Stunning Info About Corporate Finance Balance Sheet

The balance sheet is based on the fundamental equation:

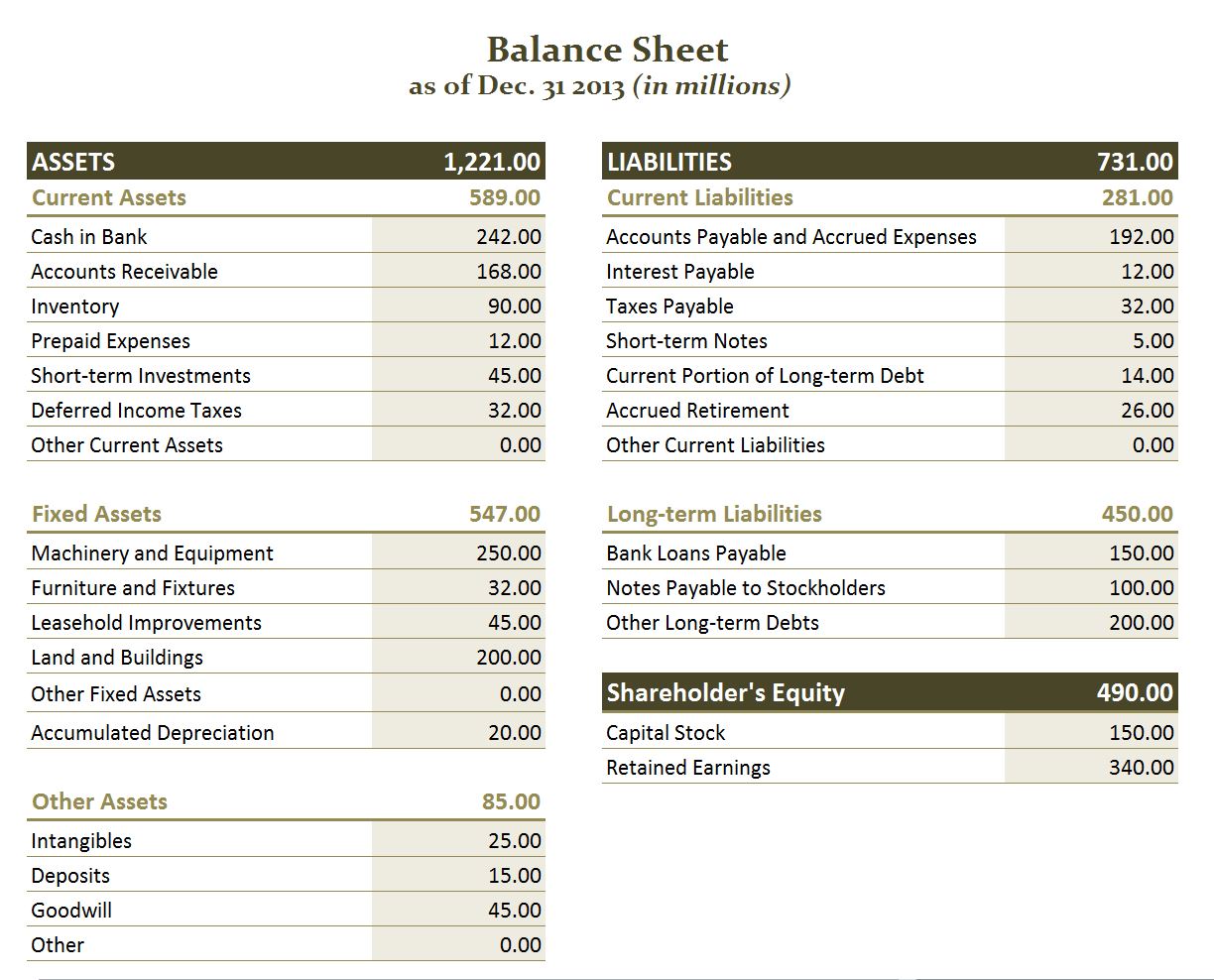

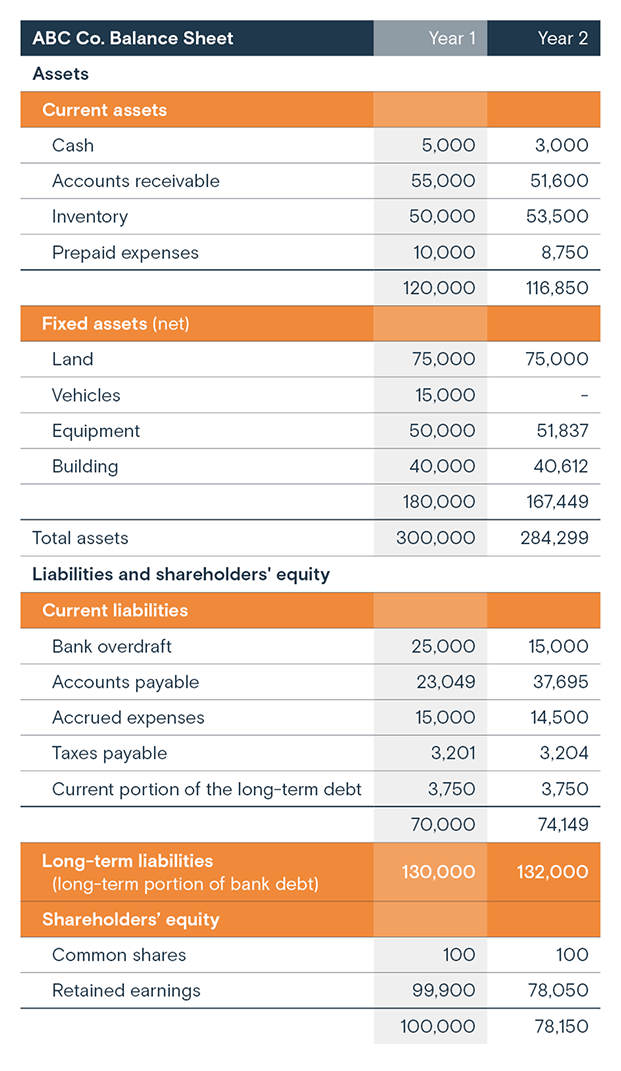

