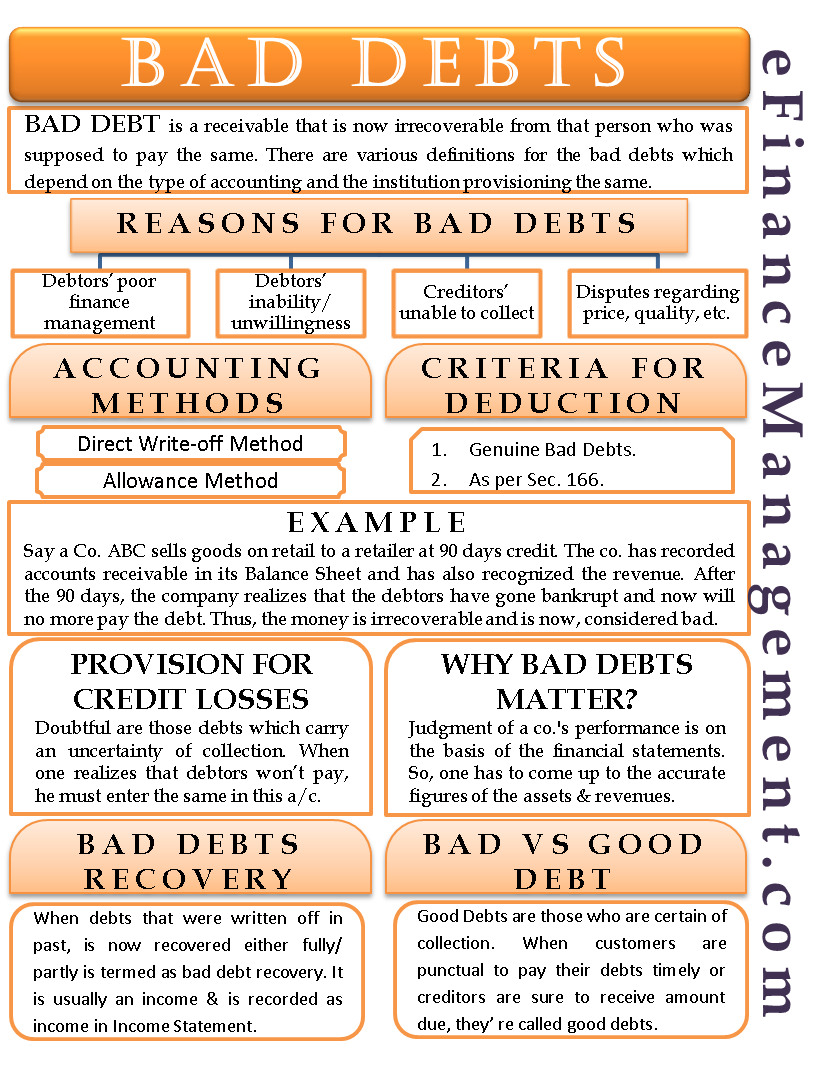

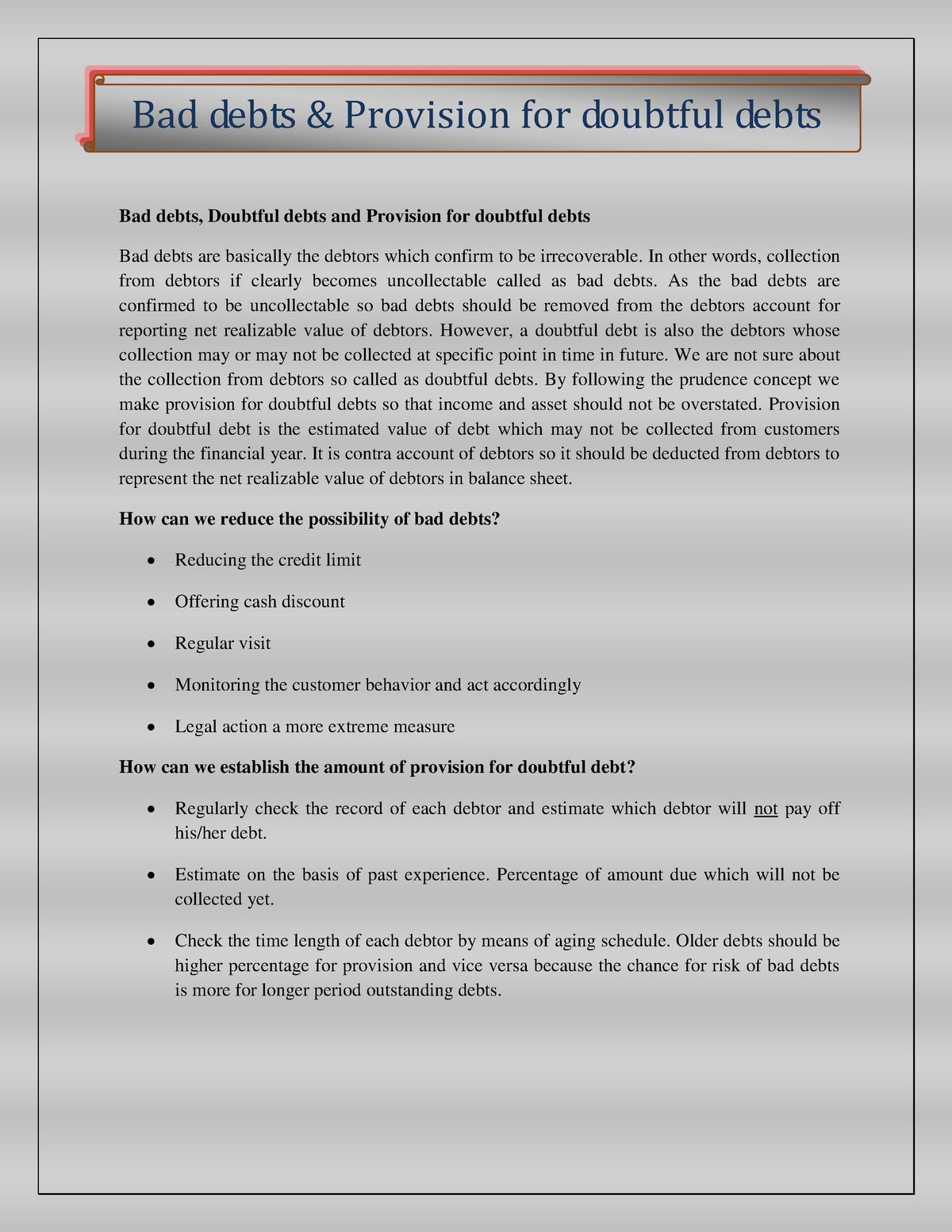

Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time.

