Here’s A Quick Way To Solve A Info About Audited Financials Balance Sheet Structure Example

Components of an audited financial statement.

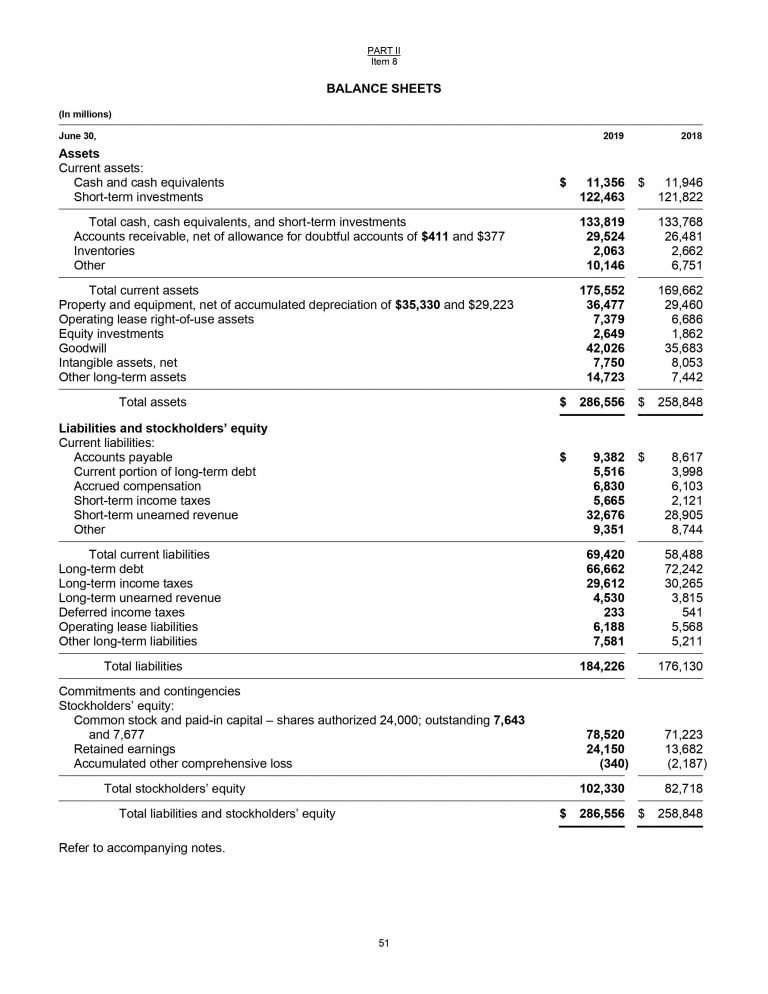

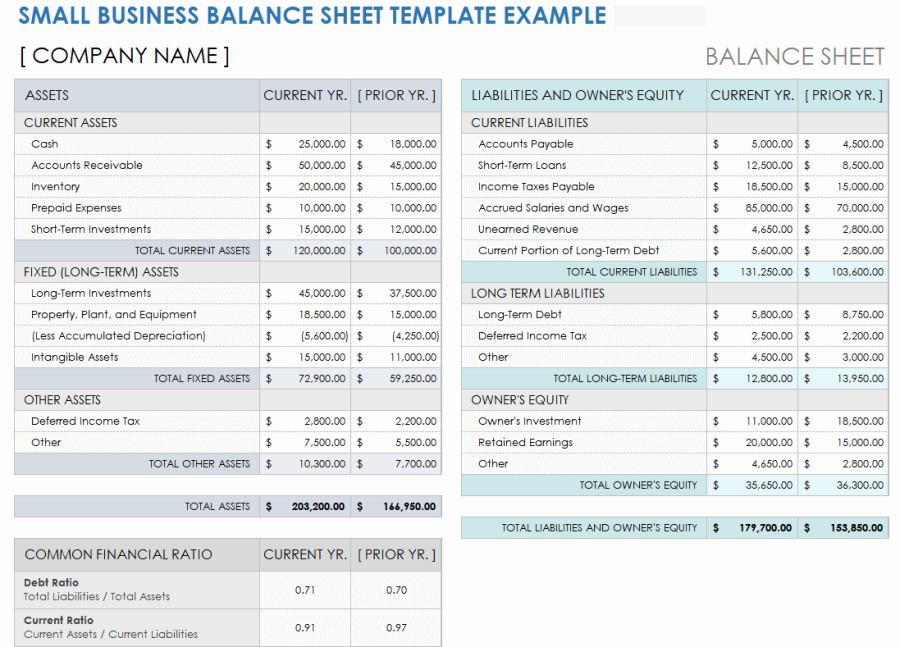

Audited financials balance sheet structure example. The image below is an example of a comparative balance sheet of apple, inc. Focused on the international standards on auditing. During a typical audit, expect your auditor to review several pieces of financial information to render an independent opinion.