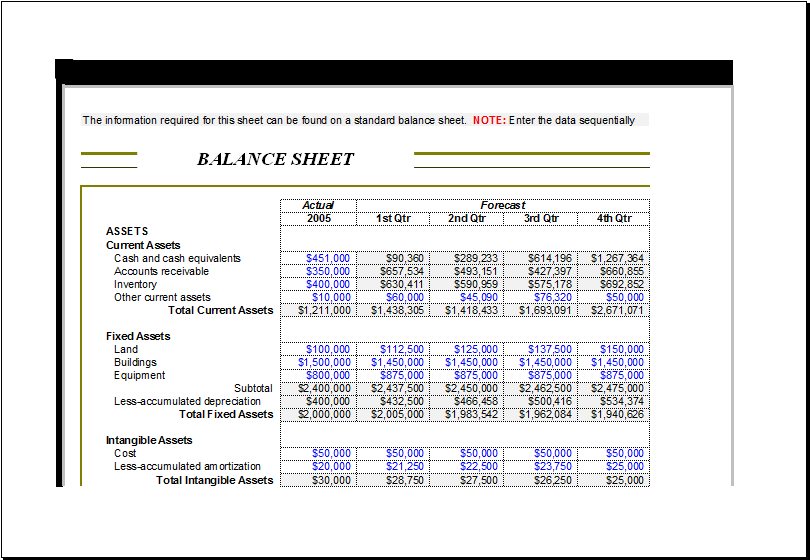

Corporate finance balance sheet. What is a balance sheet? The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time.