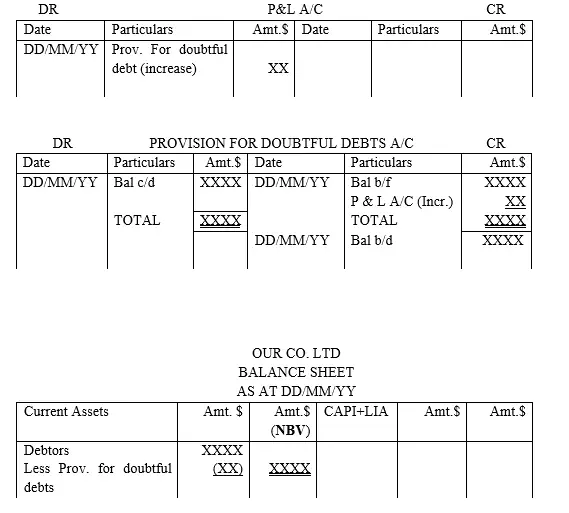

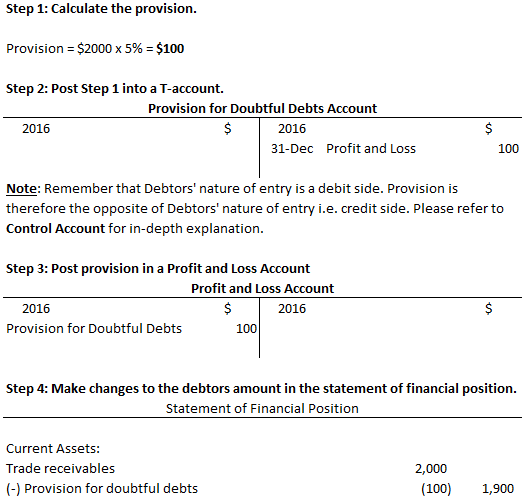

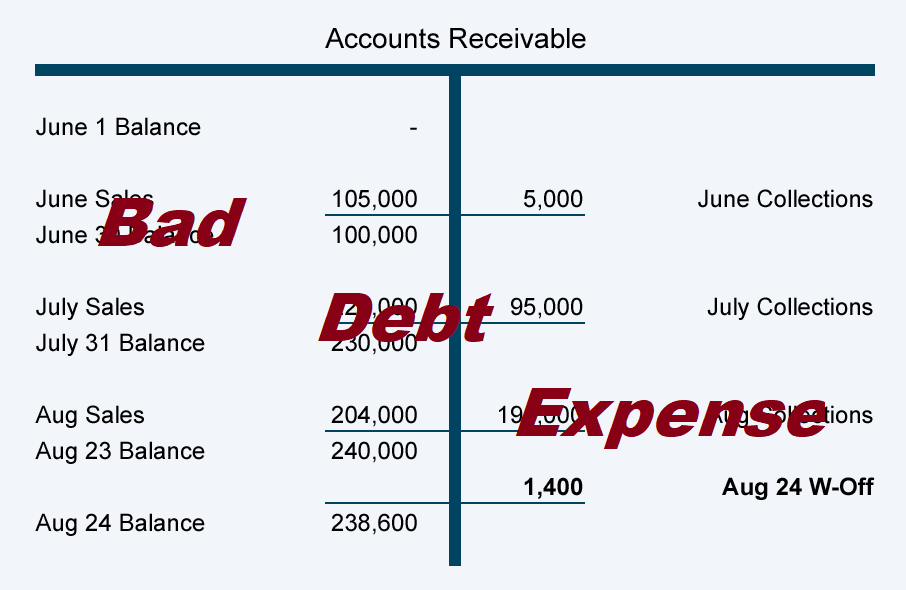

Provision for bad debts in accounting. This way the matching principle of accounting is followed and no gaap is violated. The account receivables are credited by the amount of bad debt. The provision for bad debt is estimated each year at the end of the accounting period.

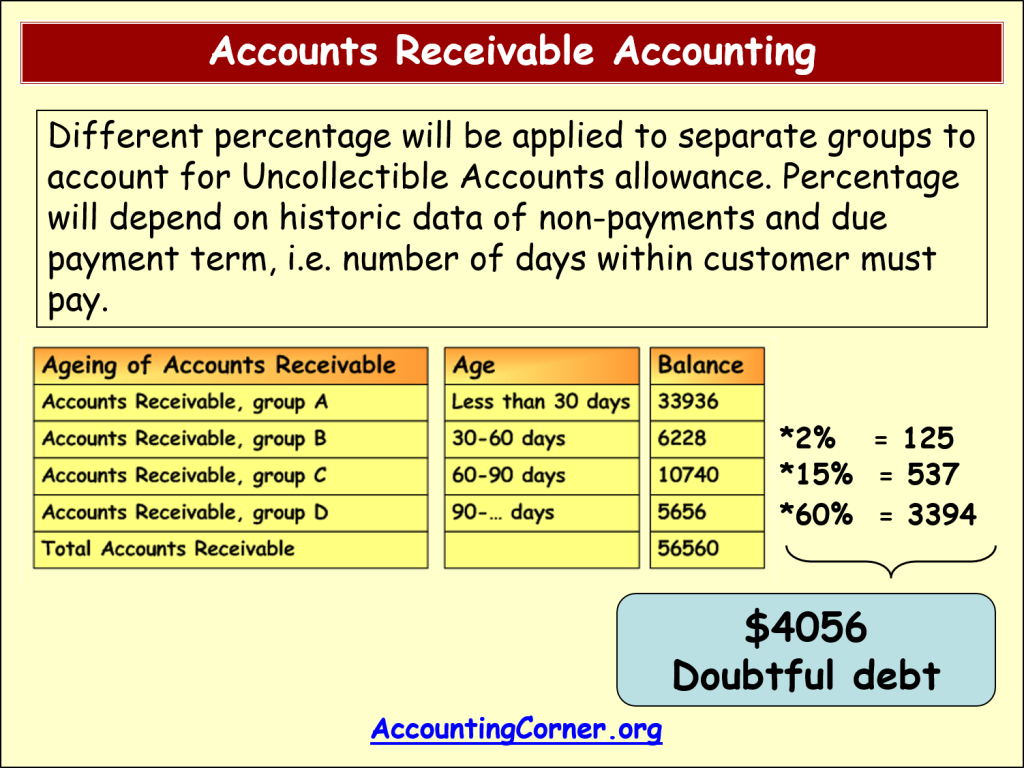

A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in the next year. But the accountant is unsure when or how much the loss/expenses. The provision for bad debts is an estimate of the debts owed to us that will go bad in the.

There are several ways to make the. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for. A provision for bad debts is the probable loss or expenses of the immediate future.