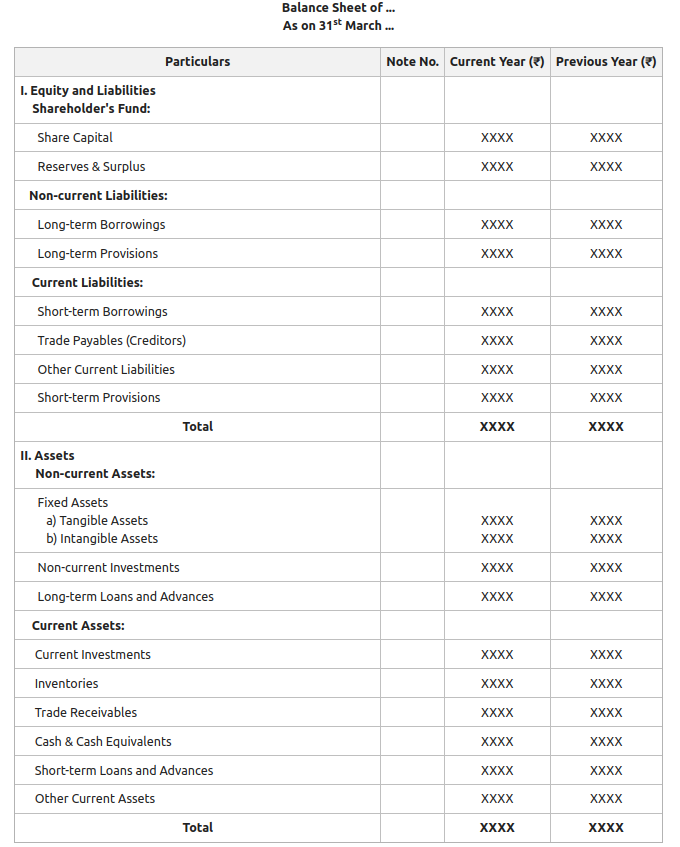

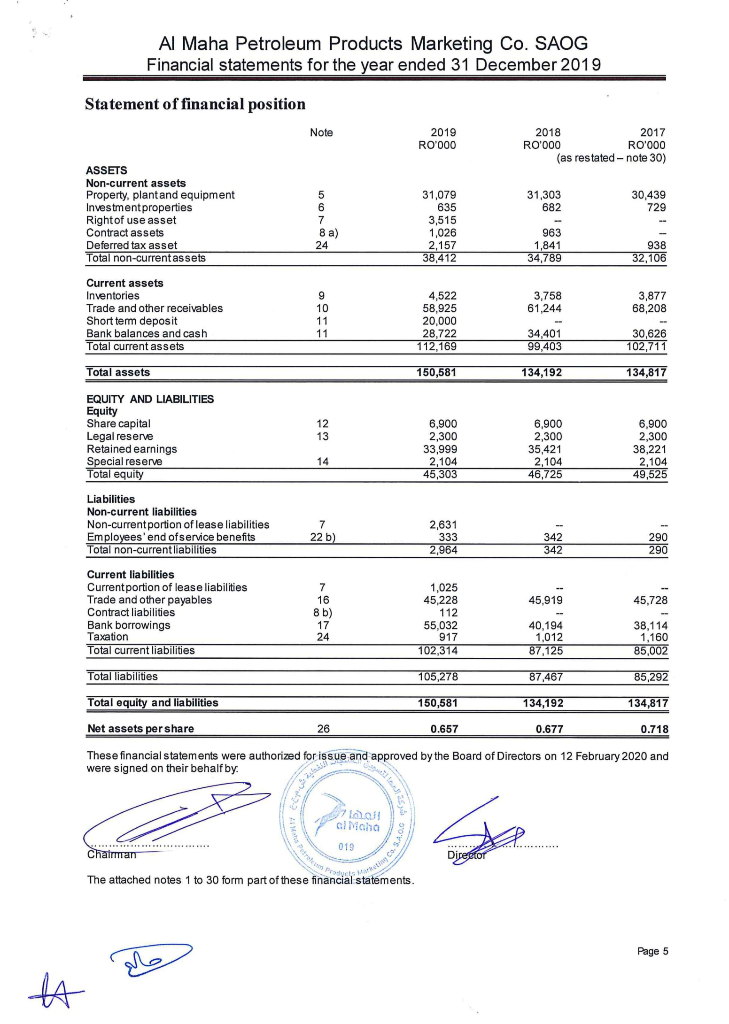

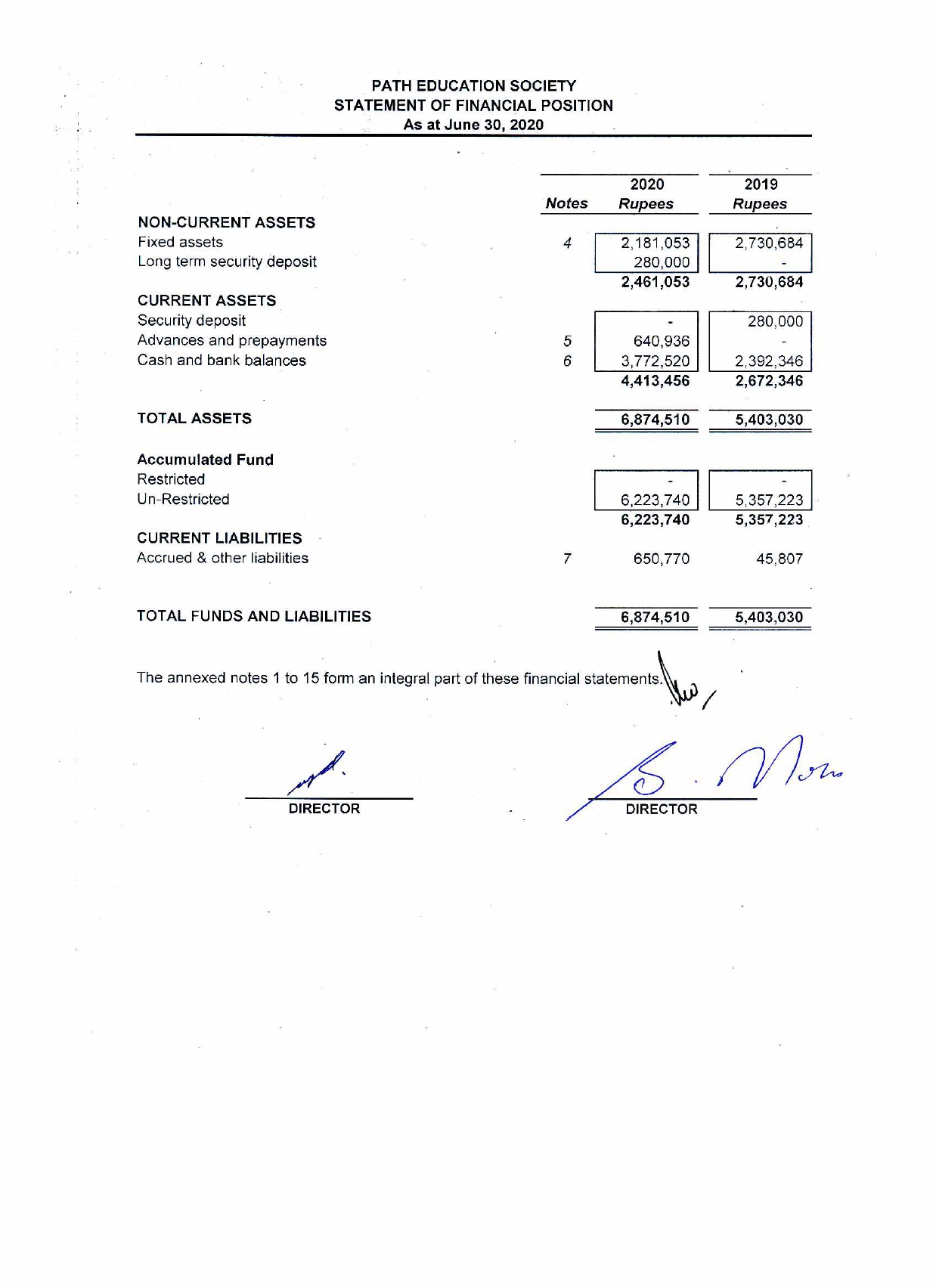

There are different types of audits that can be performed depending on the subject matter under consideration, for example: This example gives a standard structure of a b|s. Let’s look at an example.

In this process, the auditor sends confirmations to banks concerning the balances of the company. The value of these documents lies in the story they tell when reviewed together. Employee benefits 54 income taxes 59 14.

It reveals the value of assets, liabilities, and equity of a company. Net finance costs 48 11. Reference in the fourth reporting standard to the financial statements taken as a whole applies equally to a complete set of financial statements and to an individual financial statement (for example, to a balance sheet) for one or more periods presented.

For example, companies are usually required to submit a balance sheet when applying for a loan). Each of the first three sections contains the balances of the various accounts under each heading. Consolidated balance sheets.

Example of the balance sheet’s structure. This balance sheet compares the financial position of the company as of september. Audit of financial statements audit of internal control over financial reporting compliance audit

Balance sheet the balance sheet reports the financial position of the company at the end of the fiscal year (or at any other point in time a balance sheet is prepared; Earnings per share 49 employee benefits 51 12. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements:

A balance sheet details your business’s total assets, shareholder equity and debts at a given point in time. Asset = liability + owner's equity. For example, in the income statement shown below, we have the total dollar amounts and the percentages, which make up the vertical analysis.

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. To learn more about this, check out this guide on how to read a balance sheet (with examples). Example of a balance sheet.

Share‑based payment arrangements 51 13. These example accounts will assist you in preparing financial statements by illustrating the required disclosure and presentation for uk groups and uk companies reporting under frs 102, 'the financial reporting standard applicable in the uk and republic of ireland'. It provides a snapshot of the company’s financial position on a given date.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)