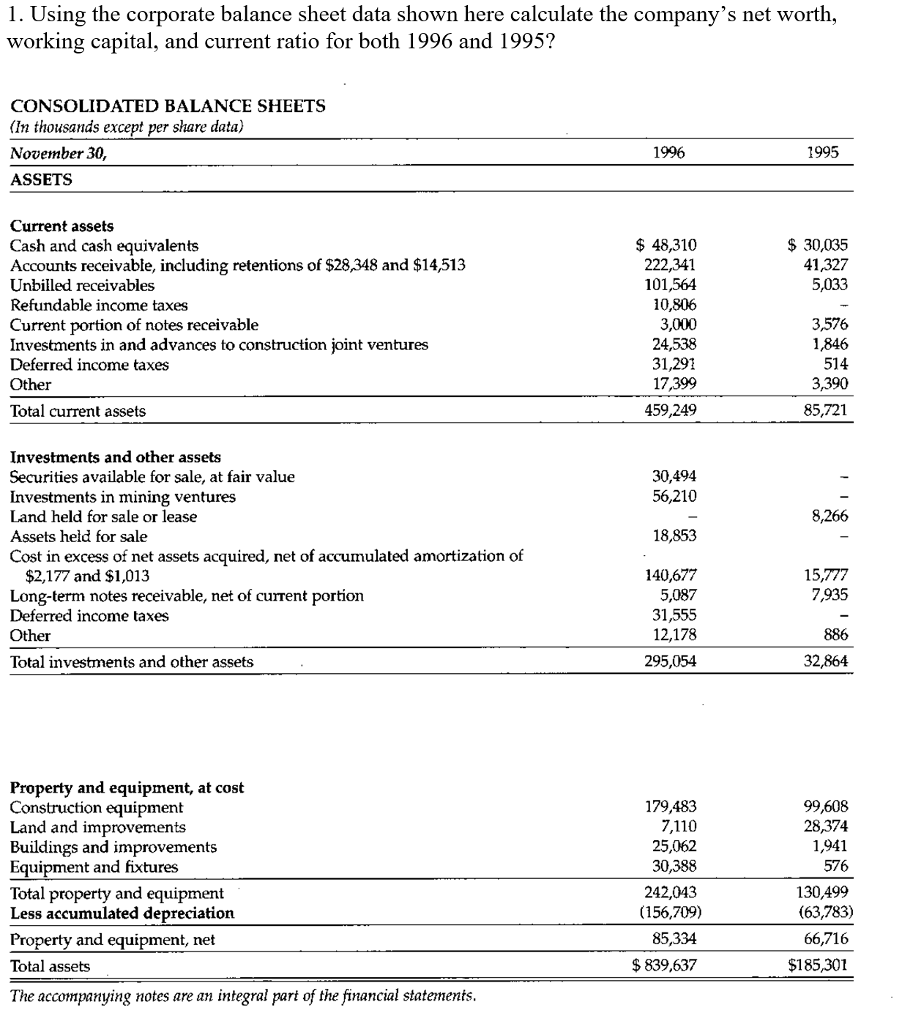

Chapter 1 corporate finance and the financial manager 3 chapter 2 introduction to financial statement analysis 27. The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. Assets = liabilities + equity.

The income statement primarily focuses on a company's revenues and expenses during. In april 2023 truist had confirmed the sale of a 20% stake, $1.95 billion, in truist insurance holdings to stone capital. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

The balance sheet is often considered the most important of the three statements, as it can be used to determine the health and durability of a business. Telekom malaysia bhd’s (tm) net debt to earnings before interest, tax, depreciation and amortisation (ebitda) may fall to 0.4 times for the financial year 2025 (fy25) and 0.2. It can also be referred to as a statement of net worth or a statement of financial position.

Download, graph, and track economic data. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. The transaction represented an aggregate value of $14.75 billion for tih.

What are the three financial statements? Hence, the balance sheet is often used interchangeably with the term “statement of financial position”. It allows you to see what resources it has available and how they were financed as of a specific date.

The balance sheet is split into two columns, with each column balancing out the other to net to zero. By kate christobek. The balance sheet provides an overview of assets, liabilities, and shareholders' equity as a snapshot in time.

A balance sheet conveys the “book value” of a company. Using this template, you can add and remove line items under each of the buckets according to the business: A business’ balance sheet offers a comprehensive overview of a company's financial health by detailing a company's assets, liabilities and shareholders’ equity.

Key points the balance sheet includes things owned (assets) and things owed (liabilities). You can learn about the health of a business by looking at its balance sheet. What are some examples of assets?

The three financial statements are: Balance sheets provide the basis for. Assets = liabilities + equity.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)