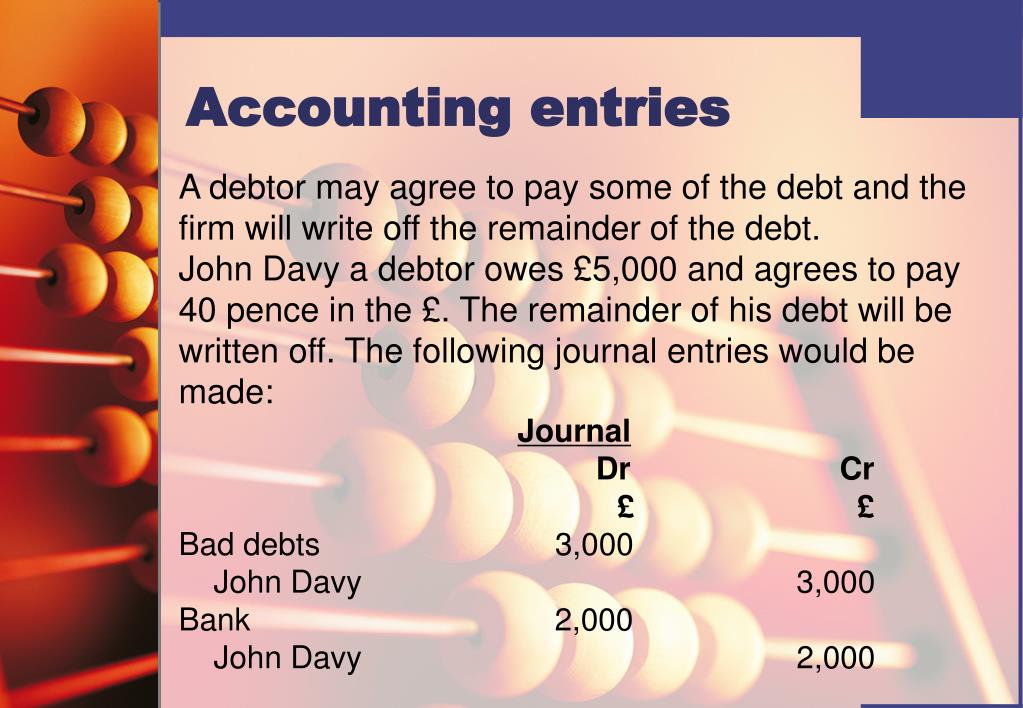

A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in. Two methods to account for bad debt. Provision for bad debts the provision for bad debts is not the same as bad debts.

It’s an amount of money the company has lent out but will never see a return. The most common approach was, to my surprise and disagreement, to create a provision in a few steps: Bad debt is basically an expense for the company, recorded under the heading of sales and general administrative expenses.

But the bad debt provision. Bad debt is money owed by a customer or client that the company cannot collect on. A bad debt provision is also known as the allowance for doubtful accounts, the allowance for uncollectible accounts, or the allowance for bad debts.

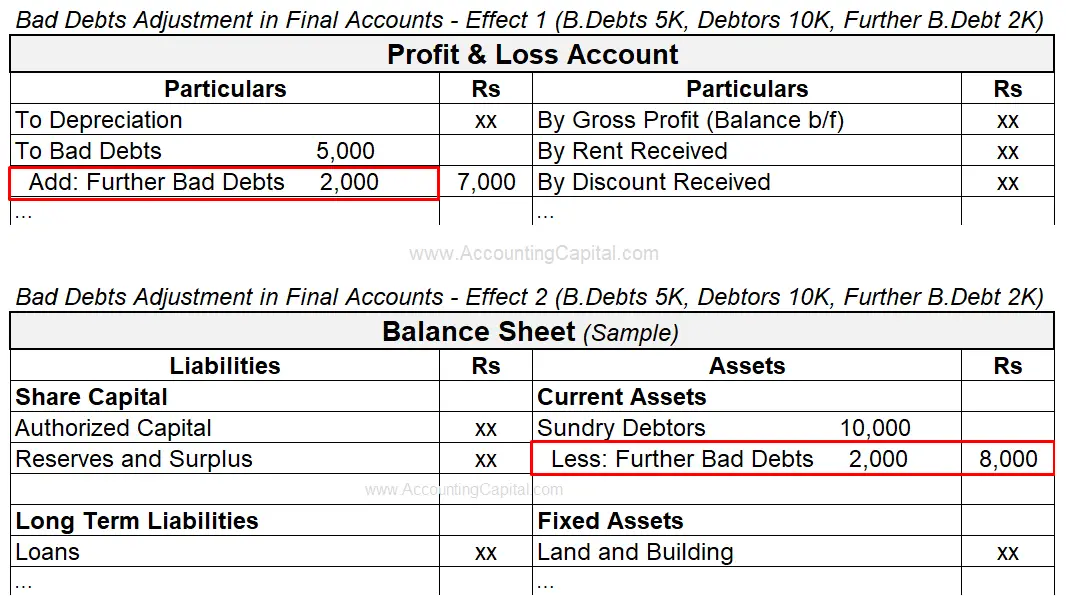

Provision for bad debts is an expense recognized in the income statement, which reduces the company's net income. The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. The provision for doubtful debts is the.

A bad debt can be written off using either the direct write off method or the provision method. How to account for bad debts 17 january 2019 a business needs to account for a bad debt as soon as it knows it has gone bad, so it is not overstating its trade. Somer anderson fact checked by kirsten rohrs schmitt what is bad debt?

It is important to understand that debts are. The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision. Analyze receivables at the reporting date and sort them according to their.

Bad debt is an amount of money that a creditor must write off if a borrower defaults on. Companies that extend credit to their customers report bad debts as an allowance for doubtful accounts on the balance sheet, which is also known as a.